If you can find it.

A major concern about the merger between Charter and Time Warner Cable and Bright House Networks is the availability of affordable Internet access. That was a major issue for New York regulators contemplating the earlier failed merger attempt between Comcast and Time Warner Cable.

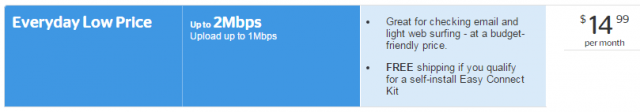

Time Warner Cable offers all subscribers a low-speed budget Internet option called Everyday Low Price Internet for $14.99 a month with no pre-qualifications, no paperwork, and no contract commitment. Although originally designed to appeal to price sensitive DSL customers, it has become Time Warner’s de-facto low-income Internet offering for those who cannot afford Standard Internet service.

According to Charter Communications’ Public Interest Statement filed today with the Federal Communications Commission — its case to win approval of its acquisition of Time Warner Cable and Bright House — the future is not looking too good for Time Warner’s $15 Internet program if the merger is approved. Charter makes a point of stating its entry-level Internet option is 60Mbps service at almost three times that price.

So what will “New Charter” offer more than 10 million cable customers going forward:

New Charter will build upon Bright House Networks’ broadband program for low-income consumers by making a broadband offering available with higher speeds and expanded eligibility while continuing to offer the service at a significant discount, and will begin making the offer available within six months after the transaction closes and offer it across the New Charter footprint within three years of closing.

If you were even aware Bright House offered a discount broadband program, congratulations!

An advocate of affordable Internet service claims Bright House has done an excellent job keeping any mention of the program off its website. In fact, it appears arranging for a visa to visit North Korea is probably slightly easier than getting cheap service from Bright House.

It turns out Bright House does have a modified version of its barely advertised “Lite Internet” plan offering 2Mbps downloads and 512kbps uploads. Anyone can buy that plan for about $20 (with a separate modem fee). Bright House’s Low-Income Internet plan offers the same service for $9.95 a month for up to 24 months.

To qualify, there is an Olympic-style playing field of hoops to jump through, according to Cheap Internet:

1) You must have at least one child qualified for the National School Lunch Program. They need not be enrolled now.

2) You cannot have been a Bright House broadband customer during the last three months. If you are a current customer, you must first cancel and go without Internet service for 90 days (or call the phone company and hope to get a month-to-month DSL plan in the interim.)

3) If you have an overdue bill older than 12 months, you are not eligible until you pay that bill in full.

But it gets crazier.

4) Bright House does not enroll customers in discounted Internet programs year-round. From a Bright House representative:

“We do participate in this particular program, however, it is only around September that we participate in it. This is a seasonal offer that we have which can only be requested from the middle of August to the middle of September, which is when most start up with school again for the year.”

That restriction gets heavy criticism from Cheap Internet.

“Families fall into poverty every day of the year, and poverty-stricken families move from one school district to another every day of the year,” the website writes. “So it’s horribly unfair to tell them they’d qualify for this program if only they had fallen into poverty sometime between the middle of August and the middle of September.”

Time Warner Cable offers $14.99 to anyone without paperwork.

But wait, there is more.

Bright House does not take orders for the Low-Income Internet plan over the Internet. That’s right. No Internet sign ups over the Internet. You have to enroll by phone: (205) 591-6880. We dialed it and experienced 30 seconds of… silence. No ringing, no busy signals, nothing. Then an automated attendant picked up looking for a pre-qualification phone number to decide if we are in a Bright House service area. That is as far as we could get. It hung up.

It turns out Bright House sometimes refers to its discount Internet program under another name: Connect2Compete. As both Cheap Internet and Stop the Cap! found, if you visit Bright House’s website and search for either term, you will find absolutely nothing.

Does it seem Bright House lacks enthusiasm selling this option to income-challenged consumers?

The most information available about the discount Internet program Charter wants to bring to Time Warner Cable customers is available on a pretty skimpy third-party website that has no connection to Charter, Time Warner or Bright House. Nothing to be concerned about there!

New Charter promises to improve the program, but Stop the Cap! believes there is a much simpler solution. For $5 more, Time Warner Cable already offers a fine discount option available to anyone, anywhere, for as long as they want it. No paperwork, no complications, no drama. The fact New Charter seems to prefer a different option — one that requires an archaeological dig to unearth needed information — makes us wonder whether they are interested in serving the needy at all.

Subscribe

Subscribe John Malone’s cable systems in Europe share little in common with what Americans get from their local cable company. In Switzerland, Liberty-owned UPC Cablecom charges $95 a month for 250/15Mbps service — a speed Charter Communications customers cannot buy at any price. Liberty is Charter’s biggest investor/partner. Later this month, Swiss cable customers will be able to buy 500Mbps from UPC. When implemented, that is expected to push Switzerland’s broadband speed rankings into the global top-10. Currently Switzerland is rated #11. The United States is #28 and Canada is ranked #34.

John Malone’s cable systems in Europe share little in common with what Americans get from their local cable company. In Switzerland, Liberty-owned UPC Cablecom charges $95 a month for 250/15Mbps service — a speed Charter Communications customers cannot buy at any price. Liberty is Charter’s biggest investor/partner. Later this month, Swiss cable customers will be able to buy 500Mbps from UPC. When implemented, that is expected to push Switzerland’s broadband speed rankings into the global top-10. Currently Switzerland is rated #11. The United States is #28 and Canada is ranked #34.

Some providers have promoted “cloud-based” on-demand access to video that Tveter says has been available from the cable company for several years.

Some providers have promoted “cloud-based” on-demand access to video that Tveter says has been available from the cable company for several years.

On May 15, the last day of this year’s session of the Missouri Legislature,

On May 15, the last day of this year’s session of the Missouri Legislature,

Indeed, when Comcast tried to acquire Time Warner last year, the dominance (nearly 60 percent of the market) that the combined company would have had over broadband service caused federal regulators to look askance. Comcast

Indeed, when Comcast tried to acquire Time Warner last year, the dominance (nearly 60 percent of the market) that the combined company would have had over broadband service caused federal regulators to look askance. Comcast  Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators.

Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators. Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller.

Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller.