The New York State Public Service Commission today notified Charter Communications its merger application with Time Warner Cable will require a “more detailed review of the petition,” which means a final decision is unlikely before the end of this year or more likely 2016:

The New York State Public Service Commission today notified Charter Communications its merger application with Time Warner Cable will require a “more detailed review of the petition,” which means a final decision is unlikely before the end of this year or more likely 2016:

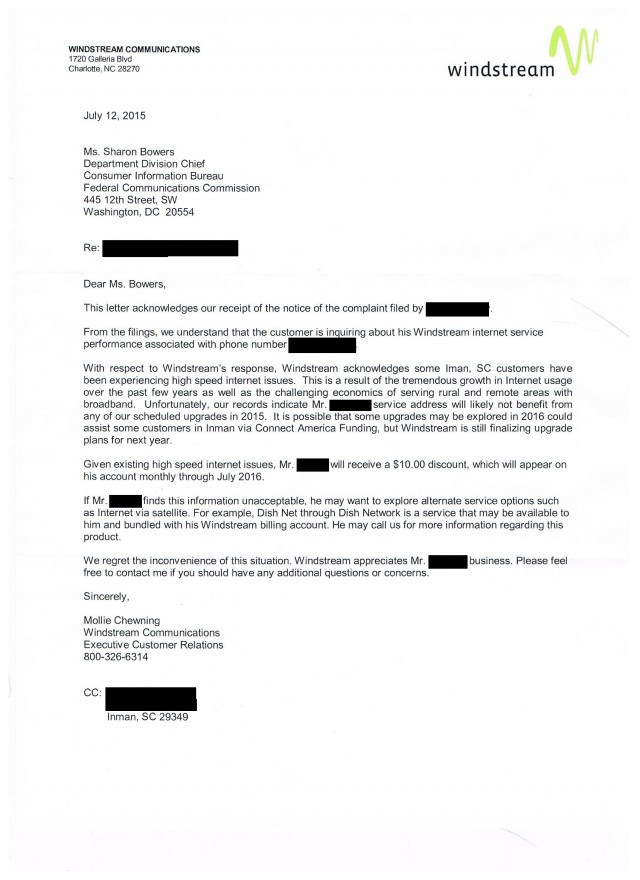

We have received the petition of Time Warner Cable Inc. and Charter Communications, Inc. dated July 2, 2015 seeking authority, pursuant to Public Service Law Sections 100, 101, and 222, to transfer a controlling interest in certain Time Warner Cable telephone systems, cable systems, franchises and assets to Charter and to issue debt. On July 10, 2015, a Supplement was received seeking further approval under PSL § 99(2) for a transfer of Time Warner Cable’s telephone franchises.

According to Sections 99 and 100 of the Public Service Law, such an application is deemed approved after ninety (90) days of filing unless the Commission or its designee notifies the petitioner in writing, within the time period, that the public interest requires the Commission’s review and its written order.

[…] A preliminary review indicates that the public interest requires a more detailed review of the petition. Therefore, pursuant to Public Service Law Sections 99,100, and 101 we are informing you that the Commission will review your petition and will issue a written response in this proceeding.

The PSC has set a deadline for comments on the merger of Sept. 16 with reply comments due two weeks after that. But on-the-record regional forums will also be held across the state to gather more comments from consumers and stakeholders. Locations of the forums have not yet been announced.

The PSC has set a deadline for comments on the merger of Sept. 16 with reply comments due two weeks after that. But on-the-record regional forums will also be held across the state to gather more comments from consumers and stakeholders. Locations of the forums have not yet been announced.

As with Comcast’s merger proposal, a significant review period is expected as the merger of Charter Communications and Time Warner Cable will have profound implications on the entire state. Outside of Long Island and a few boroughs in New York City, Time Warner Cable is by far the most dominant provider serving every major population center in New York.

Two letters have already been added to the record about the merger.

The Rochester Business Alliance filed this letter in “strong support” of the proposed deal, quoting almost entirely from press releases and merger advocacy documents issued by Charter Communications. Time Warner Cable is a “partner member” of the group, better known as the Regional Chamber of Commerce.

“The Rochester Business Alliance advocates for an environment that will promote the success of its members and the local economy,” the group writes on its website. “We help our member companies and their employees stay connected to the issues as well as to the people who can make a difference.”

“The Rochester Business Alliance advocates for an environment that will promote the success of its members and the local economy,” the group writes on its website. “We help our member companies and their employees stay connected to the issues as well as to the people who can make a difference.”

Michael Kaplan is the first consumer to weigh in on the merger, and he is opposed.

“Just like the Comcast we now have to write to you to ask that you reject this merger,” Kaplan writes. “The only people who benefit from this are the three or four people who will get very rich from it. The rest of the people you are supposed to be protecting? We get much higher cable/Internet rates because they are taking on so much debt that it’s obvious they will have to raise rates significantly. How does this help New York State?”

Kaplan also doesn’t believe Charter’s promise not to usage cap its broadband customers because the commitment expires after three years:

They also promised not to cap or throttle broadband users for three years. Is that a joke?

Time Warner has (due to public backlash) never capped or throttled their Internet. They have not placed data caps on their service which everyone knows is a cash grab.

If you are politically forced into doing this than at the very least Charter MUST keep the current arrangement Time Warner Cable has forever. FOREVER. No data caps, no overage fees, no throttling. Never.

Robert Marcus stands to make over 90 million dollars from the sale of Time Warner. Since his inception as CEO his mission has been to sell the company so he can cash out. He should improve service, equipment, work for us.

We the people are getting sick and tired of it and we are especially of a CEO who is only thinking of his end. What he will personally make. He doesn’t care on how every single person in NY State will get screwed.

Subscribe

Subscribe

That philosophy may still cost cable companies customers if a fiber competitor doesn’t have to compromise speed and performance and can afford to charge less.

That philosophy may still cost cable companies customers if a fiber competitor doesn’t have to compromise speed and performance and can afford to charge less.

Stop the Cap! will formally participate in New York State’s

Stop the Cap! will formally participate in New York State’s