An innovative plan to rent New Yorkers a dime-sized over-the-air antenna housed in a Brooklyn data center to receive and stream local broadcasters could be the end of broadcast TV as we know it, at least if you believe the claims being made by network executives in their high-powered lawsuit.

An innovative plan to rent New Yorkers a dime-sized over-the-air antenna housed in a Brooklyn data center to receive and stream local broadcasters could be the end of broadcast TV as we know it, at least if you believe the claims being made by network executives in their high-powered lawsuit.

Aereo, which charges $12 a month to an invitation-only customer base, is the target of serious legal action brought by the major broadcast networks and local TV stations that believe Aereo’s disruptive business model could allow cable operators to avoid paying retransmission consent fees for free, over the air television signals.

Aereo only streams local broadcasters in the New York metropolitan area to residents within viewing range of the signals. The company argues it operates legally because of a time-tested, sound legal principle: the Communications Act of 1934, which offers broadcasters a license to use the public airwaves in return for operating in the public interest. Aereo only rents its tiny antennas to one customer at a time, and provides them with streamed video received by that antenna. The company charges a nominal monthly fee to cover the costs of operating its data center and to cover streaming expenses.

The monthly subscription fee grants viewers access to watch one channel while recording another on a cloud-based DVR “storage locker.” Viewers can watch the signals on just about any device, as long as they are located within the New York metropolitan area. Travelers and those who live outside of the area cannot watch programming or subscribe to the service.

The threat to the nation’s pay television operators and broadcasters is obvious. Over the air television broadcasters increasingly rely on so-called “retransmission consent payments” collected from pay television operators in return for permission to place their signals on the cable, telco, or satellite TV dial. Broadcasters bank on that growing revenue. Pay television providers grudgingly agree to the payments and promptly pass them on to already rate-increase-weary subscribers, who want a way out of paying for hundreds of channels they don’t care to watch.

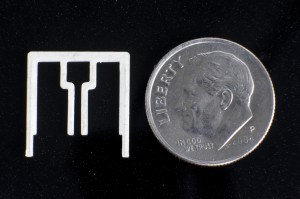

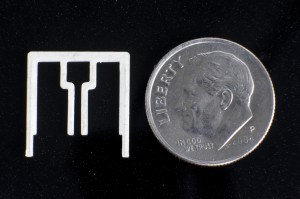

Aereo's over the air antenna is about the size of a dime.

Aereo breaks the business models of both broadcasters and the cable industry. Cord cutters can get reliable and cheap reception of over-the-air stations without dealing with cumbersome in-home antennas (or paying local cable companies for HD-quality local stations and a DVR box). Goodbye $70 cable-TV bill. Broadcasters also lose every time the local pay television company drops a subscriber. Aereo does not pay retransmission consent fees, nor do their subscribers.

But Aereo is not all bad news for pay television providers. If Aereo can survive the legal onslaught from broadcast interests, nothing stops local cable companies from licensing Aereo technology (or constructing their own system) that would bypass retransmission consent fees as well. That could save cable operators millions.

Ridiculous? Not according to Matt Bond, an executive vice-president at Comcast/NBC who told a New York federal court the risk is real.

“It makes little economic sense for cable systems and satellite broadcasters to continue to pay for NBCU content on a per-subscriber basis when, with a relatively modest investment, they can simply modify their operations to mirror Aereo’s ‘individual antenna’ scheme and retransmit, for free, over-the-air local broadcast programming,” Bond said. “I know for a fact that cable companies have already considered such a model.”

Diller

Broadcasters revile Aereo’s disruptive innovation. Bond called the service “piracy.” Other network executives say it steals their content and resells it at a profit. Some are even predicting the destruction of broadcast television as we know it if Aereo is found to be legal. Virtually every network is on board for the lawsuit, which seeks an immediate injunction that would shut the service down.

Barry Diller, a veteran broadcast executive, has invested in Aereo and calls the broadcasters’ fears rubbish.

“It’s not the beginning of the destruction of anybody,” Diller told New York Magazine. “TV wasn’t the destruction of the movie business. Television wasn’t the destruction of radio. Cable wasn’t the destruction of broadcast networks. What happens is new alternatives come, and they live alongside whatever existed.”

“You have an antenna that has your name on it, figuratively … and it’s one-to-one. It is not a network,” Diller told members of the Senate Commerce Committee during a recent hearing. “It is a platform for you to simply receive, over the Internet, broadcast signals that are free and to record them and use them on any device that you like.”

Aereo is not a pioneer in the video streaming of over the air signals. iCraveTV launched in 1999 streaming broadcast stations from Buffalo, N.Y. and Ontario, Canada from its home base in Toronto. Broadcasters filed suit and quickly shut the service down. ivi-TV tried a similar venture in 2011 and was also shut down. Even companies experimenting with IPTV technology have run into trouble with some networks that feel threatened by a possible precedent that could be mistakenly established, starting a flood of similar services.

To date, only services that agree to broadcaster sanctions (Slingbox) or who have retransmission consent contracts with providers (such as the cable industry’s TV Everywhere project) have survived, but all have limitations imposed on their functionality that reduce their usefulness to consumers.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Aereo TV Demo May 2012.flv[/flv]

Aereo TV was demonstrated by the company CEO Chet Kanojia at the New York Tech Meetup May 9. (21 minutes)

Subscribe

Subscribe