Stop the Cap!‘s strong readership in the Triad region of North Carolina comes from their experience with Time Warner Cable’s Internet Overcharging experiment this past April. For residents in greater Greensboro and surrounding communities, now you get a chance to be pioneers of a different sort.

Time Warner Cable today announced Greensboro, Raleigh, and Charlotte, all in North Carolina, among the first in the nation able to purchase Road Runner Mobile, a new 4G wireless mobile broadband service designed to accompany your existing Road Runner subscription.

On December 1st, Time Warner Cable customers can sign up for the service, providing speeds up to 6Mbps, starting at $34.95 per month, if you are on a Price Lock Guarantee (a service commitment requiring you to remain with Time Warner Cable in return for service discounts) and subscribe to a bundle of services. That low priced option has a usage allowance of 2 gigabytes per month.

“With Time Warner Cable’s 4G Mobile Network, we now offer the fastest mobile service available and extend our reach outside the home.” said Carol Hevey, Executive Vice President of the Carolina Region for Time Warner Cable. “Giving our customers the convenience of mobility and the speed of 4G, Road Runner Mobile lets customers take their favorite Internet service wherever they go. This is an important part of our strategy to give our customers any content, on any device, anytime, anywhere.”

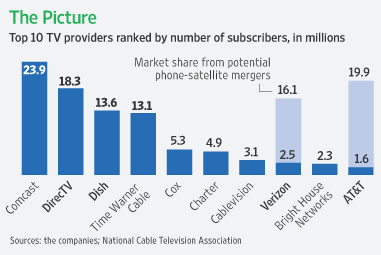

Time Warner Cable is using the Clearwire WiMax network to provide the service, a benefit it gained along with Comcast when they became part-owners of the Sprint-Clearwire venture.

Pricing will vary depending on the level of service customers need:

- Road Runner Mobile 4G National Elite gives unlimited access to both Time Warner Cable’s 4G Mobile Network and a national 3G network (Sprint, presumably), for use when traveling.

o $79.95 per month for Road Runner Standard or Turbo customers.

o Further discounts for Double and Triple play customers and those on a Price Lock Guarantee. - Road Runner Mobile 4G Elite gives customers unlimited access to the Time Warner Cable 4G Mobile Network.

o $49.95 per month for Road Runner Standard or Turbo customers.

o Further discounts for Double and Triple play customers and those on a Price Lock Guarantee. - Road Runner Mobile 4G Choice gives light users 2GB of service on the Time Warner Cable 4G network each month.

o Available for $39.95 per month to customers of at least one other Time Warner Cable service. Additional $5 off if you have a Price Lock Guarantee and bundled service package.

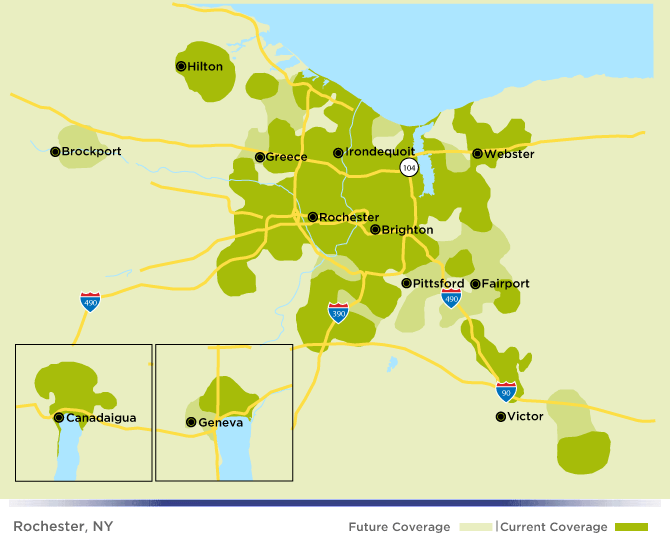

Time Warner Cable plans to launch additional mobile services to customers in the future such as the ability to program a DVR from a mobile device and the ability to take their video content with them on the go. Time Warner Cable will be expanding its 4G Mobile network to additional service areas over the next few months including Dallas, TX and Honolulu and Maui, HI.

Customer experiences with the Clearwire network have been decidedly mixed. In Portland, uneven signal coverage has plagued service and fueled customer returns. In Greensboro, some who have tested the Clearwire-branded version of the service report earlier speeds close to 5Mbps that have since slowed to below 2Mbps.

As with any wireless mobile service, inquire about trial options and cancellation policies before signing any contract. Consumers should always verify service is available to them at tolerable speeds before committing to any contract.

Subscribe

Subscribe