Apartment Complex Owner Makes Cable Service Mandatory In 13 States: “We’ll Add the $40 to Your Rent”

A major owner of apartment complexes in 13 states in the southeast and south-central United States has a deal for you, whether you like it or not.

A major owner of apartment complexes in 13 states in the southeast and south-central United States has a deal for you, whether you like it or not.

Mid America Apartment Communities, which maintains a portfolio of 42,252 apartments, is requiring its residents to purchase cable television from providers like Comcast or they’ll find the $40 month cable fee tacked on their rent, water, or refuse collection bill. They call it a wonderful savings opportunity for their residents. But a Stop the Cap! investigation followed the money and discovered the real benefits are in kickbacks paid to Mid America by participating cable companies.

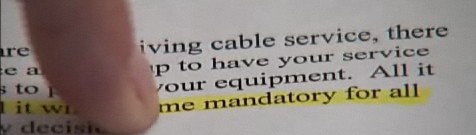

Mid America is extending the policy to all of its apartment complexes over the coming months, notifying residents about its new CableSaver program through flyers. Enrollment in the program is automatic for new residents, and will take effect for existing residents upon the renewal of their annual lease agreement.

Known as “bulk buying,” apartment complexes can receive preferential discounts for their residents if they commit to mandatory cable service for each apartment. In Chattanooga, residents of Mid America’s Hamilton Pointe, Hidden Creek, Steeplechase, and Windridge Apartments were notified this month they’ll be compelled to spend $40 a month for Comcast’s Digital Starter Package.

Mid America owns apartment complexes in 13 states. All of them will find the CableSaver program coming their way sooner or later.

The mandating of cable service is not going down well with every resident, particularly those who purchased satellite TV equipment or who have service with other providers like AT&T’s U-verse or Verizon FiOS. While Mid America isn’t banning competing cable services from serving its complexes, residents will still be forced to pay for cable service in addition to whatever their current provider charges.

Lydia Ramirez of Chattanooga lives in a Mid America Apartment Communities property. She told WDEF-TV News, “We told them that we are not interested in this but they say it’s mandatory. And so here we are.”

Ramirez just had Dish Network installed but says she’s been told she will have to pay for Comcast cable, too, if she renews her lease. She said, “We don’t want Comcast and we feel that should be our choice instead of them making it mandatory.”

Instead of being allowed to choose satellite or other cable providers, Ramirez says being forced to go with Comcast is kind of like being told you can only grocery shop at Food Lion. Ramirez adds, “I don’t see how they can do that. I think we as tenants have an option to choose what cable company we want to go with.”

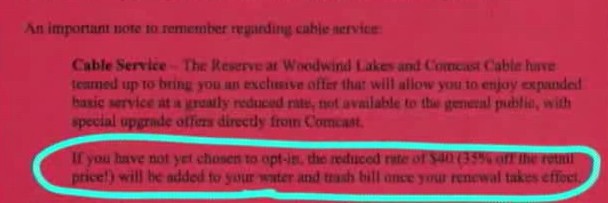

Some renters in Houston, Texas have been there and done that. Late last year, KPRC-TV reported residents at The Reserve at Woodwind Lakes got a deal they couldn’t refuse. A letter from the front office promoted an exciting new offer: It reads the complex “has teamed up with a cable company to bring you an exclusive offer that will allow you to enjoy expanded basic service at a greatly reduced rate.” Sounds great until you get to the second line of the letter, which uses language only a credit card company could love:

“If you have not yet chosen to opt in, the reduced rate of $40 will be added to your water and trash bill once your renewal takes effect.”

In other words, your “choice” to “opt in” is neither.

Mid America is selling this mandatory cable program as a real money-saver. But we discovered it’s actually a real moneymaker for Mid America, who earns compensation from kickbacks paid by cable companies in return for cramming cable service down renters’ throats.

Kickbacks for cable is nothing new in the rental business. Complex owners used to routinely make exclusive deals with providers to deliver service to residents, often through contracts that kept competitors out. But a 2007 FCC ruling made such exclusive arrangements illegal. A Federal Court of Appeals agreed: cable companies cannot have exclusive rights to provide service in apartment buildings that they wire. But complex owners and cable operators discovered an enormous loophole — complex owners can force residents to pay mandatory cable fees as part of their rent so long as they did not bar would-be competitors from also providing service. But given that renters would already be paying for service, it is unlikely they’d choose another and pay double or more for duplicated cable service.

Cable companies like Comcast enter into these agreements because they provide guaranteed revenue for minimal cost, thanks to “install it once” cable wiring and bulk billing. Since many renters are also young — renting their first apartment after leaving home — establishing a relationship with those customers may make them customers for life. Cable companies can also use the program as an opportunity to sell add-on services to renters, such as broadband, digital phone, and premium channel packages.

But why would a company like Mid America want to alienate at least some of their renters who do not want to be forced to pay for cable service? The answer is easily found in Mid America’s publicly disclosed financial reports — Mid America makes a healthy profit from the CableSaver program.

Mid America’s quarterly 10-K filing with the Securities and Exchange Commission shows the company is earning so much money from cable companies like Comcast, it has broken the revenue out into a new section of its financial report.

In the first quarter of 2010, as Mid America introduced its CableSaver program, the company reported earning $1.3 million dollars in revenue from cable kickbacks. The company tells investors its new mandatory cable program will become an important source of new revenue for the complex owner:

“We continue to develop improved products, operating systems and procedures that enable us to capture more revenues. The continued roll-out of ancillary services (such as re-selling cable television), improved collections, and utility reimbursements enable us to capture increased revenue dollars.”

It’s all a part of a profit-making strategy to increase shareholder value and stick residents with increasing costs to deliver fatter profits. Renters might be interested to know the company has more in store for them in the coming months:

Our goal is to maximize our return on investment collectively and in each apartment community by increasing revenues, tightly controlling operating expenses, maintaining high occupancy levels and reinvesting as appropriate. The steps taken to meet these objectives include:

- […] developing new ancillary income programs aimed at offering new services to residents, including telephone, cable, and internet access, on which we generate revenue;

- implementing programs to control expenses through investment in cost-saving initiatives, including measuring and passing on to residents the cost of various expenses, including water and other utility costs.

Unfortunately for residents, short of moving, there is no escaping these fees. Some residents have contacted their member of Congress or the FCC to complain about the loophole that allows a complex owner to charge for cable service residents don’t always want. Another way to send a message is to tell Mid America you will not do business with them until they make the CableSaver program truly optional. If the company stands to lose more money than it receives from cable company kickbacks, it may choose to amend its policies.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Mandatory Cable 7-19-10.flv[/flv]

We have four reports on this story, courtesy of WDEF-TV Chattanooga, Tenn., and KPRC-TV in Houston, Texas (10 minutes):

- The FCC bans exclusive cable contracts forcing renters to buy service from one provider. (KPRC-TV 10/31/2007)

- Can Complex Choose Your Cable Company? In Houston, Mid America Forcing Renters to Buy Comcast Cable. (KPRC-TV 1/7/2010)

- Four Chattanooga Area Apartment Complexes Make Comcast Cable Mandatory for Renters. (WDEF-TV 7/12/2010)

- AT&T U-verse Arrives in Chattanooga (But Won’t Be Too Attractive to Mid America Residents). (WDEF-TV 4/30/2010)

Subscribe

Subscribe