Verizon FiOS A Success Story for Customers, But a Self-Fulfilling Bad Idea for Investors, Some Claim

In the financially difficult world of landline service, there has been one bright spot for Verizon — its state-of-the-art fiber optic service FiOS. The cost of replacing obsolete copper phone with 21st century fiber optics has proved to be an expensive, but successful endeavor, at least in the eyes of customers. Hated by Wall Street for its costs but loved by those who enjoy the service, FiOS has successfully proven traditional phone companies can earn money by providing the kinds of services consumers want, just so long as investors are willing to hang in there while the investment pays off over time. But many investors aren’t.

In the financially difficult world of landline service, there has been one bright spot for Verizon — its state-of-the-art fiber optic service FiOS. The cost of replacing obsolete copper phone with 21st century fiber optics has proved to be an expensive, but successful endeavor, at least in the eyes of customers. Hated by Wall Street for its costs but loved by those who enjoy the service, FiOS has successfully proven traditional phone companies can earn money by providing the kinds of services consumers want, just so long as investors are willing to hang in there while the investment pays off over time. But many investors aren’t.

Some of Verizon’s critics in the investment community complain the company is n0t earning enough from FiOS — in fact, for some critics who didn’t want Verizon spending money on a fiber-to-the-home network in the first place, financial returns provide the evidence used to claim they were right all along.

Despite the naysayers, revenue for Verizon FiOS is up by almost one-third each year, with average revenue per user now reaching $145 a month. That’s well above the money Verizon earns on its legacy copper network phone customers keep leaving, especially outside of major cities where DSL service is spotty. There is plenty of room for Verizon FiOS to grow in the limited communities it reaches. Unfortunately, Verizon has stopped expanding its FiOS network to new communities, in part from pressure from investors who want to see cost cutting from the telecommunications giant.

Despite the positive reviews (subscription required) FiOS earns from consumer publications like Consumer Reports, Verizon slashed marketing and promotion expenses, resulting in second-quarter net additions for FiOS TV coming in at 174,000, compared with 300,000 a year earlier.

With Verizon now deploying service to communities on a reduced schedule, the results have been underwhelming according to the Wall Street Journal:

Verizon Communications may want to tweak the ad slogan for its TV and ultrafast Internet service to “This is FIOS. This is pretty small.”

Not catchy, but it would be more accurate than the current “This is Big” line.

[…]It eventually became clear that Verizon had slowed the time frame of the buildup, originally scheduled to be mostly done this year. Instead, it now expects to meet its target of passing 18 million homes with the network by 2012.

The slower timetable allows Verizon to trim capital spending this year. The problem is that FiOS’s expansion could stall with a less aggressive approach to growth. Already, Verizon has retreated from its target of adding one million subscribers a year, in favor of boosting penetration to 40% of homes passed. At June 30, its 3.2 million TV subscribers was about 20% of homes passed.

[…]And that can only reinforce questions about long-term returns on the $23 billion FIOS investment.

Evidence that Verizon is looking for more customers in its existing FiOS markets can be found in the news the company dropped its contract commitment for new customers. The term contracts may have held some potential customers back out of fear of a lengthy term commitment with a $360 early cancellation fee.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Verizon FiOS goes contract free ad.flv[/flv]

Verizon started running this ad several weeks ago touting its new “no contract” FiOS service. (15 seconds)

But a change in strategy isn’t enough for investors who demand immediate results through further cost cutting measures.

In Verizon’s second quarter earnings reports, company executives speak to this perception, proudly noting they have slashed costs through job-cutting and reduced spending on infrastructure and services. Some of those services include DSL expansion for rural Verizon customers, many who are now left on hold waiting for broadband from Verizon indefinitely.

In Verizon’s second quarter earnings reports, company executives speak to this perception, proudly noting they have slashed costs through job-cutting and reduced spending on infrastructure and services. Some of those services include DSL expansion for rural Verizon customers, many who are now left on hold waiting for broadband from Verizon indefinitely.

In many states, Verizon’s DSL expansion was incremental at best, with the company issuing press releases touting new service for literally hundreds of potential customers.

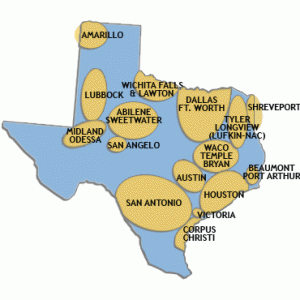

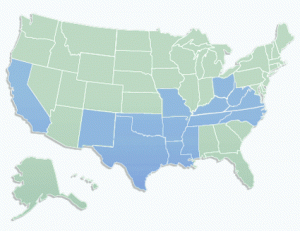

Verizon’s traditional landline business continues to lose customers year after year, and is abandoning millions of others through sell-off deals with companies like Frontier Communications. Light Reading notes Verizon eliminated 11,000 jobs in its Mid-Atlantic and Eastern regions through early retirement incentive programs, an idea soon to spread to other regions, particularly California and Texas in the coming months. This kind of cost cutting saves cash and allows companies to report positive financial results in quarterly reports.

According to John Killian, executive vice president and CFO of Verizon, the job cuts are just getting started. As Verizon further alienates its non-FiOS landline customers who can find better service and lower prices elsewhere, the company expects “further force reductions” in the coming months. Verizon is also slashing costs by selling off real estate, consolidating operations and vacating buildings.

The impact can become a vicious circle of deteriorating service, customer defections, and additional cost cutting, which starts the circle all over again. In West Virginia, deteriorating Verizon phone lines reached the point of serious service outages whenever major storms hit the state. Then Verizon simply sold off its network in West Virginia. Those customers are now served by Frontier Communications.

Verizon previously declared the era of the landline dead, and is now seeking to prove its point, even as it demonstrates it can make money by spending money on FiOS, if only investors would give them the chance.

[flv width=”576″ height=”344″]http://www.phillipdampier.com/video/CNN Behind the scenes at Verizon Fios 3-15-10.flv[/flv]

CNN took a behind the scenes tour of Verizon’s FiOS network in New York City, from the central offices to individual apartments. (4 minutes)

Subscribe

Subscribe