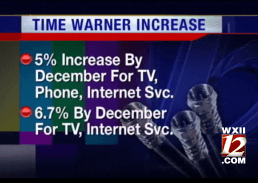

Time Warner Cable customers in North Carolina are getting rate hike letters from the cable company that foreshadows what other Time Warner Cable customers around the country can expect in the coming months.

Time Warner Cable customers in North Carolina are getting rate hike letters from the cable company that foreshadows what other Time Warner Cable customers around the country can expect in the coming months.

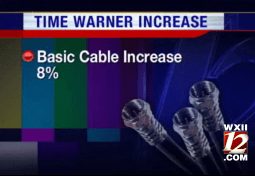

For residents in Charlotte and the Triad region, Time Warner is boosting prices for unbundled customers an average of six percent, which will impact customers not on promotional plans or who are not locked into a “price protection agreement.”

The rate increases particularly target standalone service customers. Those with the fewest services will pay the biggest increases. Those who subscribe to cable, phone, and broadband service from the company will suffer the least.

A Time Warner Cable spokesman claimed the company is just passing on the cost of programming.

WXII-TV in Greensboro reported that for many customers already struggling with their bills, they don’t want to hear anything about a price hike.

“I think it’s ridiculous at this time with the economy — it’s hard to make it as it is,” one customer told the station.

“I think it’s ridiculous at this time with the economy — it’s hard to make it as it is,” one customer told the station.

“I wish there was a better option out there, but it’s about the only thing you can get,” said another viewer.

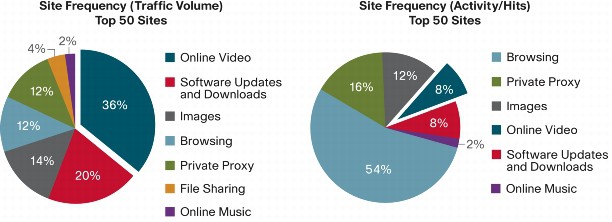

Time Warner has been developing pricing models that increasingly push customers towards bundled packages of services. Standalone broadband service saw dramatic price increases in many areas in 2010, and the company’s most aggressive new customer promotions encourage customers to take all three of its services.

But broadband customers need not expose themselves to inflated broadband prices for standalone service. Most Time Warner Cable franchises offer Earthlink broadband at comparable speeds at prices as low as $29.95 per month for the first six months. When the promotion expires, customers can switch back to Road Runner at Time Warner’s promotional price.

Time Warner does face competition in some areas of North Carolina from AT&T U-verse, which offers attractive promotional pricing for new customers. But the phone company’s broadband speeds come up short after Time Warner boosted speeds across much of the state. The cable company now delivers Road Runner at speeds of up to 50/5Mbps. AT&T tops out at 24Mbps, and not in every area.

When a competitor can’t deliver the fastest speeds, they inevitably claim consumers don’t want or care about super-fast broadband.

“We are focused on offering the broadband speeds that our customers need, at a price that they can afford,” said AT&T spokeswoman Gretchen Schultz.

Some North Carolina consumers are watching AT&T’s slower speeds and Time Warner’s price hikes from the sidelines, because they are signed up with municipal competitors.

Residents in Wilson with Greenlight service from the city don’t have to sign a contract to get the best prices and obtain service run and maintained by Wilson-area employees. The provider has embarked on a campaign to remind residents that money spent on the city-owned provider stays in the city.

In Salisbury, Fibrant is making headway against incumbent Time Warner as it works through a waiting list for customers anxious to cut Time Warner’s cable for good. Fibrant customers are assured they’ll always get the fastest possible service in town on a network capable of delivering up to 1Gbps to businesses -and- residents.

MI-Connection, the rebuilt former Adelphia cable system now owned by a group of local municipalities is managing to keep up with Time Warner with its own top broadband speeds of 20/2Mbps. The system is comparable to a traditional cable operator and does not provide fiber to the home service. Its 15,000 customers in Mooresville, Cornelius and Davidson are likely to stay with the system, but it is vulnerable to Time Warner’s bragging rights made possible from DOCSIS 3 upgrades. Since Time Warner does not provide service in most of MI-Connection’s service area, city officials don’t face an exodus of departing customers.

But that could eventually change. Some MI-Connection customers have reported to Stop the Cap! they have begun to receive promotional literature from Time Warner Cable for the first time, and there are growing questions whether the cable company may plan to invade some of MI-Connection’s more affluent service areas. Cable companies generally refuse to compete with each other, but all bets are off when that cable company is owned by a local municipality.

For most North Carolina residents, AT&T will likely be the first wired competitor, with its U-verse system. To date, U-verse has drawn mixed reviews from North Carolina consumers. Many appreciate AT&T’s broadband network is currently less congested than Road Runner, and speeds promised are closer to reality on U-verse compared with Road Runner during the early evening. But some AT&T customers are not thrilled being nickle-and-dimed for HD channels Time Warner bundles with its digital cable service at no additional charge. And for households with a lot of users, AT&T can run short on bandwidth.

“We have five kids — three now teenagers, and between my husband’s Internet usage and me recording a whole bunch of shows to watch later, we have run into messages on U-verse telling us we are trying to do too much and certain TV sets won’t work until we reduce our usage,” writes Angela. “AT&T doesn’t tell you that you all share a preset amount of bandwidth which gets divided up and if you use it up, services stop working.”

“We have five kids — three now teenagers, and between my husband’s Internet usage and me recording a whole bunch of shows to watch later, we have run into messages on U-verse telling us we are trying to do too much and certain TV sets won’t work until we reduce our usage,” writes Angela. “AT&T doesn’t tell you that you all share a preset amount of bandwidth which gets divided up and if you use it up, services stop working.”

Angela says when she called AT&T, the company gave her a $15 credit for her inconvenience, and the company claims it is working on ways to eliminate these limits in particularly active households. For now, the family is sticking with U-verse because the broadband works better in the evenings and she loves the DVR which records more shows at once than Time Warner offers. Their U-verse new customer promotional offer saves them $35 a month over Time Warner, at least until it expires.

“From reading about Fibrant and Greenlight on your site, my husband still wishes we lived in Salisbury or Wilson because nothing beats fiber, but at least what we have is better than what we used to have,” she adds.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/WXII Greensboro TWC Raising Rates 11-16-10.flv[/flv]

WXII-TV in Greensboro reports of Time-Warner Cable’s rate hikes for the Piedmont Triad region of North Carolina. (2 minutes)

Subscribe

Subscribe