Comcast may be attempting to get around Federal Communications Commission regulations governing what cable companies can charge for cable equipment by recasting the monthly fee as a “service charge.”

Comcast may be attempting to get around Federal Communications Commission regulations governing what cable companies can charge for cable equipment by recasting the monthly fee as a “service charge.”

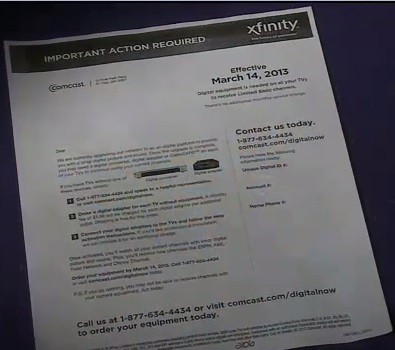

The cable operator’s decision to start charging $1.99 a month for digital transport adapters (DTAs) — small boxes that can convert digital signals into analog for older televisions — has at least one Minnesota city up in arms.

Eagan city officials met with outraged residents Tuesday to discuss the fee hike and hear a number of complaints about how Comcast does business in the community.

“It really ran the gamut, from concerns about losing stations, to concerns about being bait and switched, to having gotten boxes for free and worried that you had to pay for them in the future,” Eagan Mayor Mike Maguire told WCCO-TV.

Comcast customers in Minnesota are receiving letters from the cable operator some call deceptive. The letter warns “digital equipment is needed on all your TVs to receive channels,” despite the fact many televisions manufactured after 2007 are equipped with QAM tuners that will receive the digital signals without extra equipment, at least for now.

Only in fine print at the bottom of the letter does Comcast admit QAM-equipped sets won’t need the equipment, saving $1.99 a month per set.

Letters have also been sent to customers who have used DTA equipment provided by Comcast at no charge… until now.

Comcast earlier announced it intends to collect $1.99 a month from each subscriber using DTA equipment, even if those customers previously had received the equipment for free.

But Comcast’s decision to charge $24 a year in perpetuity for a box with a wholesale cost of less than $50, depending on the model, may run afoul of Federal Communications Commission regulations that forbid cable operators from charging excessive amounts to lease cable equipment:

Cable operators may require their subscribers to use specific equipment, such as converters, to receive the basic service tier. They may include a separate charge on your bill to lease this equipment to you on a monthly basis. This monthly rate must be based on the operator’s actual costs of providing the equipment to you. Operators may also sell equipment to you, with or without a service contract. If an operator provides a choice between selling and leasing the equipment, the monthly leasing rate will be regulated but the sales price will be unregulated. If an operator only sells equipment and does not also lease equipment, then the sales price must be the actual cost of the equipment plus a reasonable profit, and any service contract should be based on the estimated cost to service the equipment. If the customer buys the equipment but does not purchase a service contract, the customer can be charged for repairs and maintenance. Cable operators may not prevent customers from using their own equipment if such equipment is technically compatible with the cable system.

Eagan Mayor Mike Maguire

In a possible attempt to avoid regulatory language regarding cable equipment, Comcast has declared its new $1.99 fee is actually an “additional outlet service charge,” not an equipment fee.

“The deployment of DTA technology allows us to bring more value to our customers through additional HD channels and faster Internet speeds, both of which are used by the majority of our customers,” said Mary Beth Schubert, vice president of corporate affairs. “These types of enhancements require significant investment, and we feel the nominal fee now being implemented for DTA additional outlet service on our digital tiers reflects the additional value of the service.”

“There is no charge for the first three DTA devices,” said Schubert. But she quickly added, “After the digital transition in March and April, those TVs will not have access to these channels unless they are paying the $1.99 DTA additional outlet service fee.”

Michael Bradley, an attorney representing 20 local communities, is investigating to see if Comcast’s language about its new fee violates FCC rules.

The new charge is expected to be lucrative for Comcast, earning the company at least $550 million annually in new revenue.

Comcast intends to boost that even further as it embarks on encrypting its digital lineup, making QAM-equipped televisions useless to receive scrambled cable channels.

“These customers will eventually need to connect a digital device to their QAM tuner equipment at a future date as we implement additional network security features,” warned Schubert. “Customers will be provided complete information well before any additional measures take place.”

The FCC previously negotiated an agreement with cable operators intending to encrypt their cable lineup to keep customers from experiencing bill shock from new, mandatory equipment fees:

| If, at the time your cable operator begins to encrypt, you subscribe |

Then you are entitled to |

| only to broadcast basic service and do not have a set-top box or CableCARD |

a set-top box or CableCARD on up to two television sets without charge or service fee for two years from the date your cable operator begins to encrypt. |

| to a level of service other than broadcast basic service but use a digital television to receive only the basic service tier without use of a set-top box or CableCARD |

a set-top box or CableCARD on one television set without charge or service fee for one year from the date your cable operator begins to encrypt. |

| only to the basic service tier without use of a set-top box or CableCARD and you receive Medicaid |

a set-top box or CableCARD on up to two television sets without charge or service fee for five years from the date your cable operator begins to encrypt. |

But by recasting new fees as unregulated “additional outlet fees,” Comcast and other cable operators may have successfully outwitted the FCC’s good intentions, earning billions in new revenue annually as a result of a simple language change.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WCCO Minneapolis Comcast Fee Causes Outrage in Minn 2-20-13.mp4[/flv]

WCCO reports the city of Eagan held an informational meeting Tuesday about Comcast’s newest fee for digital boxes required on older televisions. Comcast customers nationwide will soon pay the new $1.99 “DTA additional outlet service fee” for each television equipped with the digital set top DTA box “to offset increasing programming and operational costs.” (2 minutes)

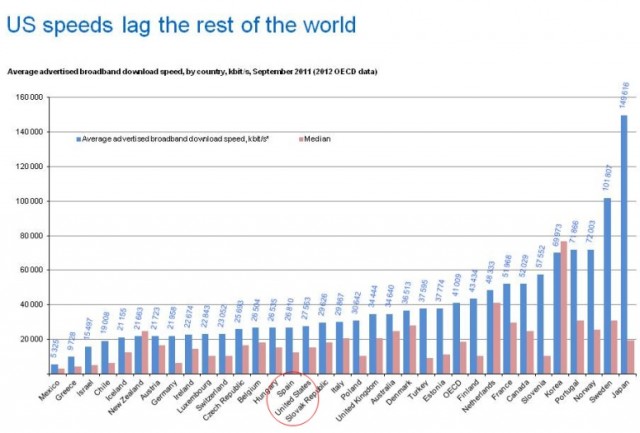

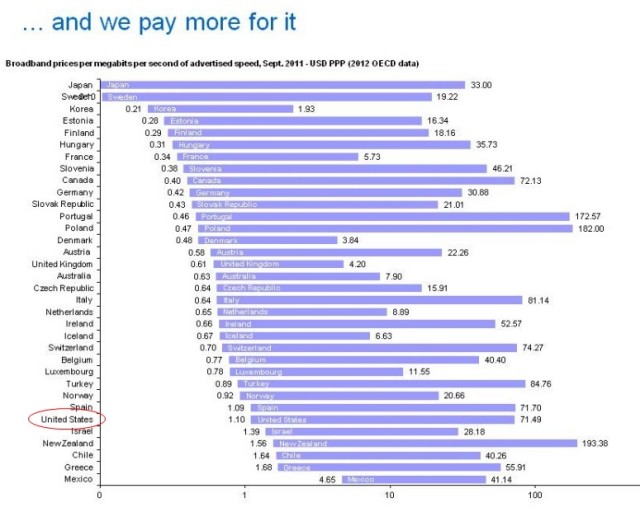

Both Time Warner Cable and Verizon don’t think you want or need gigabit fiber broadband — the kind of service now available in Kansas City from Google Fiber.

Both Time Warner Cable and Verizon don’t think you want or need gigabit fiber broadband — the kind of service now available in Kansas City from Google Fiber.

Subscribe

Subscribe

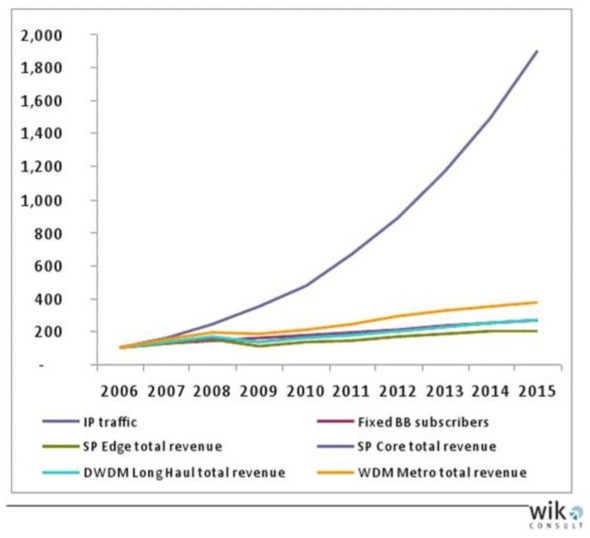

Data caps protect incumbent big studio and network content creators at the expense of independent producers and others challenging conventional entertainment business models.

Data caps protect incumbent big studio and network content creators at the expense of independent producers and others challenging conventional entertainment business models.

Do you ever wonder why your local cable system suddenly decided to begin carrying barely known networks like Centric, Logo, Palladia, and a dozen other channels you can’t recall ever watching even as providers perennially complain about “increased programming costs?”

Do you ever wonder why your local cable system suddenly decided to begin carrying barely known networks like Centric, Logo, Palladia, and a dozen other channels you can’t recall ever watching even as providers perennially complain about “increased programming costs?”

Comcast may be attempting to get around Federal Communications Commission regulations governing what cable companies can charge for cable equipment by recasting the monthly fee as a “service charge.”

Comcast may be attempting to get around Federal Communications Commission regulations governing what cable companies can charge for cable equipment by recasting the monthly fee as a “service charge.”