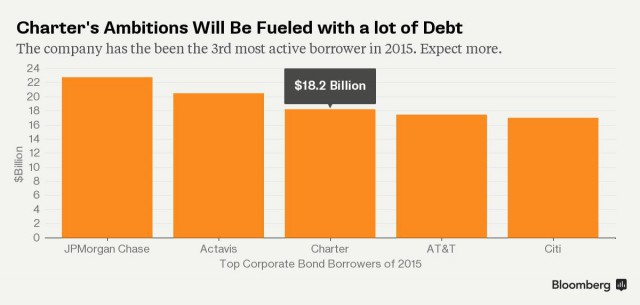

Less than three months before announcing it would acquire Time Warner Cable in a $55 billion deal, Charter Communications quietly dropped usage caps, in place on its broadband plans since 2009, without explanation and the FCC wants to know why.

Less than three months before announcing it would acquire Time Warner Cable in a $55 billion deal, Charter Communications quietly dropped usage caps, in place on its broadband plans since 2009, without explanation and the FCC wants to know why.

FCC officials have sent a letter to Charter requesting a range of information about the company’s broadband services, including information about Charter’s since-dropped usage cap program. The federal agency reviewing its buyout of Time Warner Cable wants to know when Charter dropped its usage caps and why.

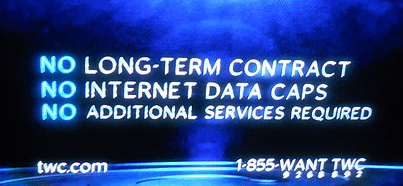

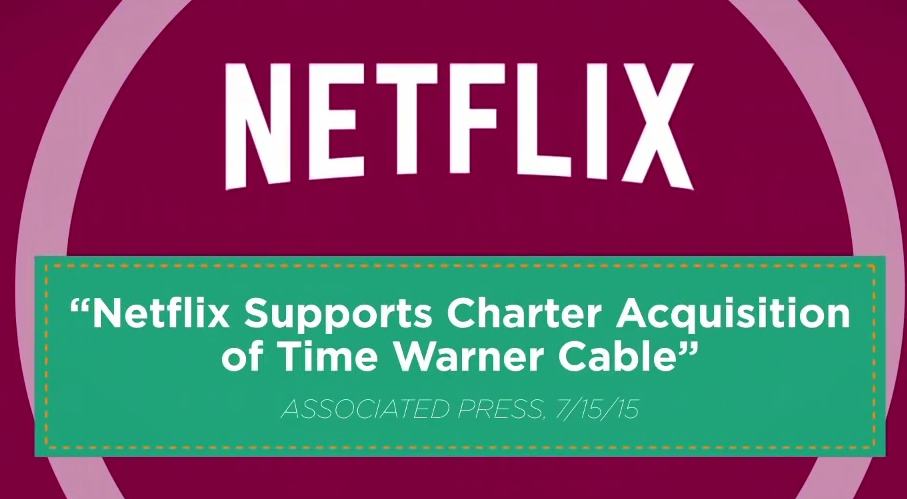

Charter Communications has promoted “no usage caps” as a selling point to convince regulators its purchase of Time Warner Cable is a consumer-friendly transaction. Charter has promised a cap-free Internet experience for Time Warner Cable customers for three years, but has not committed to offer unlimited broadband service beyond that date.

Two months before Time Warner Cable planned a since-dropped 2009 market test of usage caps in New York, North Carolina and Texas, Charter Communications confirmed it was introducing “monthly residential bandwidth consumption thresholds” on its broadband customers ranging from 100GB for customers with speeds of 15Mbps or slower and 250GB for customers subscribed to 15-25Mbps service.

“In order to continue providing the best possible experience for our Internet customers, later this month we will be updating our Acceptable Use Policy (AUP) to establish monthly residential bandwidth consumption thresholds,” Charter’s Eric Ketzer told DSL Reports at the time. “More than 99% of our customers will not be affected by our updated policy, as they consume far less bandwidth than the threshold allows.”

Few customers realized Charter had placed a cap on Internet usage because the cable company treated the limits as “soft caps” — guidelines they could cite if they found a customer using a very large amount of bandwidth. But customers were not charged overlimit fees and few ever heard from Charter about their usage, even if it well-exceeded their allowance.

In front of Time Warner Cable offices in Rochester, N.Y. protesting Time Warner Cable’s proposed usage caps. (April 2009)

Only a handful of companies, including national providers like AT&T (for DSL) and Comcast (in usage cap market trial areas), have followed up usage allowances with stinging overlimit fees for those exceeding them, applied to customer bills. The practice is far more common among smaller and regional cable companies like Alaska’s GCI, which earned 10 percent of its broadband revenue billing customers for excess usage.

In March of this year, Stop the Cap! reported Charter quietly dropped usage caps (or “thresholds”) from their Acceptable Use Policy, ending six years of usage capped service — less than three months before announcing it was acquiring Time Warner Cable.

Time Warner Cable’s own experience with usage caps was short-lived after Stop the Cap! and other consumer advocates and elected officials launched a protest campaign against Time Warner Cable’s plans to expand a test of usage-based billing beyond Beaumont, Tex. to Rochester, N.Y., Greensboro, N.C., and the cities of Austin and San Antonio in Texas.

Time Warner proposed four tiers of usage allowances: 5, 10, 20, and 40 GB priced from $29.95 to $54.90 a month. The overlimit fee was to be $1/GB. Sanford Bernstein, a Wall Street research firm, predicted an average family subscribed to Time Warner’s top 40GB usage plan would pay around $200 a month in overlimit fees if they used Netflix more than 7.25 hours a week.

Within two weeks of launching protests in the four cities where Time Warner was planning to add caps, the plan was shelved permanently. But many Time Warner Cable customers have remained wary of the company’s plans regarding usage caps. Time Warner’s retooled, optional usage capped tiers offered to customers looking for a discount have proved dismal failures since their introduction, with fewer than 1% of Time Warner customers finding usage-limited Internet access compelling.

Rationing Your Internet Experience?

Consumer advocates also fear usage caps could reappear under Charter as quickly as they disappeared. Stop the Cap! is suspicious of Charter’s time-limited commitment to keep customers free of usage caps for three years. We are lobbying state and federal regulators to permanently extend that commitment as a condition of approving any merger between Charter and Time Warner.

“Customers must be assured they can always choose a reasonably priced unlimited use Internet option,” said the group’s founder Phillip Dampier. “If Charter/Time Warner Cable/Bright House wants to offer optional discounts for customers volunteering to limit their personal use, we are not opposed to that. But based on Time Warner’s own record, you can count on only a few thousand customers willing to voluntarily surrender unlimited, flat rate access.”

Stop the Cap! believes there is no credible reason Internet providers should be imposing compulsory usage caps or usage billing on anyone.

“Broadband is a huge money-maker and the costs to offer it continue to drop even as provider profits rise,” said Dampier. “Rationing broadband with a usage allowance is as credible as rationing Niagara Falls or breathing.”

The FCC is also requesting documentation detailing Charter’s proposed expansion of Wi-Fi hotspots in Time Warner Cable areas and company plans to boost standard broadband speeds from 15Mbps to 60Mbps. Charter has until Oct. 13 to respond.

Subscribe

Subscribe

Time Warner Cable will continue to offer customers unlimited data plans and further expand its Maxx upgrade program until it reaches the company’s entire service area or the merger with Charter Communications is approved by regulators.

Time Warner Cable will continue to offer customers unlimited data plans and further expand its Maxx upgrade program until it reaches the company’s entire service area or the merger with Charter Communications is approved by regulators.