If you are a Time Warner Cable customer, one of four things will happen by this time next year:

If you are a Time Warner Cable customer, one of four things will happen by this time next year:

- You will still be a Time Warner Cable customer if regulators shoot down its merger with Comcast;

- You will be a Comcast customer;

- You will be a Charter Communications customer;

- You will be served by a brand new cable company temporarily dubbed “SpinCo,” owned partly by Comcast but managed by Charter.

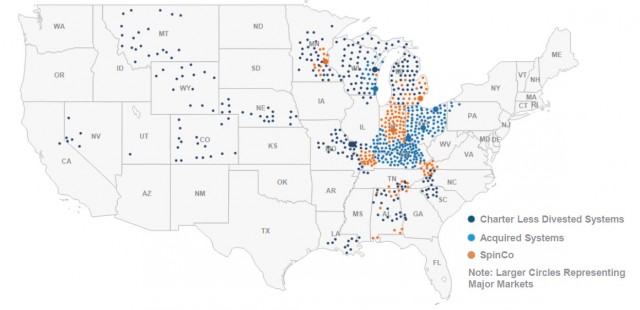

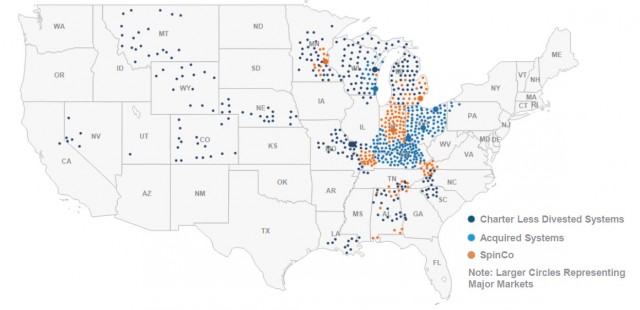

Comcast and Charter this week reached an agreement on how to handle the 3.9 million Time Warner Cable customers Comcast intends to spin-off to keep its total subscriber numbers at a level they believe will appease regulators. The transaction will affect Time Warner customers in the midwest the most, particularly former Insight Cable customers.

Charter Communications will say goodbye to customers in California, New England, northern Georgia, Texas, North Carolina, Oregon, Washington, Virginia and parts of Tennessee. Most of those customers will now be served by Comcast. Among the regions affected: New York, Boston, Dallas/Ft. Worth, Northern/Southern California, and Atlanta.

[flv]http://www.phillipdampier.com/video/WISN Milwaukee First Comcast Now Charter 4-28-14.flv[/flv]

WISN in Milwaukee reports Time Warner Cable customers there were just getting used to the idea of Comcast and they are not happy service will be provided by Charter Communications instead. (2:03)

Comcast and Time Warner Cable will in turn give up many of its cable systems in the midwest, either transferring them to Charter or the “SpinCo” venture managed by Charter.

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.

If you are a Comcast or Time Warner Cable customer next to a current Charter service area in Michigan, Minnesota, Indiana, Alabama, Eastern Tennessee, Kentucky or Wisconsin, chances are you will end up a subscriber of the “SpinCo” venture. That will prove a distinction without much difference to customers, because Charter will manage the day-to-day operations of the new cable company and has the right to eventually acquire it outright.

With the exception of a small handful of systems in western sections of Pennsylvania, Virginia and North Carolina, all of New England, New York, and the mid-Atlantic region will be serviced by Comcast.

With the exception of Cablevision in eastern New York, Comcast will be the dominant cable provider across New York State from Manhattan to Buffalo.

The agreement also includes a commitment by Charter to drop its opposition to the Time Warner Cable/Comcast merger.

“Today’s announcement from Comcast would, in essence, lead to the creation of a three-company cable cartel. Masquerading as subscriber divestitures, the agreement with Charter brings together the three largest cable providers, who account for 38% of cable subscribers and 45% of Internet subscribers,” the Writers Guild of America West said in a statement. “The decision of these three powerful companies to divide markets and share ownership of subscribers through a new publicly traded corporation is unprecedented and adds to the mounting evidence against the Comcast-Time Warner Cable merger.”

The transaction is expected to be tax-free and will happen in three stages:

- Asset Sale: Charter acquires systems serving around 1.4 million former TWC customers for an estimated $7.3 billion in cash;

- Asset Transfer: Charter and Comcast transfer assets in a tax-free exchange involving around 1.6 million former TWC customers and about 1.6 million Charter customers;

- Asset Spin-off: Comcast will spin-off a new entity (“SpinCo”) composed of cable systems serving around 2.5 million Comcast customers to its shareholders, with Charter acquiring close to 33% of the equity of SpinCo in exchange for 13% of the equity of a new holding company of Charter.

Charter Communications would become the nation’s second largest cable operator if the deal is approved, owning outright systems with an estimated 5.7 million video customers and managing an extra 2.5 million SpinCo customers, together totaling more than 8.2 million video customers.

Comcast wanted the deal done quickly so it could begin lobbying Washington and other regulators with detailed divestiture plans to keep Comcast’s total subscribers to less than 30% of the national cable market.

Although Comcast will face tough competition in Time Warner Cable territories also served by Verizon FiOS, Charter and its managed SpinCo will compete primarily with AT&T U-verse. Just 1% of Charter’s territory is expected to see competition from Verizon’s fiber network.

[flv]http://www.phillipdampier.com/video/Bloomberg Divesting Comcast Subs 4-28-14.flv[/flv]

Comcast agreed to divest 3.9 million customers to Charter Communications, potentially helping to ease the approval process for its merger with Time Warner Cable. Media Morph Chairman and Chief Strategist Shahid Khan and Bloomberg’s Paul Sweeney speaks on Bloomberg Television’s “In The Loop.” (6:23)

Charter Communications, Inc. and Comcast Corporation today announced the name of the new cable company that will be spun off from Comcast upon completion of the Comcast – Time Warner Cable merger and the Comcast – Charter transactions.

Charter Communications, Inc. and Comcast Corporation today announced the name of the new cable company that will be spun off from Comcast upon completion of the Comcast – Time Warner Cable merger and the Comcast – Charter transactions.

Subscribe

Subscribe Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either.

Although Charter Communications did not succeed in its bid to assume control of Time Warner Cable, it isn’t crying about its loss to Comcast either. Since Thomas Rutledge was hired on as CEO at Charter Communications, a steady stream of his former colleagues from Cablevision’s executive suites have followed him to his new employer.

Since Thomas Rutledge was hired on as CEO at Charter Communications, a steady stream of his former colleagues from Cablevision’s executive suites have followed him to his new employer. Nuzzo has been with Cablevision since 1986, so his sudden choice to leave, along with other long-time Cablevision executives, continues to fuel speculation Cablevision won’t be around much longer, especially if Comcast successfully wins approval to acquire Time Warner Cable. Of course, Wall Street analysts have made similar predictions for years without anything to show for it.

Nuzzo has been with Cablevision since 1986, so his sudden choice to leave, along with other long-time Cablevision executives, continues to fuel speculation Cablevision won’t be around much longer, especially if Comcast successfully wins approval to acquire Time Warner Cable. Of course, Wall Street analysts have made similar predictions for years without anything to show for it.

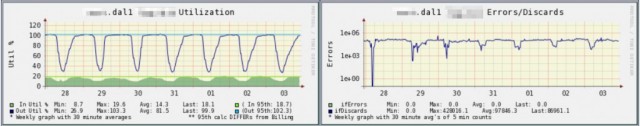

However, Taylor says more than a year ago, something suddenly changed at five U.S. Internet Service Providers. They stopped periodic upgrades and allowed some of their connections to become increasingly busy with traffic. Today, six of Level 3’s 51 peer connections are now 90 percent saturated with traffic for several hours a day, which causes traffic to degrade or get lost.

However, Taylor says more than a year ago, something suddenly changed at five U.S. Internet Service Providers. They stopped periodic upgrades and allowed some of their connections to become increasingly busy with traffic. Today, six of Level 3’s 51 peer connections are now 90 percent saturated with traffic for several hours a day, which causes traffic to degrade or get lost. In fact, Netflix traffic seems to be a common point of contention among Internet Service Providers that also sell their own television packages. They now insist the streaming video provider establish direct, paid connections with their networks. Level 3 is affected because it carries a substantial amount of traffic on behalf of Netflix.

In fact, Netflix traffic seems to be a common point of contention among Internet Service Providers that also sell their own television packages. They now insist the streaming video provider establish direct, paid connections with their networks. Level 3 is affected because it carries a substantial amount of traffic on behalf of Netflix. If you are a Time Warner Cable customer, one of four things will happen by this time next year:

If you are a Time Warner Cable customer, one of four things will happen by this time next year:

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.