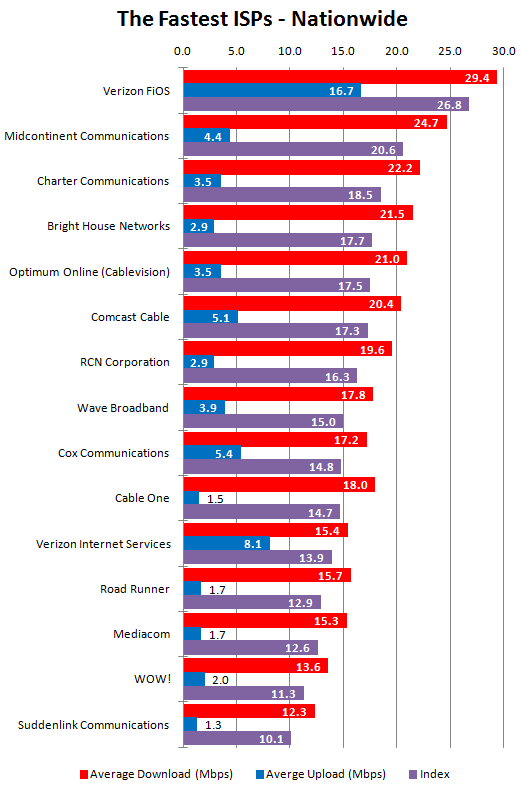

PC Magazine has declared fiber to the home service America’s fastest broadband technology, and among larger providers, Verizon’s FiOS once again took top honors for delivering the fastest and most consistent broadband speeds.

PC Magazine has declared fiber to the home service America’s fastest broadband technology, and among larger providers, Verizon’s FiOS once again took top honors for delivering the fastest and most consistent broadband speeds.

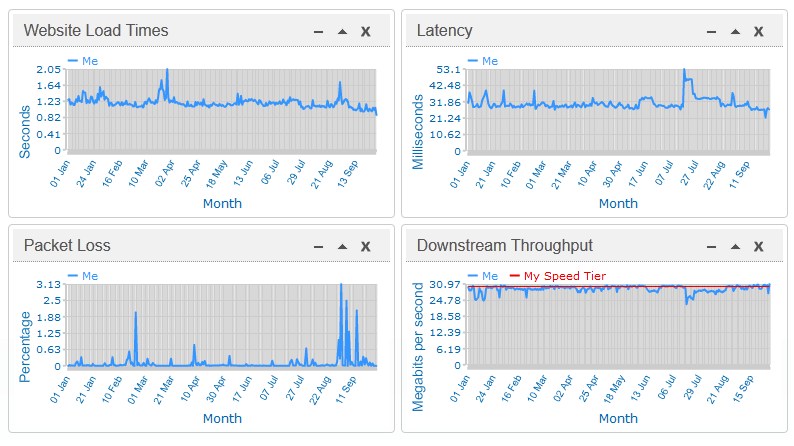

Over the past nine months, the magazine’s readers have been conducting regular speed tests using their personal broadband connections. The magazine found fiber optics remains the best current technology for delivering cutting-edge broadband service, with an average speed rating for FiOS reaching 29.4/16.7Mbps. Since PC Magazine readers were subscribed to various speed tiers while conducting the tests, the magazine’s ratings do not measure the fastest possible speeds on offer from different providers. Verizon’s most-popular service bundle includes 15/5Mbps service, heavily weighting Verizon’s speed rating which is capable of even faster speeds with their 50-300Mbps premium service tiers. But on average, consistently fast speeds kept them in the top spot.

Cable broadband technology was the second-best choice, depending on how cable operators implement it. Cable companies depend on a singl, shared broadband pipeline in each neighborhood. DOCSIS 3 upgrades allow a cable operator to vastly expand that pipeline by “bonding” several channels together to increase the maximum bandwidth. Cable operators that combine the latest technology with the smallest number of customers sharing a connection do the best.

Midcontinent Communications (better known by customers as Midco), achieved first place nationwide. The company, which serves customers in Minnesota, the Dakotas, and Wisconsin, took top honors with an average speed of 24.7/4.4Mbps — the best of any cable operator.

Ratings sometimes show the level of investment made by cable operators in their network. A sudden boost in average speeds is a sure sign a cable operator is rolling out network upgrades. A speed decline can expose a cable company trying to oversell an already constrained network. Charter Cable, which has routinely gotten poor ratings in Consumer Reports’ rankings, showed dramatic improvement in PC Magazine’s ratings, achieving third place with an average speed increase from 15Mbps to 18.5Mbps. But while the added speed is nice, the company’s usage caps are not. Conversely, WOW!, which achieved top scores in Consumer Reports’ ratings, scored towards the bottom of PC Magazine’s tests.

Comcast, which last year trumpeted its high rankings in controversial ads claiming to deliver the fastest broadband in the nation has now been overrun by both Midco and Charter. Comcast Xfinity is now in sixth place, hardly the fodder for any future ad campaign.

Cox Cable actually lost ground since last year, with average speed now down to 14.8Mbps. The bottom four: Time Warner Cable, Mediacom, WOW!, and Suddenlink — are all hampered by slow upload speeds and more anemic “take-rates” on higher speed broadband plans with the speeds on offer. With fewer premium speed customers, average speed ratings take a hit from the larger proportion of customers sticking with standard service.

Phone companies barely appeared in the magazine’s top ratings. AT&T’s U-verse could not even make the top-15. While 25Mbps was adequate when U-verse was first deployed, the broadband speed race has quickly overshadowed the company’s fiber to the neighborhood service, which still relies on home phone lines and antiquated copper infrastructure in the immediate neighborhood.

Phone companies still offering traditional ADSL on almost all-copper networks turned in even more dismal results — most too low to rate. Only Frontier’s adopted FiOS network kept them in the rankings in the overall broadband “slow zone” in the Pacific Northwest, along with CenturyLink’s acquired ADSL2+ and bonded DSL networks built by Qwest.

ISPs that perform poorly typically criticize the methodology of voluntary speed tests as the basis for speed and performance ranking. Most criticize the apparent lack of consistency, random sampling, the possibility rankings may be weighted in certain geographic areas, and may mix a disproportionate number of customers with standard or premium level speeds to unfairly boost or diminish average speed rankings. But overall, PC Magazine’s rankings show some technologies superior to others. If a customer has a choice, finding a fiber to the home provider is likely to provide an improvement over what the cable company offers, but the differences between phone company DSL and cable broadband are even starker.

Subscribe

Subscribe