Channel 35 is Los Angeles’ Government Access station

Los Angeles cable subscribers are paying $30-50 a year in extra franchise fees the city government has no idea what to do with, allowing a bank account dedicated to housing the unspent funds to reach $35 million and counting. For more news related to the city of Los Angles, feel free to take a peek at sites such as Los Angeleno.

A new audit by the Office of the City Controller found no misappropriation or ethical lapses by the city government, but it did criticize the lack of long-term planning regarding how franchise revenue should be used, as well as lax auditing of expenses that were paid from the fund. Los Angeles City Controller Ron Galperin added the city’s lack of consistent auditing of the five major cable operators servicing greater Los Angeles may be allowing cable operators to charge customers franchise fees the companies are keeping for themselves. A 2006 law passed at the behest of Verizon and AT&T allowing statewide video franchise agreements in California isn’t helping either.

For decades, communities have been able to demand up to a 5% franchise fee from cable and phone companies offering video services in their areas in return for access to public rights-of-way and other public property. Most cities, including Los Angeles, have requested the maximum allowed – 5% of the provider’s gross annual revenue earned within the city. Cable operators retaliated by recouping the franchise fee by billing cable customers for it on a separate line on monthly cable bills.

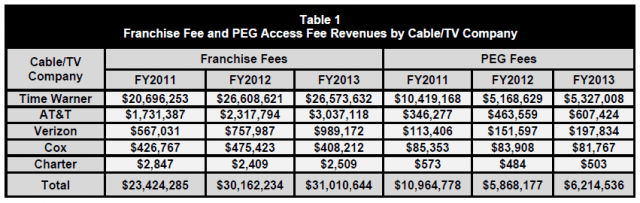

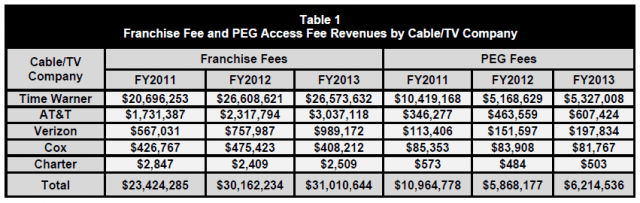

In Los Angeles, 60% of all franchise fees ($31 million) paid are transferred to the city’s all-purpose General Fund, used for all types of city expenses. The remaining 40 percent ($12.4 million) is supposed to be earmarked for a Telecommunications Fund, but the city often raids that account as well. Time Warner Cable subscribers account for 85% of Los Angeles’ cable franchise revenue, AT&T U-verse contributes another 10% with other operators paying considerably less. Last year, Charter Cable wrote a check for less than $5,000, primarily because only a tiny part of the city of Los Angeles is served by Charter today.

So where is the excess money still in the account coming from?

The Unintended Consequences of Statewide Video Franchising

Eight years ago, Governor Arnold Schwarzenegger signed AB 2987: the “Digital Infrastructure and Video Competition Act of 2006” (DIVCA). In reality, DIVCA was just another statewide video franchise bill heavily pushed by the state’s dominant phone companies — AT&T and Verizon — to let them begin offering video services without having to sign franchise agreements with thousands of local governments across the state.

AT&T and Verizon sold the legislation to the public as a red-tape cutter to bring Verizon FiOS and AT&T U-verse to millions of Californians without unnecessary bureaucratic delay.

AT&T and Verizon sold the legislation to the public as a red-tape cutter to bring Verizon FiOS and AT&T U-verse to millions of Californians without unnecessary bureaucratic delay.

But lobbyists from both phone companies, as well as several cable companies, were successful in inserting their own amendments into the law that undercut their arguments for passing the legislation:

- As local franchise agreements expired, companies took their franchise renewal business direct to the state, cutting off local oversight. Communities could no longer require operators to expand into rural areas or impose fines for sub-standard service;

- Cable companies won the right to toss Public, Educational, and Government Access (PEG) channels out of their buildings. Many communities assigned responsibility for housing and operating PEG channels as part of their franchise agreement. DIVCA rendered those agreements void and unenforceable;

- Cable companies no longer had to offer institutional broadband networks for free or at a discount to local governments, schools and libraries, and many existing networks were closed down as soon as the local franchise agreement expired and communities balked at the new prices charged by telecom companies.

But perhaps the most controversial amendment was language that gets AT&T and Verizon out of meeting obligations to build out their fiber networks where they choose not to built them, while still compelling smaller independent telephone companies to offer service to every customer within their telephone service area within a reasonable amount of time.

So instead of promoting a rush towards video competition, both AT&T and Verizon won concessions that let them cherry pick — on their own schedule — customers for AT&T U-verse and Verizon FiOS:

- Verizon is in compliance with DIVCA as long as 25% of the households where service is available are low-income and within 5 years, Verizon increases that to at least 40%;

- AT&T stays out of trouble with DIVCA by providing video service to 35% of low-income households where service is available. Within five years, AT&T must reach at least 50%.

One of the biggest victims of DIVCA are PEG channels which lost the sponsorship of the cable companies that used to underwrite them as part of their franchise agreements. American Community Television reported in California, Illinois and Indiana, where statewide video franchising laws were passed, cable operators that operated PEG channels closed the doors, sometimes with only 30 days notice. Even in states where PEG funding remained, channels have been exiled to Channel Siberia (eg. Channel 1,512) or are under constant threat of losing their channel if they don’t meet an operator’s arbitrary quality of programming criteria.

Time Warner Cable has moved PEG channels to digital service in a majority of their service areas, requiring many customers to have an added-cost cable box to watch.

To help Californian PEG services cope, a state law permitted cities to collect an extra 1% of gross revenue from cable operators to keep funding these channels. But if a city already collects a full 5% franchise fee, any money collected from PEG channels must only be spent on their operations — no raiding of funds allowed. If the local government thinks there are bigger priorities than supporting public, educational, and government access, the future of PEG channels is questionable.

How to Spend the Untouchable Proceeds

The new home of Los Angeles’ Government Access channel

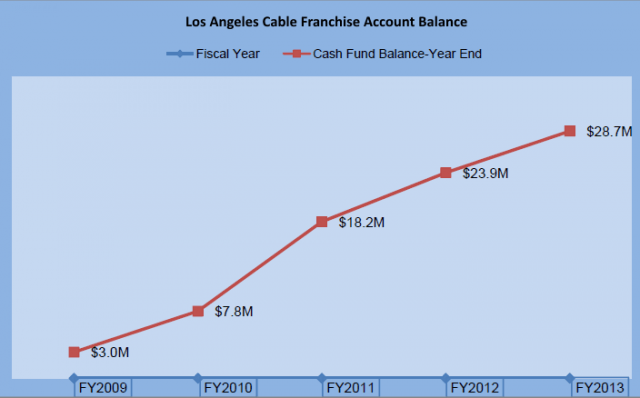

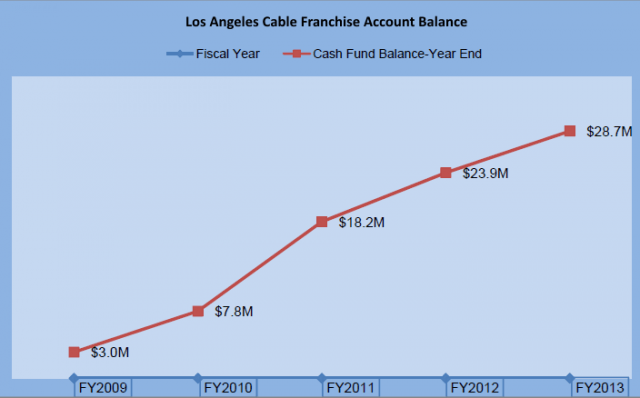

With Los Angeles-area cable companies collecting and sending on the proceeds of the 1% PEG surcharge to city coffers, the money has been more or less just piling up over the last seven years, unspent.

As of the end of June last year, the city had squirreled away about $22 million collected from cable TV customers stashed in a non interest-bearing account. PEG operations across the United States are not known for being profligate spenders, relying on budgets that would be insufficient to keep the lights on at a typical local public television station. So some question whether Los Angeles’ Public Access, Educational Access, and Government Access networks need $22 million to continue operations.

The city has decided the Government Access channel — the one that airs council meetings and other political functions — does need a new home. So the city is spending $20 million to completely renovate one of the oldest buildings in Los Angeles, the long-vacant three-story Merced Theater near Olvera Street.

When complete, the state-of-the-art digital facilities of Cityview Channel 35 may rival those of some commercial television stations in Los Angeles. The building will house a small performance venue on the first floor, a studio with space for a 70-person live audience, and plenty of office space on the third floor. What it evidently won’t have room for is the Public Access and Educational Access channels that make up the rest of the PEG trio. The new facility is for the exclusive use of Channel 35.

Local residents are happy someone is finally doing something with the theater, which has been empty and unused for at least 30 years. The project could also make Los Angeles’ Government Access channel one of the most capable in the country, producing high quality programming well beyond the ubiquitous city council meetings.

“Space for a live audience of about 70 people will allow us to engage the public with debates, town halls and other events that we weren’t able to do,” Mark Wolf, executive officer at the city Information Technology Agency, which oversees Channel 35, told Downtown News. “The venue also gives us a full upgrade to digital technology, as we’ve been operating in an analog environment.”

Downtown News partly misled its readers when it suggested cable providers are footing the bill for the renovated home of Channel 35. Although money from the city’s general fund won’t be used for the project, the money did originate from cable subscribers who have paid higher cable bills since 2007 because the city elected to collect a 1% PEG franchise fee.

Galperin

Even after spending $20 million on the Merced Theater, the money from Time Warner Cable, Cox, AT&T, Verizon, and Charter cable TV subscribers will keep rolling in. The audit found that by the time the new Merced Theater facility opens in 2016, the city will again have between $21-25 million in unspent PEG funds.

Galperin thinks throwing more money at traditional PEG operations would be a mistake, particularly when younger audiences are not even subscribing to cable television.

“We’re in a new era,” Galperin said. “The old rules that envisioned everybody getting their programming from cable are changing before our very eyes. We are in a totally different era in terms of how people get their information, so much of viewership is on the Internet now, not necessarily on cable.”

Because PEG funds can only be spent on PEG operations, as a starting point, funds could be spent to build up what is now an anemic, barely functioning website for Channel 35. Although the channel does stream online, it is intermittent in our experience. Channel 35 might also partner with local public broadcasting and minority-interest channels in co-production ventures. It should also develop a robust on-demand library of its content for site visitors because that is increasingly how Americans choose to watch television.

Galperin suggested other uses including a public Wi-Fi network and city Internet sites for programming and other information, but these may stray outside of the boundaries of what is permissible under current California and federal law.

Of course, there is one other alternative – rescind the PEG fee altogether until there is a legitimate need to collect the money from already overburdened cable subscribers.

[flv]http://www.phillipdampier.com/video/Surviving DIVCA.mp4[/flv]

Silicon Valley Community Television aired this lengthy conference last fall for the benefit of local governments across California still trying to make sense of the 2006 Digital Infrastructure and Video Competition Act, a provider-influenced piece of legislation that has tied the hands of most communities to manage their local telecommunications infrastructure for the good of their citizens. (2 hours, 47 minutes)

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Subscribe

Subscribe

AT&T and Verizon sold the legislation to the public as a red-tape cutter to bring Verizon FiOS and AT&T U-verse to millions of Californians without unnecessary bureaucratic delay.

AT&T and Verizon sold the legislation to the public as a red-tape cutter to bring Verizon FiOS and AT&T U-verse to millions of Californians without unnecessary bureaucratic delay.

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase.

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase. “I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”

“I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”

Netflix has

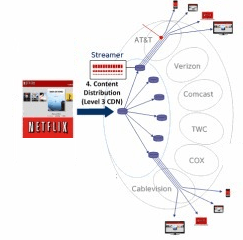

Netflix has  Netflix has traditionally avoided owning the “pipes” that distribute movies and TV shows to paying customers. Instead, it usually contracts with “transit providers” to send content from Netflix headquarters on to “content distribution networks (CDN)” that manage video streaming. A Netflix video may pass through a number of connections on a variety of independently owned networks before it arrives at the front door of your Internet Service Provider. Companies like Comcast handle “the last mile” of the journey that began at Netflix and ends at your computer or television set.

Netflix has traditionally avoided owning the “pipes” that distribute movies and TV shows to paying customers. Instead, it usually contracts with “transit providers” to send content from Netflix headquarters on to “content distribution networks (CDN)” that manage video streaming. A Netflix video may pass through a number of connections on a variety of independently owned networks before it arrives at the front door of your Internet Service Provider. Companies like Comcast handle “the last mile” of the journey that began at Netflix and ends at your computer or television set. Netflix and YouTube together are now estimated to cover 50 percent of all video traffic on the Internet, and that traffic is growing. Cogent dutifully passes that video content along to Internet Service Providers like Verizon and Comcast that have customers waiting to watch. But it is a two-way street. Any outbound traffic from customers could also be forwarded to Cogent to send on. Traditionally, both sides have managed the traffic by gradually increasing the bandwidth and speed of their connections to one-another. But as Netflix traffic grows and grows, companies like Comcast and Verizon believe they are being saddled with the costs to upgrade their networks in ways that are out of proportion to the traffic they send in the other direction. ISPs often grumble about the cost but keep on upgrading to keep paying customers happy. Verizon and Comcast are suspected of dragging their feet on those upgrades in an effort to win compensation.

Netflix and YouTube together are now estimated to cover 50 percent of all video traffic on the Internet, and that traffic is growing. Cogent dutifully passes that video content along to Internet Service Providers like Verizon and Comcast that have customers waiting to watch. But it is a two-way street. Any outbound traffic from customers could also be forwarded to Cogent to send on. Traditionally, both sides have managed the traffic by gradually increasing the bandwidth and speed of their connections to one-another. But as Netflix traffic grows and grows, companies like Comcast and Verizon believe they are being saddled with the costs to upgrade their networks in ways that are out of proportion to the traffic they send in the other direction. ISPs often grumble about the cost but keep on upgrading to keep paying customers happy. Verizon and Comcast are suspected of dragging their feet on those upgrades in an effort to win compensation. But that argument does not explain why Netflix was compelled to make a financial arrangement with Comcast. The two companies have been in negotiations on the subject of traffic compensation for months. Many industry observers believe those talks went nowhere until Netflix customers began complaining about the increasing network slowdowns. Some even dropped their Netflix subscriptions over the issue.

But that argument does not explain why Netflix was compelled to make a financial arrangement with Comcast. The two companies have been in negotiations on the subject of traffic compensation for months. Many industry observers believe those talks went nowhere until Netflix customers began complaining about the increasing network slowdowns. Some even dropped their Netflix subscriptions over the issue.