Shaw Communications executives last week announced, to the relief of Wall Street, the cable company is pulling back on great deals for cable TV, Internet and phone service this summer.

Shaw Communications executives last week announced, to the relief of Wall Street, the cable company is pulling back on great deals for cable TV, Internet and phone service this summer.

In an effort to appease Wall Street analysts like Phillip Huang, a researcher for UBS Investment Bank — who fear lower prices could “spiral into a price war, which obviously would be a lose, lose situation,” Shaw has made it clear it intends to stop some of its most aggressive promotions this summer.

“When you talk about promotions in the market, we’ve been very disciplined in that regard,” Shaw executives told analysts on last week’s quarterly results conference call. “It’s a highly competitive environment and will continue to be that way and we’re going to operate in a certain fashion.”

That “certain fashion” has cost them at least 21,500 subscribers who have already left Shaw this past quarter, most headed to Shaw’s biggest competitor Telus.

But some Wall Street analysts remain unsatisfied, noting there are major differences in telecommunications pricing in Canada. Western Canadians pay substantially less for phone, cable, and broadband service than their counterparts in Ontario and Quebec. Shaw and Telus customers also have much larger usage allowances for broadband service, and Telus so far has not enforced what limits they have.

Analysts peppered Shaw executives about why they are not raising prices to match what Bell, Rogers, and Vidéotron customers further east are paying.

Jay Mehr, Shaw’s senior vice president of operations told investors to hang in there.

“We still believe that we have some good pricing power when discipline really comes back into this market,” Mehr said on the call with investors. That signals Shaw is prepared to raise prices when aggressive deals end.

Wall Street also questioned why the company does not use long-term contracts to lock customers in place:

Glen Campbell – BofA Merrill Lynch, Research Division: […] On service contracts: You’ve been pretty firm in not using them. Your competitor clearly does. […] Can you talk about the reasons for not going down the service contract road and whether you might reconsider that position?

Bradley S. Shaw – Shaw Communications: Well, there’s arguments for contracts as you — I guess, it’s really what these contracts do. As you said, we have equipment. Our [indiscernible] space — our Easy Own plan certainly is a very consumer-friendly plan as customers are getting something, and they’re agreeing to pay for it over time. And that creates kind of a natural kind of a relationship. What we don’t want to have happen is having customers, who are feeling confined by a contract, who otherwise would like to do something else. We don’t think that’s consumer-friendly. And so we’re looking at ways that we’d have more consumer-friendly kind of relationships but that still create some kind of a longer-term relationship that you can count on. But we don’t want to have the ball and chain kind of contracts that others have adopted.

[…] From a customer point of view. But also, the nature of contracts is there needs to be an enticement to get the customer sign a contract, and that enticement tends to be what we’re seeing in the market, which is fairly significant giveaways of hardware and other devices to be able to incent that. And so it will have has an impact on your cost of acquisition, and we’re trying to manage that. As Peter said, our Easy Own program is a very customer-friendly way for people to come on and make a commitment to us. And at the end of the period, they own their equipment. They haven’t had to pay upfront, and so it’s a nice way to manage that without being heavy-handed.

Some other developments at Shaw, reported during the conference call:

- Spending on upgrades will continue to be on the aggressive side as the company builds out its new Exo Wi-Fi network and converts cable systems to digital service, creating additional space for broadband speed increases and other services;

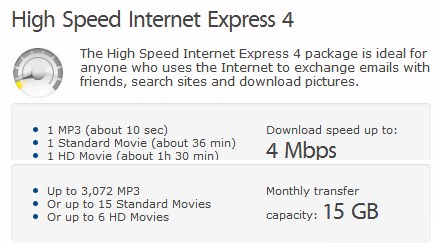

- Broadband delivers the highest profit margins of all of Shaw’s services, so it remains a very important part of Shaw’s package;

- Customers are gravitating towards higher speed broadband packages, delivering extra revenue;

- The company has re-priced some of its plans and offers to be more friendly to broadband-only customers;

- Shaw is working to gain approval from communities across western Canada to deploy its Wi-Fi network, with plans to begin limited promotion of the new service by late fall or early 2013. Shaw expects its Wi-Fi network to have substantial coverage across the region within three years;

- Shaw plans to work with U.S. cable operators to participate in a Wi-Fi roaming network that will allow its customers access to the Wi-Fi networks being built in the United States;

- Shaw’s “TV Everywhere” project is being designed to protect existing video revenue. Rights are being acquired across the board for broadband, tablets and other mobile devices for a robust on-demand service. But live streaming is secondary.

Subscribe

Subscribe