KJWY-TV was a station in Jackson, Wyo. But now it serves Philadelphia, Pa.

Two small television stations in Wyoming and Nevada with audiences in the thousands have packed up and are moving to bigger cities after exploiting a loophole in FCC rules.

KJWY, Channel 2 in Jackson, Wyo. used to relay television programs from a Casper station for the benefit of the 9,500 people living in the Teton County community. The station operated with just 178 watts — the lowest powered digital VHF station in the country. KVNV, Channel 3 in Ely, Nev., originally relayed Las Vegas’ NBC affiliate for the benefit of 4,200 locals. Both stations were purchased at a very low-cost by a mysterious partnership of buyers back east.

Today, KJWY has a new call sign – KJWP. It’s still on Channel 2, but the station is now licensed to operate from Wilmington, Del, with its transmitter located just across the border in Philadelphia. It’s one of the rare few television stations in the eastern half of the country that have “K” call letters usually assigned to stations west of the Mississippi River. KVNV is expected to follow to its new home in Middletown Township, Monmouth County, N.J., later this year. Its transmitter will have nothing but open water between northern New Jersey and nearby New York City — its intended target.

The two stations’ original combined audiences likely never exceeded 10,000, because both stations had very limited range for their transmitters which served two very small communities. But in the big cities of New York and Philadelphia, the stations can now reach a potential audience north of ten million and collect advertising revenue the stations in Wyoming and Nevada could only dream about.

PMCM, LLC., obviously had this in mind when it acquired the two stations in 2009. The principals behind PMCM already own six Jersey Shore radio stations in Monmouth and Ocean County under the name Press Communications, LLC.

How Congress and the FCC Opened the Door

PMCM discovered a little-known law that was originally introduced to help spur the launch of VHF television stations serving small Mid-Atlantic states shadowed by nearby large cities. In 1982, New Jersey Sen. Bill Bradley attached an amendment to an unrelated tax bill that required the FCC to automatically renew the license of any commercial VHF station that agrees to move to a state without one. The new law superseded nearly all the FCC’s other licensing regulations. At the time the law was passed, the only two states that were without any commercial VHF stations were Delaware and New Jersey.

PMCM discovered a little-known law that was originally introduced to help spur the launch of VHF television stations serving small Mid-Atlantic states shadowed by nearby large cities. In 1982, New Jersey Sen. Bill Bradley attached an amendment to an unrelated tax bill that required the FCC to automatically renew the license of any commercial VHF station that agrees to move to a state without one. The new law superseded nearly all the FCC’s other licensing regulations. At the time the law was passed, the only two states that were without any commercial VHF stations were Delaware and New Jersey.

That summer, RKO General, embroiled in a major scandal over illegal billing irregularities and deceiving regulators, thought it could save its New York station – WOR-TV – from threatened license revocation by agreeing to move from New York City to Secaucus, N.J. In agreeing to move the station, WOR would also expand much-needed coverage of New Jersey news and current affairs. But viewers barely noticed and by 1987 RKO General’s bad behavior got them booted out of the broadcasting business altogether after what FCC administrative law judge Edward Kuhlmann called a pattern of the worst case of dishonesty in FCC history. WOR’s new owners changed the call sign to WWOR-TV and the station’s home remains in Secaucus.

Two things happened after the mess with WOR. Bradley’s law remained on the books and America’s adoption of digital over the air television for full power stations meant channel number changes for many stations by the time the transition was complete in 2009. WWOR-TV relocated to UHF channel 38 (while still promoting itself as Channel 9) and Delaware’s only remaining VHF station is non-commercial WHYY Channel 12, a PBS station better known as hailing from Philadelphia. Once again, New Jersey and Delaware were without commercial VHF stations, a fact that did not escape the notice of PMCM.

Me-TV Launches in Philadelphia and New York

After a lengthy court battle with the FCC, PMCM successfully moved and relaunched KJWP, Channel 2, on March 1 as Philadelphia’s Me-TV affiliate. Although the transmitter power was raised, the station’s digital VHF signal still doesn’t reach very far, so its owners invoked “must-carry” with area cable systems, which means cable systems must carry the channel so long as the station does not ask for any payment.

After a lengthy court battle with the FCC, PMCM successfully moved and relaunched KJWP, Channel 2, on March 1 as Philadelphia’s Me-TV affiliate. Although the transmitter power was raised, the station’s digital VHF signal still doesn’t reach very far, so its owners invoked “must-carry” with area cable systems, which means cable systems must carry the channel so long as the station does not ask for any payment.

The station’s reach is defined by the FCC far beyond its actual broadcast signal. Officially, the station can demand cable carriage as far south as Dover, Del., as far west as Lancaster, Pa., almost all of southern New Jersey and into northern New Jersey. Today, Comcast and other cable systems carry KJWP across Philadelphia and the Delaware Valley. Verizon FiOS is adding the station by this weekend and it is also available via satellite TV local station packages. Unlike larger stations fighting to be paid by cable systems, KJWP is happy to be carried by all without charge because it can sell advertising to a much larger potential audience. It plans to produce local programming, including news, which opens up even more advertising opportunities.

KVNV remains on the air in Ely for now as a My Family TV affiliate, showing a mix of family friendly and religious programs. But its days as a Nevada broadcast station are numbered. KVNV will officially sign-off in Ely for good in a few months and relaunch operations across the New York City market as New York’s official Me-TV affiliate. Like with KJWP, KVNV will keep its original call letters and invoke must-carry, which means the station is likely to appear on northern New Jersey Comcast systems, Time Warner Cable in Manhattan and other boroughs, as well as Cablevision on Long Island and across parts of Brooklyn.

Subscribe

Subscribe

“Look, the amount of decision makers, which is so surprisingly small in the industry in general, is potentially getting smaller,” Steve Krakauer, TheBlaze’s vice president of digital content told POLITICO. “Keeping up the fight is so important.”

“Look, the amount of decision makers, which is so surprisingly small in the industry in general, is potentially getting smaller,” Steve Krakauer, TheBlaze’s vice president of digital content told POLITICO. “Keeping up the fight is so important.”

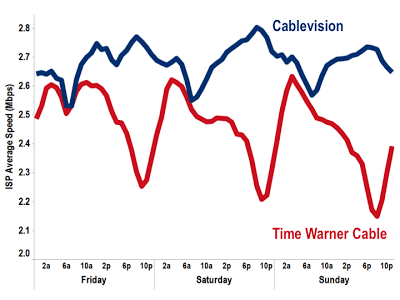

Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover.

Bright House Networks’ long standing relationship with Time Warner Cable — which negotiated programming deals on behalf of the smaller cable operator with operations in the south — may come to an end with an approval of a merger between Comcast and Time Warner. That could make Bright House a prime candidate for a takeover. Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that.

Charter is almost certain to buy at least some of the three million Time Warner Cable customers Comcast intends to cast-off if it wins regulator approval of its buyout deal. But Team Charter has assembled enough financing to go much farther than that. Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.

Cox, like Cablevision, has been closely controlled by its founding family for years, so rumors of sales of one or both have never come to fruition. But with the merger announcement of Comcast and Time Warner Cable, Wall Street pressure to consolidate is growing by the day. There is talk that if Comcast succeeds in its buyout effort, even satellite providers like DirecTV and DISH are likely to seek a merger. Even Cablevision, which serves suburban New York City may finally feel enough pressure to sell.