When Jeff McDonaghe celebrated the beginning of 2013, his cable and Internet bill from Shaw Communications was roughly $117 a month. In April, Shaw announced a wide-ranging rate increase that cost the Calgary resident an extra $7 a month. Now Shaw is back for more with another rate increase that will cost the McDonaghe family an additional $11 a month. His October bill: nearly $135 — $18 more a month.

When Jeff McDonaghe celebrated the beginning of 2013, his cable and Internet bill from Shaw Communications was roughly $117 a month. In April, Shaw announced a wide-ranging rate increase that cost the Calgary resident an extra $7 a month. Now Shaw is back for more with another rate increase that will cost the McDonaghe family an additional $11 a month. His October bill: nearly $135 — $18 more a month.

“Shaw seems to have gotten quite comfortable raising rates at least twice a year, because my bill has gone up like clockwork every six months or so,” McDonaghe tells Stop the Cap!

Shaw representatives blamed the “price adjustment” on the cost of programming, its upgraded “digital gateway” set-top box, and higher licensing and regulatory fees.

September 2013 Rate Adjustment

September 2013 Rate Adjustment

At Shaw, we’re committed to providing quality products and services at the best value for all customers.

To continue delivering the best entertainment options, you may notice a few changes to your monthly bill, effective September 1, 2013.

For customers in Manitoba and Ontario (excluding Hamilton), these changes will take effect on October 1, 2013.

Changes are as follows:

| Internet | Monthly rate as of September 1, 2013 |

|---|---|

| High Speed 10 | $55.00 |

| High Speed 20 | $60.00 |

| Broadband 50 | $80.00 |

| Broadband 100 | $90.00 |

| Broadband 250 | $120.00 |

| Television | Monthly rate as of September 1, 2013 |

|---|---|

| TSN Jets | $10.00 |

| Sportsnet World | $17.00 |

| Adult Channels (Playboy, Penthouse, Red Hot, Hustler) |

$23.00 |

| Adult Bundles (pick two channels) |

$40.00 |

| Pick and Pays (at current $2.95 price) |

$3.00 |

| Oasis and Discovery World | $4.00 |

| Multicultural Channels | +$0.05 above current rates |

| Home Phone | Monthly rate as of September 1, 2013 |

|---|---|

| Personal Phone | $30.00 |

| Second Phone Line | $10.00 |

| Distinctive Ring | $4.00 |

| Voicemail and Call Waiting | $6.00 |

| Bundle | Monthly rate as of September 1, 2013 |

|---|---|

| Starter Bundle (includes Shaw Gateway Whole Home HDPVR and two Portals on a two-year service agreement) |

$119.90 |

| Plus Bundle (includes Shaw Gateway Whole Home HDPVR and two Portals on a two-year service agreement) |

$154.90 |

| Large Bundle (includes Shaw Gateway Whole Home HDPVR and two Portals on a two-year service agreement) |

$174.90 |

| X-Large Bundle (includes Shaw Gateway Whole Home HDPVR and two Portals on a two-year service agreement) |

$209.90 |

Some of the most significant rate hikes will affect grandfathered service plans, leaving some customers scratching their heads.

Shaw’s old 20Mbps plan (no longer listed on the company’s website) now costs $60 a month, the same price charged for Shaw’s newer 25Mbps tier.

The company’s old “discount” Internet plan delivered DSL-like speed of 7.5Mbps for $45 a month. On Sept. 1, Shaw raised its price to $50. Today, Shaw’s entry-level 10Mbps broadband package sells for $55 a month — only $5 more — with a 125GB monthly usage cap.

Despite the company’s claims of increased costs, Shaw reported $250 million in profits during the third quarter of this year, delivering better than anticipated results with a promise to return some of the excess cash to shareholders in the form of dividends.

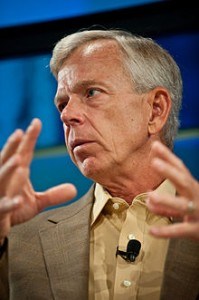

“Given the improvement in free cash flow and assuming continued favorable market conditions, our board plans to target dividend increases of five to ten percent over the next two years,” said Brad Shaw, CEO of Shaw Communications.

“Given the improvement in free cash flow and assuming continued favorable market conditions, our board plans to target dividend increases of five to ten percent over the next two years,” said Brad Shaw, CEO of Shaw Communications.

Shaw’s financial gains come at the cost of its declining customer base. During the summer, Shaw lost at least 26,578 basic cable subscribers due to increased competition from Telus’ TV service. The company did better adding broadband customers (4,157), but its greatest growth has come from its phone business, where the company picked up 17,719 new landline customers.

Drew McReynolds from RBC Capital Markets said Shaw was growing revenue mostly by “better monetizing the existing subscriber base.”

“Shaw’s revenue and EBITDA beat was mostly due to price increases,” added Greg MacDonald, managing director at Macquarie Capital Markets Canada.

Former CEO Jim Shaw is costing Shaw some of its earnings as well with a pension payout of almost $500,000 a month. In fact, the Shaw family that founded the cable company has three generations of pension and salary obligations it expects to be honored:

- J.R. Shaw, the company chairman has an annual pension of $5.4 million;

- Jim Shaw, J.R.’s son, now gets $5.95 million annually;

- Bradley Shaw, Jim’s brother and current CEO is eligible for a $3.97 million pension at age 65. His accrued pension obligation is $37.6 million.

Jim Shaw’s pension alone has cost Shaw more than $71 million in financing expenses because the company’s executive pension plan is not pre-financed; the costs are instead paid from annual cash flow as a compensation expense.

“Those price hikes are going to executive compensation and to shareholder dividend payments, because my service has not improved a bit despite paying almost $20 more a month this year,” complains McDonaghe. “The best mere mortals like ourselves can get when threatening to cancel are some temporary credits of around $5 a month for each of their services. Even with those credits, my bill is still higher.”

Subscribe

Subscribe

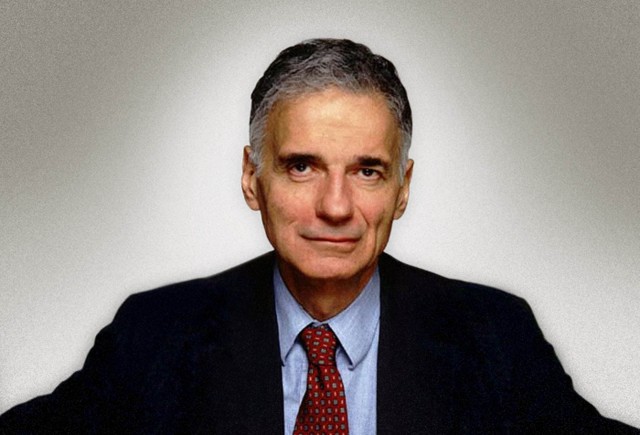

Rogers Cable has also suffered subscriber losses in Ontario from increasing competition from Bell’s IPTV service Fibe, which continues to run aggressive new customer promotions.

Rogers Cable has also suffered subscriber losses in Ontario from increasing competition from Bell’s IPTV service Fibe, which continues to run aggressive new customer promotions. Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.

Executives at Canada’s largest telecom companies are sighing relief after Verizon announced it was not interested in competing in Canada.