Apple TV (version 4)

The cable industry is on the cusp of saving billions of dollars annually buying and maintaining set-top boxes and cable modems if they can convince customers to buy their own instead.

Cable companies collectively spend as much as $10 billion a year on customer premise equipment (CPE), ranging from simple Digital Transport Adapters for older analog-only TV sets, to the most advanced cloud-based set-top boxes and DVRs.

Cable industry analyst Craig Moffett believes the cable industry will save a fortune and lose one as consumers buy their own set-top equipment like Apple TV or Roku boxes and buy their own modems to avoid monthly rental charges. That means cable companies will likely forfeit a considerable percentage of their leasing/rental revenue.

“The idea that customers will eventually consume video through their own Apple TV or Roku boxes, or simply connect their cable to their smart TVs, Xboxes and Sony PlayStations, is neither new nor far-fetched,” wrote Moffett. “There are good reasons to believe that CPE spending may come down significantly in future (product) generations.”

Most cable equipment is leased to customers and often installed by a cable operator that covers the costs of sending a truck to the customer’s home. After installation, the average American cable subscriber pays $89.16 a year renting a single cable box, and for those with multiple boxes and a DVR, those costs rise to $231.82 a year. A cable modem can be purchased for $50-90 on average, and usually pays for itself in less than one year of rental charges charged by many cable operators.

Comcast X1

Even with more capable consumer-targeted set tops like the latest Apple TV ($149-199) and Roku devices now approaching $100, it will not take long for consumers to recoup their money avoiding rental fees.

Cable operators like Time Warner Cable now carry the majority of their cable channels on apps accessible through devices like the Roku. Customers will not get the flashiest on-screen experience, but they do get a welcome alphabetical channel lineup and a reasonably good picture. Future generations of the boxes are expected to enhance usability and picture quality.

Cable operators like Charter stand to gain the most. If their merger with Time Warner Cable and Bright House Networks is approved, all three companies are expected to see reductions in equipment expenses estimated at $2.97 billion in 2015 to as little as $917 million by 2019, according to Moffett. Charter is already expecting to see its capital spending fall more than a billion dollars a year, from $6.97 billion to $5.83 billion by 2019, but consumers should not expect to see the savings passed on to them.

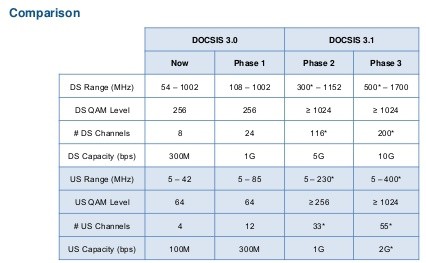

Cable operators can also expect considerable savings after fully deploying DOCSIS 3.1 technology that powers their broadband services. The next generation cable broadband platform offers increased efficiency and flexibility that will allow operators to sell faster speeds.

Comcast may stand apart from others believing deluxe set-top boxes like its X1 are urgently needed to keep cable TV customers satisfied. One of Comcast’s largest planned expenses is deploying millions more of these advanced platforms to customer homes in 2016.

Subscribe

Subscribe

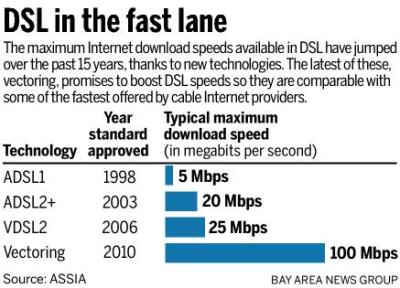

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Just a few years earlier, most providers wouldn’t think of offering discounted 10Mbps service, fearing it would cannibalize revenue as customers downgraded to get lower priced service. Increasing demands on bandwidth from online video and multiple in-home users have gradually raised consumer expectations, and their need for speed.

Any final approval of Charter Communication’s planned acquisition of Time Warner Cable and Bright House Networks will likely not come before next summer, as

Any final approval of Charter Communication’s planned acquisition of Time Warner Cable and Bright House Networks will likely not come before next summer, as  Time Warner Cable customers who purchased their own cable modems to avoid the company’s $8 monthly rental fee will effectively be forced to indirectly pay those fees once again if Charter Communications wins approval to buy the cable operator.

Time Warner Cable customers who purchased their own cable modems to avoid the company’s $8 monthly rental fee will effectively be forced to indirectly pay those fees once again if Charter Communications wins approval to buy the cable operator. Zoom wants Charter to be required to offer consumers that own their own equipment a tangible monthly discount for broadband service as a condition of any merger approval.

Zoom wants Charter to be required to offer consumers that own their own equipment a tangible monthly discount for broadband service as a condition of any merger approval. An expert hired by Charter Communications to offer “qualified” views on the competitive impact of a merger involving Charter, Bright House Networks, and Time Warner Cable got his facts wrong about Charter’s data cap policy, a mistake that calls into question his analysis about the company’s potential to abuse broadband customers by imposing data caps after its three-year commitment not to expires.

An expert hired by Charter Communications to offer “qualified” views on the competitive impact of a merger involving Charter, Bright House Networks, and Time Warner Cable got his facts wrong about Charter’s data cap policy, a mistake that calls into question his analysis about the company’s potential to abuse broadband customers by imposing data caps after its three-year commitment not to expires.