Dear Chairman Genachowski, Attorney General Holder and Commissioner Sandoval:

We write to urge you to reject AT&T Inc.’s proposed purchase of T-Mobile because it will without question lead to higher prices for consumers.

We write to urge you to reject AT&T Inc.’s proposed purchase of T-Mobile because it will without question lead to higher prices for consumers.

This is not conjecture; it is the lesson of history. Seven years ago, AT&T Inc.’s wholly owned subsidiary, AT&T Mobility LLC (then known as Cingular Wireless Corporation) requested permission to buy AT&T’s wireless network (then known as AT&T Wireless Services, Inc.) for $41 billion. At that time, AT&T and Cingular had the first and second largest share, respectively, of wireless communications providers in the U.S.

In order to get the merger approved, AT&T and an army of executives, lobbyists and allies assured regulators and consumers that the deal was in the public interest by making promises — the very same promises that we’re hearing from AT&T today:

| 2004 AT&T–Cingular Pre-merger Promises | 2011 AT&T–T-Mobile Pre-merger Promises |

| “The combination of AWS and Cingular will allow the availability of these services on a seamless, nationwide basis far more promptly than can otherwise be achieved, if they could be achieved at all, by the companies individually.” | “We are confident in our ability to execute a seamless integration, and with additional spectrum and network capabilities we can better meet our customers’ current demands…” |

| AT&T is “working to make this transition as seamless as possible for customers of AT&T Wireless.” “[C]ustomers of both companies will continue to enjoy the benefits of their current phones, rate plans, and features, without any service interruptions.” | “Will T-Mobile customers have to get a new phone? No. Their current T-Mobile phone will continue to work fine once the transaction is complete.” |

| AT&T Wireless customers were assured that they would be able to “continue using their existing phones and rate plans but now have access to the largest digital voice and data network in the country.” | “Will T-Mobile customers have to move to a new plan? Will they lose their plans? No. They will be able to keep their existing price plan.” “Once the transaction closes, T-Mobile customers will gain access to the benefits of AT&T’s network.” |

| “By acquiring both spectrum and infrastructure, the company can provide expanded coverage to consumers in the near term.” | AT&T and T-Mobile USA customers will see service improvements – including improved voice quality – as a result of additional spectrum, increased cell tower density and broader network infrastructure.” |

| “[C]onsumer benefits cannot be realized quickly by acquiring spectrum in a piecemeal fashion.” | Contrary to opponents’ arguments, neither [AT&T’s] massive investment [in wireline and wireless networks], nor piecemeal technology “solutions” can solve the macro-level, system-wide constraints confronting AT&T. |

| “Wireless telephony markets are and will remain robustly competitive [after the merger].” | “The transaction will enhance margin potential and improve the company’s long-term revenue growth potential as it benefits from a more robust mobile broadband platform for new services.” |

What happened after the AT&T – Cingular merger? Once the Federal Communications Commission approved the deal (after negligible scrutiny), the newly merged company – which later renamed itself AT&T Mobility LLC– betrayed its promises. It abandoned the old AT&T network, deliberately degrading the network so that AT&T customers would be forced to migrate to Cingular’s own network, pay an upgrade fee of $18, buy new phones and agree to new and more expensive rate plans. These anti-consumer moves were enforced by an anti-competitive “early termination fee” of anywhere between $175 and $400, which prevented customers of AT&T from moving to another carrier.

In short, AT&T policyholders were railroaded into spending hundreds of dollars more in order to maintain their cellular service – a colossal rip-off by the same corporate executives who are now asking for permission to do it all over again.

Nothing in the terms of the proposed merger bars AT&T from engaging in a repeat performance against helpless T-Mobile customers if this deal is approved. Indeed, even as the companies mount a massive public relations campaign to win your approval, T-Mobile executives are already implicitly acknowledging that once the merger is approved, AT&T will make changes in the T-Mobile network:

T-Mobile has no plans to alter our 3G / 4G network in any way that would make your device obsolete. The deal is expected to close in approximately 12 months. After that, decisions about the network will be AT&T’s to make. That said, the president and CEO of AT&T Mobility was quoted in the Associated Press saying “there’s nothing for [customers] to worry about… [network changes affecting devices] will be done over time… ”

Moreover, AT&T has publicly admitted that if the merger goes through, T-Mobile subscribers with 3G phones will have to replace their phones to keep their wireless broadband service. AT&T plans to “rearrange how T-Mobile’s cell towers work” so that T-Mobile’s airwaves can be used for 4G service rather than 3G. Even though AT&T will be altering T-Mobile’s 3G cell towers to operate 4G services, Ralph de la Vega, president and CEO of AT&T Mobility and Consumer Markets, said that after the merger, T-Mobile 3G phones will need to be replaced with AT&T 3G phones, which “will happen as part of the normal phone upgrade process.” Once AT&T forces the T-Mobile subscribers with 3G phones to buy AT&T 3G phones, it is only a matter of time before AT&T pushes all of its subscribers over to the 4G network.

Moreover, AT&T has publicly admitted that if the merger goes through, T-Mobile subscribers with 3G phones will have to replace their phones to keep their wireless broadband service. AT&T plans to “rearrange how T-Mobile’s cell towers work” so that T-Mobile’s airwaves can be used for 4G service rather than 3G. Even though AT&T will be altering T-Mobile’s 3G cell towers to operate 4G services, Ralph de la Vega, president and CEO of AT&T Mobility and Consumer Markets, said that after the merger, T-Mobile 3G phones will need to be replaced with AT&T 3G phones, which “will happen as part of the normal phone upgrade process.” Once AT&T forces the T-Mobile subscribers with 3G phones to buy AT&T 3G phones, it is only a matter of time before AT&T pushes all of its subscribers over to the 4G network.

T-Mobile customers who are forced to migrate to AT&T’s network will have to buy new phones, agree to more expensive rate plans, or cancel their contracts and pay a termination fee.

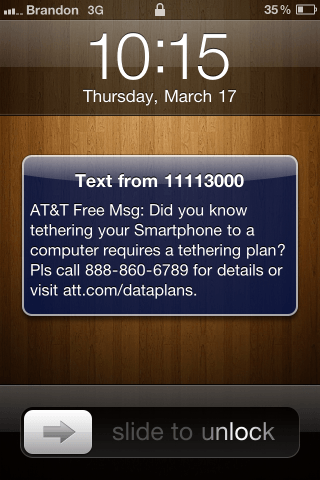

Once known for its low prices, T-Mobile has already begun increasing its rates and decreasing options in anticipation of the merger. On July 20, 2011, T-Mobile discontinued its unlimited data plans, replacing them with plans that cap the amount of data a customer can use; once the customer hits the data cap, T-Mobile will substantially slow down their network speed. Nine days later, AT&T, which stopped offering new unlimited data plans last year, announced it would similarly start throttling data speeds even for customers on “grandfathered” unlimited data plans. AT&T is attributing its slow-down to the “serious wireless spectrum crunch.” In another implicit promise sure to be broken, AT&T has told its customers and regulators that “[n]othing short of completing the T-Mobile merger will provide additional spectrum capacity to address these near term challenges.”

Finally, T-Mobile was recently named one of the world’s most ethical companies for 2011. It was the only U.S. wireless telecommunication service provider that made the list. By contrast, complaints about AT&T’s service and prices are legion. Indeed, the views of millions of AT&T customers have been summarized by an online campaign known as “#attfail.” This merger will eliminate a U.S. wireless company that at least seemed to care about its customers.

To this day, the AT&T customers who were misled and overcharged by AT&T’s actions after the 2004 merger are still fighting in the courts for refunds and other remediation arising from the merger. In 2006, lawyers for Consumer Watchdog, joined by a group of private law firms, filed a national class action lawsuit against AT&T on behalf of the millions of customers who were victimized by the merger: Coneff v. AT&T Corp., et al., No. C06-0944 (W.D. Wash). In response, AT&T’s lawyers claimed that when AT&T customers were forcibly moved to the new network, they simultaneously agreed to waive their right to seek refunds from AT&T in court because of a provision buried in the fine-print of AT&T’s contract that required arbitration of all disputes and barred customers from joining together in an arbitration. Throughout the litigation, AT&T changed its arbitration clause several times, each time modifying various terms while retaining the arbitration clause that prohibited customers from bringing or participating in a class action, regardless of whether it is brought in arbitration or in court.

To this day, the AT&T customers who were misled and overcharged by AT&T’s actions after the 2004 merger are still fighting in the courts for refunds and other remediation arising from the merger. In 2006, lawyers for Consumer Watchdog, joined by a group of private law firms, filed a national class action lawsuit against AT&T on behalf of the millions of customers who were victimized by the merger: Coneff v. AT&T Corp., et al., No. C06-0944 (W.D. Wash). In response, AT&T’s lawyers claimed that when AT&T customers were forcibly moved to the new network, they simultaneously agreed to waive their right to seek refunds from AT&T in court because of a provision buried in the fine-print of AT&T’s contract that required arbitration of all disputes and barred customers from joining together in an arbitration. Throughout the litigation, AT&T changed its arbitration clause several times, each time modifying various terms while retaining the arbitration clause that prohibited customers from bringing or participating in a class action, regardless of whether it is brought in arbitration or in court.

In 2009, the U.S. District Court in Seattle, Washington, held that AT&T’s arbitration clause was unconscionable because most AT&T customers would never obtain redress without the ability to bring a class action. The case is presently before the 9th Circuit. In its briefing, AT&T now contends that the U.S. Supreme Court’s recent decision in AT&T Mobility v. Concepcion 563 U.S. __ (2011) should be interpreted by the courts to apply to the egregiously unfair and one-sided mandatory arbitration clauses like the one struck down in Coneff in 2009, which, in our case and unlike in Concepcion, has been shown to preclude customers’ basic due process rights.

Albert Einstein defined insanity as doing the same thing over and over again and expecting different results. Considering AT&T’s track record, it is irrational to expect that the AT&T and T-Mobile merger will yield different results. If the merger is approved, millions of T-Mobile customers will be subjected to the same costly and unfair practices that AT&T customers experienced after the 2004 Cingular merger. Moreover, permitting AT&T to swallow a competitor will leave the American cellular marketplace controlled by a duopoly that, through the artifice of termination fees and arbitration agreements, will effectively eliminate competition between them.

This is a bread and butter test of the federal government’s commitment to American consumers versus the Wall Street and corporate interests that too often seem to be the winners every time the federal government takes action. The Administration should ignore the lofty pronouncements of the corporate-funded academics and allies who provide cover for the glib promises of two cellular giants, along with the Wall Street firms that will reap millions in fees for providing the merger paperwork, in favor of the average American family, who, after all they have been forced to sacrifice these last few years, should not be required to pay more of their dollars for the ability to use a cell phone.

Harvey Rosenfeld

Laura Antonini

You can find documented footnotes accompanying this letter here.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/ATT T-Mobile Merger Ad.flv[/flv]

AT&T is blanketing the airwaves with claims of improved service in its advertising promoting the merger with T-Mobile. (1 minute)

Subscribe

Subscribe