A merger of Time Warner Cable and Comcast is just one more step towards undermining our democracy, worries former Secretary of Labor Robert Reich.

A merger of Time Warner Cable and Comcast is just one more step towards undermining our democracy, worries former Secretary of Labor Robert Reich.

In a blog entry republished by Salon, Reich sees increasing evidence that the trust-busting days at the turn of the 20th century are long over, and Americans will likely have to relearn the lessons of allowing capitalism to run amuck.

It was the Republican Party of the 1890s that had the loudest voice in Washington protesting the concentration of business power into vast monopolies that had grown so large, they not only hurt consumers but threatened to undermine democracy itself.

Republican Senator John Sherman of Ohio was at the forefront of acting against centralized industrial power, which he likened to the abusive policies of the British crown that sparked America’s revolution for independence.

“If we will not endure a king as a political power,” Sherman thundered, “we should not endure a king over the production, transportation, and sale of any of the necessaries of life.”

The merger of Comcast and Time Warner Cable is just the latest example America is in a new gilded age of wealth and power that no longer prevents or busts up concentrations of economic power, observes Reich.

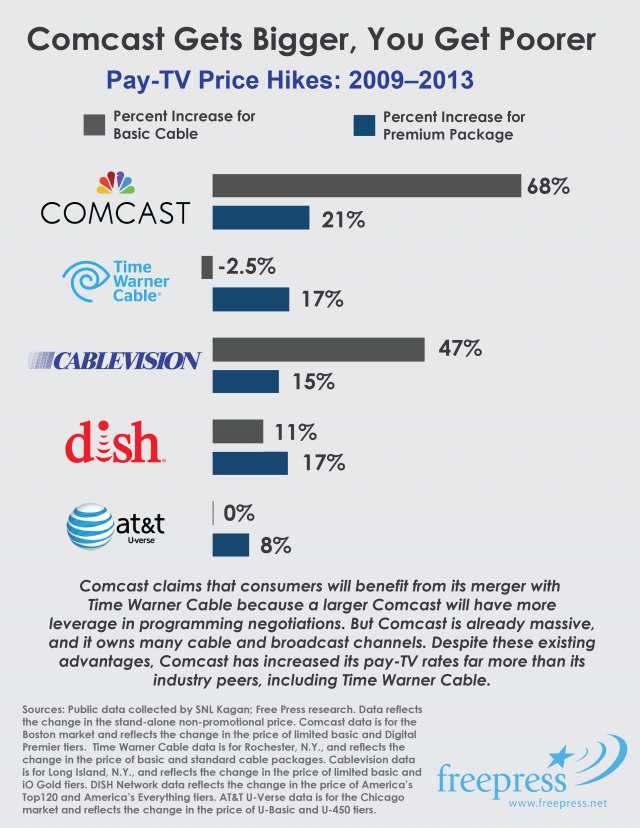

“Internet service providers in America are already too concentrated, which is why Americans pay more for Internet access than the citizens of almost any other advanced nation,” Reich argues.

Reich

Reich worries about the implications of allowing Comcast to grow larger, considering how much the current company already invests in Washington to get the government policies it wants:

- Comcast has contributed $1,822,395 so far in the 2013-2014 election cycle, according to data collected by the Center for Responsive Politics — ranking it 18th of all 13,457 corporations and organizations that have donated to campaigns since the cycle began. Of that total, $1,346,410 has gone to individual candidates, including John Boehner, Mitch McConnell, and Harry Reid; $323,000 to Leadership PACs; $278,235 to party organizations; and $261,250 to super PACs;

- Comcast is also one of the nation’s biggest revolving doors. Of its 107 lobbyists, 86 worked in government before lobbying for Comcast. In-house lobbyists include several former chiefs of staff to Senate and House Democrats and Republicans as well as a former commissioner of the Federal Communications Commission. Nor is Time Warner Cable a slouch when it comes to political donations, lobbyists, and revolving doors. It also ranks near the top.

Atwell-Baker

The Center for Responsive Politics expanded on the revolving door issue between the cable industry and the Federal Communications Commission that will be responsible for approving the Comcast-Time Warner merger.

It found one of the most prominent travelers to be former FCC commissioner-turned Comcast lobbyist Meredith Atwell-Baker. Always a friend of the cable industry, the Republican commissioner hurried out the door two years into her four-year term after getting a lucrative job offer from Comcast in June 2011. Despite claims she stopped participating in votes relating to Comcast after getting her job offer, she was a strong supporter of Comcast’s merger with NBCUniversal and favored the cable industry’s approach towards preserving a barely noticeable feather-light regulatory touch.

Atwell-Baker never contemplated her move might be seen as a conflict of interest, but then again, it represented nothing new for Washington. At the time, the only condition limiting her was a two-year ban on lobbying the FCC. But that does not apply to Congress so Atwell-Baker spent her time as Comcast’s senior vice president of government affairs trying to influence the House and Senate on 21 bills that could affect Comcast’s bottom line.

Just as shameless — Michael Powell, who served as FCC chairman during the first term of the George W. Bush Administration. After leaving the FCC he took the lucrative position of top man at the National Cable & Telecommunications Association, the cable lobby. The Center found several other former FCC employees heading into the private sector, advising Big Telecom companies on how to best influence regulators:

- Rudy Brioche, was an adviser to former commissioner Adelstein before moving to Comcast as its senior director of external affairs and public policy counsel in 2009. Brioche was so valued by the FCC, in fact, that he was brought back to join the commission’s Advisory Committee for Diversity in the Digital Age in 2011;

- James Coltharp, who served as a special counsel to commissioner James H. Quello until 1997, is now a Comcast lobbyist;

Once out of the public sector for several years, some lobbyists see their value deteriorate as they get increasingly out of touch with the latest administration in power. So several seek a refresh, temporarily leaving their lobbying job to return to public sector work.

Once out of the public sector for several years, some lobbyists see their value deteriorate as they get increasingly out of touch with the latest administration in power. So several seek a refresh, temporarily leaving their lobbying job to return to public sector work.

The Center offered David Krone as a potential example. Krone formerly held leadership and lobbying positions with companies like AT&T, TCI Communications and the National Cable & Telecommunications Association. After 2008, he was hired by Senate Majority Leader Harry Reid (D-Nev.) to advise him on telecommunications matters. Today he is Reid’s chief of staff. If and when Reid leaves office, Krone can always join the parade of ex-Hill staffers back to the lucrative world of lobbying.

Will elected officials give a receptive ear to Comcast’s arguments in favor of its merger? Most likely, considering every member of the Senate Judiciary Committee (except deal critic Sen. Al Franken), has recently received campaign contributions from the cable giant, according to OpenSecrets:

Comcast PAC donations to Senate Judiciary Committee Democrats

Comcast PAC donations to Senate Judiciary Committee Democrats

- Chuck Schumer, New York: $35,000

- Patrick Leahy, Vermont, Chairman: $32,500

- Sheldon Whitehouse, Rhode Island: $26,500

- Chris Coons, Delaware: $25,000

- Dick Durbin, Illinois: $23,000

- Amy Klobuchar, Minnesota: $22,500

- Dianne Feinstein, California: $18,500

- Richard Blumenthal, Connecticut: $11,500

- Mazie Hirono, Hawaii: $5,000

- Al Franken, Minnesota: $0

Comcast PAC donations to Republicans

- Orrin Hatch, Utah: $30,000

- Chuck Grassley, Iowa, Ranking Member: $28,500

- John Cornyn, Texas: $21,000

- Lindsey Graham, South Carolina: $13,500

- Jeff Sessions, Alabama: $10,000

- Mike Lee, Utah: $8,500

- Ted Cruz, Texas: $2,500

- Jeff Flake, Arizona: $1,000

Reich thinks its time to return to the trust-busting days of President Teddy Roosevelt, who found the transportation infrastructure of the 20th century and the fuel used to power it increasingly controlled by a handful of giant players that abused monopoly power to set unjustifiable prices and suppress competition. Getting Congress, increasingly flush with now-unlimited corporate money, to agree to its own refresh a century later may prove a tougher sell.

Netflix intends to raise the price of its online video service to as much as $10 a month sometime during the next three months to help finance content acquisition and improve its streamed video experience. But for up to two years, the new price will probably not impact existing customers.

Netflix intends to raise the price of its online video service to as much as $10 a month sometime during the next three months to help finance content acquisition and improve its streamed video experience. But for up to two years, the new price will probably not impact existing customers.

Subscribe

Subscribe Time Warner Cable reports it has unleashed major broadband speed upgrades for a handful of communities in New York and Los Angeles and is now delivering speeds up to 300Mbps.

Time Warner Cable reports it has unleashed major broadband speed upgrades for a handful of communities in New York and Los Angeles and is now delivering speeds up to 300Mbps. A merger of Time Warner Cable and Comcast is just one more step towards undermining our democracy, worries former Secretary of Labor Robert Reich.

A merger of Time Warner Cable and Comcast is just one more step towards undermining our democracy, worries former Secretary of Labor Robert Reich.

Jonathan Adelstein

Jonathan Adelstein Once out of the public sector for several years, some lobbyists see their value deteriorate as they get increasingly out of touch with the latest administration in power. So several seek a refresh, temporarily leaving their lobbying job to return to public sector work.

Once out of the public sector for several years, some lobbyists see their value deteriorate as they get increasingly out of touch with the latest administration in power. So several seek a refresh, temporarily leaving their lobbying job to return to public sector work. Comcast PAC donations to Senate Judiciary Committee Democrats

Comcast PAC donations to Senate Judiciary Committee Democrats If you have started to confuse the Washington Post editorial page with that of the Wall Street Journal, you are not alone.

If you have started to confuse the Washington Post editorial page with that of the Wall Street Journal, you are not alone.