Some of Clearwire’s very first, and most loyal customers in the Pacific Northwest are receiving an unwelcome message of thanks for their years of service with the company: a massive rate increase.

Some of Clearwire’s very first, and most loyal customers in the Pacific Northwest are receiving an unwelcome message of thanks for their years of service with the company: a massive rate increase.

The company is nearly doubling rates for customers who were promised special “lifetime” discounts for agreeing to remain with the wireless 4G broadband service, which has been experiencing financial problems recently.

D.B. in Seattle has been a Clearwire customer for years, even before the company upgraded to WiMax speeds. In 2009, Clearwire sent him an offer he couldn’t refuse: stay with Clear and pay just $22 a month (plus $5 modem rental fee) for life.

“Of course I accepted immediately,” D.B. writes. “Then Clear [sent me a letter recently] telling me my monthly fee was going up to approximately $47 a month with the modem fee.”

D.B. has been calling and e-mailing Clearwire asking what happened to the $22-for-life promotion he has in writing from the company, but “nobody knows anything.”

Clearwire says they have improved their service recently in Seattle, but D.B. isn’t impressed.

“I’m here to tell the world that is not true,” he says. “Plus the times I’ve had this thing freeze up has greatly increased, and usually I have to unplug the modem for five minutes [to get service back].”

Mireille in Seattle managed to get an even lower “lifetime” rate from Clearwire two years ago.

“They offered me a monthly rate of $19.95 for as long as I maintained uninterrupted Clearwire service. That means forever and ever until I cancel.,” she says. “Last week they sent me an email letting me know that they were raising my rate to $35.95 a month (that includes a $10 a month ‘long time customer discount’) and since I was such a good customer I was being offered that rate for the life of my uninterrupted Clearwire service. Sound familiar?”

Mireille calls it something else: breach of contract.

“I spoke to three different people and no one had anything to say besides that they were sorry but they were not able offer me that rate anymore.”

Customers in the Portland, Ore. area are getting similar e-mails, and The Oregonian took note:

Clearwire Corp., a wireless Internet provider that operates as Clear, is raising prices for 30,000 customers who signed up for the service soon after its 2009 launch.

The Kirkland, Wash.-based company didn’t provide details of the rate hikes, but e-mails to customers show that monthly rates for some home Internet plans will rise from $35 to $45 beginning in October.

Clearwire said the rate hike affects both home and mobile customers who subscribed when the service was first available, at a time when rates were lower or promotional prices were available.

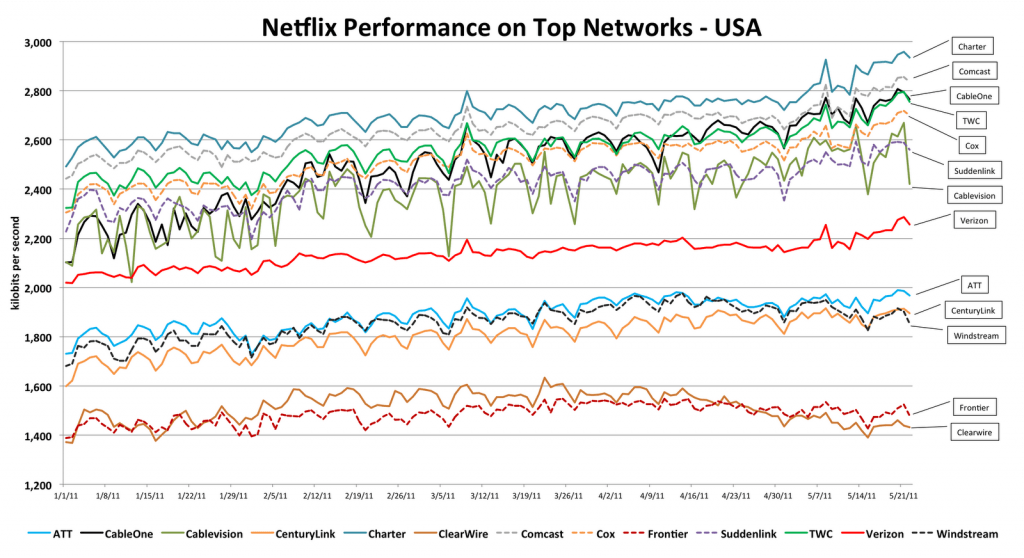

Clearwire still offers a home Internet plan for $35 a month, but it limits download speeds to 1.5 megabits per second — one-eighth the speed of Comcast’s standard plan. Clear’s standard plan, which now costs $45, promises downloads between 3 and 6 megabits per second.

Subscribe

Subscribe