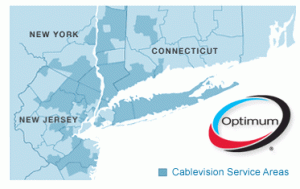

Despite continued financial pressure on cable companies’ core cable television business, Cablevision Systems was able to grow its broadband service, and retain broadband customers. The company also announced it will spin off its Madison Square Garden unit into an independent entity, still owned by Cablevision shareholders. Madison Square Garden includes the arena of the same name as well as ownership of two sports teams – the New York Knicks and New York Rangers.

The spinoff will create two distinct entities for Cablevision – an entertainment company comprised of Cablevision cable systems and Rainbow Programming, which runs several basic cable networks, and MSG, which will be sports-oriented.

In its earnings report, Cablevision said the Madison Square Garden unit had an operating loss of $8.4 million, and according to cable analyst Craig Moffett of Sanford Bernstein, will likely face a $500 million dollar charge for renovation of the arena in the coming years. Cablevision said it earned $87 million, or 29 cents per share, in the most recent quarter, compared with $94.7 million, or 32 cents per share a year ago. The decline in earnings was attributed to pressure from MSG losses and a drop in the number of basic video subscribers, as well as losses from its Newsday newspaper operation.

Cablevision’s broadband service retained strong customer loyalty. It also stands out as being free of Internet Overcharging, and proud of it. The company has made it clear it appreciates broadband growth in the United States and considers broadband usage “addictive,” and wants to be certain it remains so.

Cablevision is also considering introducing additional features to its Wi-Fi service, including the provision of a wireless voice service available to customers in New York and New Jersey.

Subscribe

Subscribe