Pulling the wool over your eyes.

As the Federal Communications Commission continues to consider AT&T’s proposal to abandon its wired infrastructure in rural service areas, hundreds of comments are arriving at the federal agency both for and against the idea. Between the submissions from large telecom companies and state regulators, a curious mix of professionally prepared comments favoring AT&T’s proposal have also arrived, many from organizations that simply do not have a direct interest in the outcome.

These Friends of AT&T include a range of non-profit, minority, and civil rights groups that have little interest in rural telecommunications policy but every interest in pleasing a company that lends executives to serve on advisory boards or writes big checks.

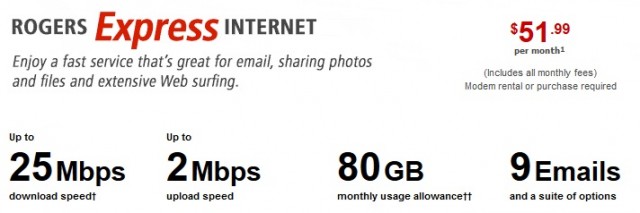

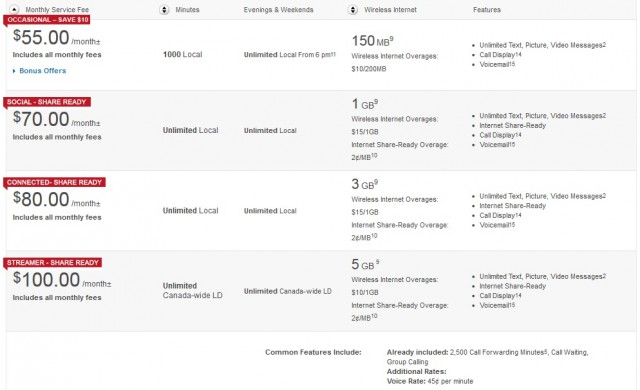

Even worse, some of the constituencies these groups purport to represent are among the most vulnerable. The rural poor, elderly, and economically disadvantaged are precisely those that cannot afford to lose budget-friendly phone and broadband service in favor of the expensive wireless solutions AT&T proposes as replacements.

Not all groups favoring AT&T are simply trolling for corporate contributions. Some seem to have been hoodwinked by the AT&T’s lobbyists, believing that abandoning rural wired infrastructure is an evolutionary step towards better service. They do not understand AT&T will offer exceptionally expensive broadband and voice calling over a wireless network notorious for dropped calls, poor rural reception, and stingy data caps in its place.

Stop the Cap! is here to help. Over the coming weeks, we will be running a special series calling out a range of groups that either take AT&T money and advocate for their cause or seem misinformed about the future rural reality AT&T has in store for rural America. We encourage readers to contact these groups and let them know they are hurting themselves — and you — spending precious resources advocating for a multibillion dollar telecommunications company that honestly does not need their help and does not have their interests at heart.

Ask these groups to carefully consider the comments from organizations that live and breathe rural broadband, consumer protection, and oversight:

A million-five can buy a lot of advocacy.

RURAL BROADBAND POLICY GROUP: “[We are] alarmed at the request AT&T has presented before the Commission, and believes that approving this petition will inflict negative consequences on rural communities and consumers including loss of affordable and reliable basic telephone service, which is the only form of communication many remote communities can access; eliminate consumer protections that have made it possible for rural people to access telecommunications services; reverse our commitment to Universal Service; endanger our national public safety; and fuel a divest-from-Rural-trend that will disadvantage our national economy and global competency. We simply cannot allow that to happen.”

FREE PRESS: “For the typical consumer, the grant of AT&T’s wishes would mean no protections from price gouging, no accountability for service outages, no consumer protections from cramming and slamming, and no reliable access to emergency services. For millions of consumers and businesses, it would mean no access at all, as AT&T would be free to stop providing service. And because there would no longer be any obligation for interconnection, Americans should expect to see rolling localized Internet blackouts as intercarrier disputes pop up, which will be “resolved” by higher prices paid to dominant carriers like AT&T.”

MICHIGAN PUBLIC SERVICE COMMISSION: “The MPSC recognizes that the transition to an IP-based network is already underway. The MPSC supports the transition from TDM to IP-based or other next generation networks and services, and the deployment of affordable, open, and high-capacity broadband by all broadband providers. However, it is imperative to recognize that great care must be taken to ensure the continuation of the competitive marketplace, universal service, and consumer protections. AT&T’s Petition proposes sweeping deregulation of the incumbent providers, which would allow them to withdraw service unilaterally. There cannot be a reduction in competition, thus leaving customers subject to prices and/or rates that are not just, reasonable, and affordable, with little or no competitive recourse.”

Coming Up: The National Farmers Union: Hoodwinked by AT&T’s Lobbyists

Subscribe

Subscribe Rogers Communications, Canada’s largest cable operator,

Rogers Communications, Canada’s largest cable operator,

Alex Dudley, a specialist in corporate crisis communications, has left Time Warner Cable after serving as the cable company’s group vice president of public relations, to take an executive position at Charter Communications.

Alex Dudley, a specialist in corporate crisis communications, has left Time Warner Cable after serving as the cable company’s group vice president of public relations, to take an executive position at Charter Communications.