More people will read this story than Atlantic Broadband has current customers for its 1Gbps broadband project in Miami.

More people will read this story than Atlantic Broadband has current customers for its 1Gbps broadband project in Miami.

“Atlantic Broadband is proud to be the first company to deliver 1 Gigabit Internet service to its customers here in the Miami Beach area,” said David Keefe, Atlantic Broadband’s senior vice president and general manager of the South Florida region. “While other companies are talking about what they will be doing, Atlantic Broadband moved forward and started offering this service in one of its communities. We look forward to extending access to our Gigabit Internet service to other properties and communities within our Miami footprint.”

Although Mr. Keefe isn’t being modest, his company’s gigabit broadband coverage area certainly is.

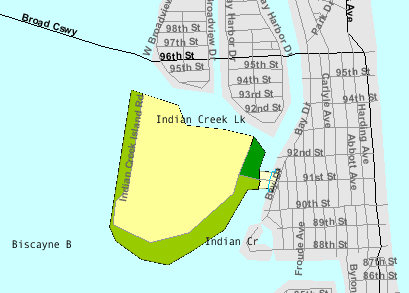

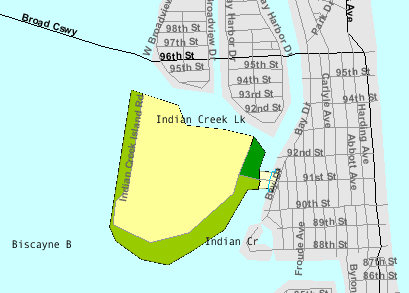

At present, the company serves just 40 properties with the super high-speed broadband service in high-income Indian Creek Village — the 8th richest community in the United States.

The tiny village of Indian Creek, in the Miami-Dade area, is made up of 40 properties and is the 8th richest community in the U.S.A.

Designed to appeal to residents who can spare no expense, the Atlantic Broadband package also includes more than 350 TV channels powered by TiVo, integrated access to Netflix, and unlimited phone service for up to four lines.

An Atlantic Broadband spokesperson wouldn’t reveal the price of the package, and admitted customers cannot choose standalone broadband-only service.

“The needs of Indian Creek Village were unique so custom service packages were created that include all of Atlantic Broadband’s TV services, Gigabit Internet and four phone lines,” a spokeswoman told Multichannel News. “Currently, there is not a published a standalone price for Gigabit Internet.”

Residents in the wealthy enclave include Victoria’s Secret model Adriana Lima, Spanish singer Julio Iglesias, his son Enrique Iglesias, Robert Diener, co-founder of Hotels.com, Edward Lampert, hedge fund billionaire and owner of what is left of Kmart and Sears, Don Shula, retired football coach, Charles Bartlett Johnson, mutual fund billionaire, billionaire investor Carl Icahn and former Philadelphia Eagles owner and billionaire art collector Norman Braman.

Other famous residents both past and present have included Beyoncé and Jay-Z, pro golfer Raymond Floyd, coach Rick Pitino, U.S. Senator George Smathers, Sheik Mohammed al Fassi, television host Don Francisco, co-founder of Calvin Klein Barry Schwartz, radio magnate Raul Alarcon, coal and oil executive, heiress and philanthropist Suzie Linden, Arthur I. Appleton, President of Appleton Electric Company and founder of the Appleton Museum of Art and Bridlewood Farm, and his wife Martha O’Driscoll a former Hollywood actress.

Atlantic Broadband has not ripped out classic cable infrastructure for its less-well-to-do customers outside of the village in the Miami-Dade area and relies on RF over Glass technology for its network extensions. That allows the company to keep its legacy equipment in place while giving some residents access to fiber and others traditional coaxial cable.

Atlantic serves an island of customers in the Miami Beach area, but most of Miami gets its cable service from Comcast. Competitor AT&T has promised fiber upgrades and gigabit speeds for its own customers in the Hialeah, Hollywood, Homestead, Opa-Locka, and Pompano Beach areas, but no time frame has been announced for the upgrade.

Atlantic Broadband will have one advantage over AT&T U-verse. It does not have usage caps.

Atlantic Broadband serves around 230,000 residential and business subs in western Pennsylvania, Miami Beach, Maryland/Delaware, and Aiken, S.C. It is owned by Cogeco Cable of Canada.

Subscribe

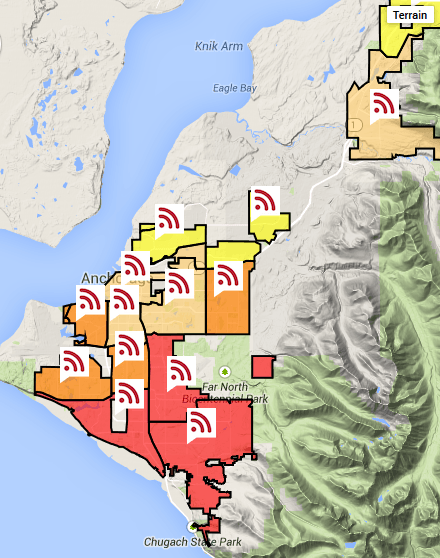

Subscribe Alaska-based GCI has rolled out a free upgrade for customers in Anchorage, Fairbanks, Juneau, Ketchikan, Mat-Su Valley, and Sitka that delivers broadband speeds up to 250/10Mbps.

Alaska-based GCI has rolled out a free upgrade for customers in Anchorage, Fairbanks, Juneau, Ketchikan, Mat-Su Valley, and Sitka that delivers broadband speeds up to 250/10Mbps.

The speed increases come after its competitor Alaska Communications announced speed increases of its own. ACS sells unlimited access broadband service at speeds up to 50Mbps. ACS has beefed up its copper infrastructure to support faster Internet speeds, starting with 15Mbps introduced across the state in May. Now customers in Anchorage can subscribe to faster tiers including 30 and 50Mbps.

The speed increases come after its competitor Alaska Communications announced speed increases of its own. ACS sells unlimited access broadband service at speeds up to 50Mbps. ACS has beefed up its copper infrastructure to support faster Internet speeds, starting with 15Mbps introduced across the state in May. Now customers in Anchorage can subscribe to faster tiers including 30 and 50Mbps. More people will read this story than Atlantic Broadband has current customers for its 1Gbps broadband project in Miami.

More people will read this story than Atlantic Broadband has current customers for its 1Gbps broadband project in Miami.

Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.)

Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.)