Allen: Comcast thinks “Give Sharpton $50,000 and a bucket of chicken and we’re good.”

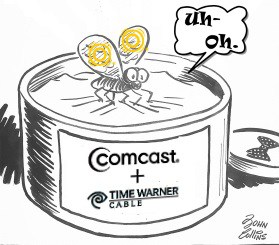

A $20 billion racial discrimination lawsuit filed on behalf of black-owned media companies has uncovered alleged ties between executives of Comcast and Time Warner Cable and public officials who have allegedly helped cover up cable industry discrimination, price-fixing, collusion, and illegal payoffs.

Byron Allen, chairman and CEO of Entertainment Studios, in a blitz of eyebrow-raising interviews, accuses the two cable giants of putting minority-owned channels in the back of the bus, while falsely claiming black celebrities are the owners of minority networks that are actually controlled by former Comcast executives and private equity firms.

“Comcast has, in essence, created a ‘Jim Crow’ process with respect to licensing channels from 100 percent African American–owned media,” the suit reads, according to The Huffington Post. “Comcast has reserved a few spaces for 100 percent African American–owned media in the ‘back of the bus’ while the rest of the bus is occupied by white-owned media companies.”

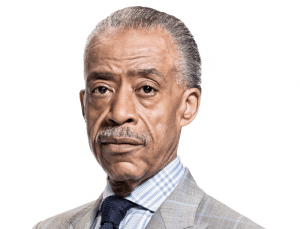

The lawsuit, filed against Time Warner Cable, Comcast, the Urban League, the NAACP, former FCC commissioner Meredith Attwell Baker, and Al Sharpton’s National Action Network, claims the defendants are taking payoffs from the two cable giants and colluding to promote their business agendas and give minority support to their mergers and acquisitions.

“The industry spends about $50 billion a year licensing cable networks in which 100 percent African American-owned media receives less than $3 million per year in revenue from that $50 billion stream of money that is spent to acquire content,” he said.

Under normal circumstances, many African-American civil rights organizations would immediately raise a ruckus over the imbalance, but Allen alleges Comcast and Time Warner Cable have bought their silence, and in the case of Al Sharpton, his loyalty and support.

Byron Allen accuses Comcast of locking out 100% black-owned networks.

“Instead of spending real money with real, 100 percent African American-owned media, it is easier to give [Sharpton] $50,000 to give them a cover,” he said. “‘Give [Sharpton] $50,000 and a bucket of chicken and we’re good.'”

Allen called Sharpton the “least expensive negro” Comcast could find, and rewarded his loyalty with a $750,000 annual salary hosting a barely watched nightly show on Comcast-owned MSNBC.

“Why is Sharpton on TV every night on MSNBC? Because he endorsed Comcast’s acquisition of NBCUniversal,” Allen said. “He signed the memorandum of understanding back in 2010. He endorsed the merger. Next thing you know we’re watching him on television trying to form a sentence. Every night we have the privilege of watching adult illiteracy.”

Attwell-Baker is a defendant for her highly visible warp speed trip through D.C.’s revolving door, as the former Republican FCC commissioner seemed to be writing her resignation letter seconds after voting in favor of the Comcast-NBCUniversal merger, quickly accepting a high paid lobbying job with the cable company.

“President Obama promised us transparency, hope, and change,” he said. “And what happened in the Obama administration is former commissioner Meredith Attwell Baker voted for the merger of Comcast NBCU and then 90 days later took a much higher paying job with Comcast after granting them the merger. That was betraying the public’s trust as a public service.”

[flv]http://www.phillipdampier.com/video/HuffPost Byron Allen 2-27-15.mp4[/flv]

Watch the HuffPost Live interview with Byron Allen, who reveals who really owns the minority channels Comcast brags about. (7:37)

“President Obama has been bought and paid for. He has taken donations from Comcast. Comcast is his biggest contributor,” he added. “AT&T is one of his biggest contributors. Listen, Obama, your own FTC is investigating AT&T for throttling. How can you even consider them to buy DirectTV when you’re suing them? Is it because you took donations? Yes, Obama. Don’t even think about letting them merge until they settle this lawsuit and that lawsuit.”

Sharpton, in addition to being a regular supporter of Comcast’s various business agendas, also hosts a nightly show on Comcast-owned MSNBC, for which he is paid $750,000 a year.

“AT&T spent more money on Al Sharpton’s birthday party than they have on 100 percent African-American owned media combined,” Allen said. “He (Sharpton) should return the money because AT&T doesn’t even celebrate Martin Luther King Day as a national holiday. The employees there take it as a sick day.”

Apart from Allen’s inflammatory appearances on cable news, his lawsuit does bring to light several important new facts about Comcast’s claims it supports minority-owned channels. Allen’s lawsuit alleges many of those channels are actually secretly owned and controlled by former Comcast executives, private equity firms, and Wall Street banks.

- “Aspire is controlled by Leo Hindery and Leo Hindery is not black. They don’t pay Aspire any subscription fees. Aspire is free,” said Allen.

- “Sean ‘P Diddy’ Combs’ network Revolt TV is controlled by a private equity firm called Highbridge Capital. The person who runs Highbridge Capital is a former Comcast executive named Payne Brown. Highbridge Capital is owned by JP Morgan. On the board of JP Morgan is Steve Burke, the number two executive at Comcast,” said Allen.

These revelations are important because Comcast promised to create and carry minority-owned channels as part of several conditions mandated by regulators to approve the 2011 acquisition of NBCUniversal. Allen claims Comcast has broken its commitment and instead created “token front” networks or minority network “window dressing” that feature well-known African-American celebrities that pose as owners of the networks, but in fact they are controlled by white-owned businesses.

The lawsuit claims Comcast carries only one 100% African-American owned and controlled network — the Africa Channel. But dig a little deeper and you find the network is owned by a former Comcast/NBCU executive that played a critical part organizing minority group support for the NBCUniversal buyout.

Comcast and Sharpton’s organization both dismissed the lawsuit as inflammatory and frivolous.

[flv]http://www.phillipdampier.com/video/CNN Sharpton called black pawn in white game 3-1-15.flv[/flv]

Byron Allen appeared on CNN’s Reliable Sources and called Sharpton “a black pawn in a very sophisticated white economic chess game. He’s being used by his white masters at Comcast and AT&T. He just needs to shut up and get in the bleachers.” (7:12)

Subscribe

Subscribe Independent television in Great Britain

Independent television in Great Britain  John Malone’s Liberty Global is seen as a leading contender, already owning a 6.4% stake in ITV acquired from BSkyB for $824 million. Liberty Global and Discovery Networks have maintained close association and jointly bid $930 million to acquire All3Media, the production arm of reality shows like “Undercover Boss.”

John Malone’s Liberty Global is seen as a leading contender, already owning a 6.4% stake in ITV acquired from BSkyB for $824 million. Liberty Global and Discovery Networks have maintained close association and jointly bid $930 million to acquire All3Media, the production arm of reality shows like “Undercover Boss.”

The federal government is likely to count Bright House’s 2.2 million customers as part of the Time Warner Cable family, at least as far as control of cable programming pricing is concerned. Despite Comcast’s voluntary commitment to keep its national share of the cable TV business under 30 percent with the merger of Time Warner, Comcast hasn’t taken seriously counting the customers of the uninvited cousin – Bright House.

The federal government is likely to count Bright House’s 2.2 million customers as part of the Time Warner Cable family, at least as far as control of cable programming pricing is concerned. Despite Comcast’s voluntary commitment to keep its national share of the cable TV business under 30 percent with the merger of Time Warner, Comcast hasn’t taken seriously counting the customers of the uninvited cousin – Bright House.

The group involved in the current controversy reportedly received $350,000 from Comcast and promptly began a vocal opposition campaign against Net Neutrality, an open Internet policy Comcast still opposes being enacted as official FCC policy.[2]

The group involved in the current controversy reportedly received $350,000 from Comcast and promptly began a vocal opposition campaign against Net Neutrality, an open Internet policy Comcast still opposes being enacted as official FCC policy.[2] If you have started to confuse the Washington Post editorial page with that of the Wall Street Journal, you are not alone.

If you have started to confuse the Washington Post editorial page with that of the Wall Street Journal, you are not alone.