Steve Burke is CEO of NBCUniversal and an executive vice president at Comcast.

Comcast is in the enviable position of negotiating with itself for permission to carry Comcast-owned NBC stations over Comcast Cable, earning the company hundreds of millions in retransmission consent fees paid by cable subscribers.

Comcast executive vice president Steve Burke, who also oversees the Comcast-owned NBCUniversal, said retransmission fees are changing the broadcast business, and makes Comcast a ton of money along the way.

“NBC made virtually nothing on retransmission consent two years ago,” Burke told investors at the Bank of America Merrill Lynch 2013 Media, Communications & Entertainment Conference. “This year we’ll make about $200 million.”

Since acquiring NBCUniversal, cable subscribers cannot help but find themselves watching at least one channel owned by the entertainment and cable conglomerate. Burke said in addition to owning NBC local stations in the largest U.S. cities, Comcast also owns or controls an impressive number of popular cable channels including USA, Syfy, Bravo, E!, MSNBC, CNBC, The Weather Channel, and a variety of sports networks. Seven Comcast-owned cable networks earn the company more than $200 million annually, providing almost two-thirds of the programming division’s operating cash flow.

But Burke isn’t satisfied with those earnings, claiming cable companies undervalue the networks’ true worth by 20-25 percent.

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.”

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.”

Burke told investors the company is positioning to capitalize on the growth of retransmission consent fees that will deliver more revenue to the broadcast and cable programming divisions of Comcast that will be eventually reflected on subscribers’ bills.

“The key to retransmission consent is to have contracts expire with the big distributors that allow you to reopen the existing retransmission consent contracts,” Burke said. “One thing that we really hadn’t figured on when we did the deal was how rapidly retransmission consent was going to establish itself. We underestimated that frankly. That’s a very good thing for NBCUniversal, but not so good I think for Comcast Cable.”

Although Comcast has been very vocal about unreasonable price increases for broadcast and cable television programming owned by other companies, it expects comparable compensation for its own stations and networks.

“As our contracts come up, we will get those revenues the same way CBS, ABC and FOX have,” Burke argues. “I see no reason why we won’t […] get paid in a similar fashion to the way that they get paid in the future.”

Subscribe

Subscribe Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources

Comcast Corporation and Charter Communications are actively working on a deal to let Comcast acquire Time Warner Cable subscribers in New York, New England, and North Carolina, according to sources  Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.

Comcast’s involvement in the deal could inject much-needed cash into a takeover bid financed largely by debt. It might also prompt Charter to sweeten its offer for TWC.

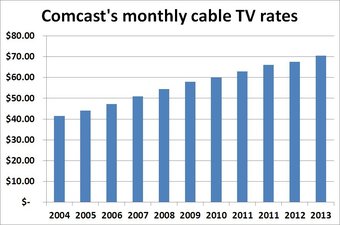

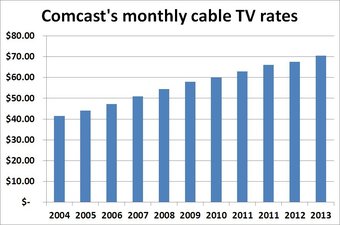

It’s happy days at Comcast’s marketing and public relations department. How does a cable company pocket an extra $1.50 a month from 21.6 million cable TV customers without facing the wrath of the masses? Blame it on greedy broadcasters and quietly bank up to $32.4 million a month in new revenue.

It’s happy days at Comcast’s marketing and public relations department. How does a cable company pocket an extra $1.50 a month from 21.6 million cable TV customers without facing the wrath of the masses? Blame it on greedy broadcasters and quietly bank up to $32.4 million a month in new revenue.

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.”

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.”