Milwaukee’s Public, Educational, and Government (PEG) channels will soon be off Time Warner Cable’s analog basic cable lineup with little recourse for city officials upset about the channel losses.

Milwaukee’s Public, Educational, and Government (PEG) channels will soon be off Time Warner Cable’s analog basic cable lineup with little recourse for city officials upset about the channel losses.

Time Warner Cable is notifying analog cable subscribers in several Wisconsin cities about an upcoming digital conversion that will cut an average of a dozen channels from the analog lineup this fall. In Wisconsin, Time Warner is targeting several well-known cable networks like The Weather Channel and CNBC for the digital switch, as well as Ion TV over the air affiliates and several independent/religious broadcast stations.

The loss of PEG channels without any discussion with local officials has some Wisconsin community leaders upset, fearing significant viewing losses. Communities across Wisconsin lost their right to compel the carriage of the public interest channels after a 2007 deregulation bill essentially written by AT&T became law.

“It has been brought to our attention that a number of channels in the local Time Warner Cable ‘basic’ package will be shifted to the digital tier next month, meaning that most Milwaukeeans without a newer model television will need to obtain a digital to analog converter box in order to continue to view the entire basic cable package. We are both frustrated and perturbed by this news,” said Milwaukee Council members Jim Bohl, Robert Bauman, and Tony Zielinski. “Let’s not minimize who it is that will be most impacted by this move on Time Warner’s part either — people with older model televisions who only subscribe to a basic cable package. In short, this cut in service will have a disproportionate effect on residents within the city of Milwaukee.”

Time Warner Cable spokesman Michael Hogan made it clear the transition is something subscribers will have to get used to, because Time Warner is gradually moving all of its cable systems to digital only service.

Time Warner Cable spokesman Michael Hogan made it clear the transition is something subscribers will have to get used to, because Time Warner is gradually moving all of its cable systems to digital only service.

“We are moving towards a higher-quality, digital-only experience by making channels that had been available in both analog and digital formats available in a digital format only,” said Hogan. “Delivering channels digitally frees up capacity in our network to deliver faster Internet speeds, more HD channels and On Demand choices, and other new services in the future. We began the process several years ago of moving towards a digital-only experience. All of our direct video competitors – including direct broadcast satellite providers and phone companies – already take advantage of the efficiencies of digital delivery and deliver all of their programming solely in digital format.”

The Sordid History of “Video Competition” in Wisconsin

The race to digital service to keep up with satellite providers and AT&T U-verse is not exactly the type of competition Wisconsin residents thought they would get from the passage of a 2007 statewide video franchise law advocated by AT&T.

According to the Center for Media and Democracy, the Wisconsin law is modeled on the American Legislative Exchange Council’s “Cable and Video Competition Act,” a model bill ghostwritten by AT&T for use in statehouses around the country. AT&T provided more funding for ALEC’s activities in Wisconsin from 2008-2012 ($55,735) than any other corporation. Supporters of the legislation promised it would lead to more competition, better customer service and lower cable rates.

Bohl

Instead, it leaves Wisconsin communities with no recourse when cable operators decide to digitize or encrypt cable channels that city officials believe should be widely available to the public. Provisions in the law no longer permit local communities to have any say in a provider’s channel lineup, placement, or technology used to deliver the service.

Milwaukee Alderman Jim Bohl called the channel conversion a Time Warner bait-and-switch maneuver that will cut off residents’ access to city government. As for those promises of lower cable rates, Bohl rolled his eyes.

“I can only tell you it’s gotten worse,” Bohl told the Milwaukee Express. “This change would not have been looked at real happily by the council. I don’t think they ever would have done that if they were still accountable for their franchise agreement with the city of Milwaukee.”

Time Warner Cable subscribers without converter boxes who directly attach coaxial cable to the back of older television sets will be affected by the switch and will need to pay extra for a standard set-top box on each affected television in the home (roughly $7 a month each), or take advantage of a temporary offer from the cable company to supply a small digital to analog converter box that will be available for free for one year. After that, the smaller converter boxes will cost $0.99 a month each with no purchase option.

Without the boxes, Time Warner Cable subscribers will find themselves increasingly out of luck as the company gradually eliminates analog channels from the lineup.

Being AT&T’s Best Friend Can Be Rewarding

Montgomery

Supporters of AT&T’s video competition bill have been luckier than most Wisconsin cable subscribers.

Former Republican state Rep. Phil Montgomery, lead sponsor and claimed author of the 2007 video competition bill, was well compensated with a sudden $2,250 campaign contribution from AT&T the year the bill was introduced. Another $1,500 arrived from AT&T executives and one of their spouses in Texas and $1,500 from a senior AT&T executive in Wisconsin.

Before AT&T’s bill was written, the company barely knew Montgomery existed, donating a total of only $300 to his campaigns from 1998-2005.

After the bill became law, Montgomery spent his remaining years in the Wisconsin Assembly building a solid record avidly supporting AT&T’s public policy maneuvers, including a measure to deregulate basic phone rates and end oversight of telephone service quality by the state’s Public Service Commission.

Despite revelations Montgomery served as an ALEC board member and received contributions amounting to $10,800 from telecom companies, in 2011 Gov. Scott Walker appointed him to chair the PSC — very same agency Montgomery worked for years to disempower.

“He was very friendly to industry when he was a legislator, and was seen as carrying water for the telecommunications industry and the utilities,” said Mike McCabe, executive director of the Democracy Campaign. “Consumer advocates would naturally have concerns about somebody who seemed so supportive of industry now being in a position of overseeing those industries.”

Sen. Jeff Plale Takes Marching Orders from AT&T, His Chief of Staff’s Rap Sheet, a Freezer Full of Steaks and a Country Club for Cronies

Plale

AT&T’s biggest ally in the Wisconsin Senate was Jeff Plale, one of only a handful of Democrats — all pro-business conservatives — belonging to ALEC.

The patience of his district was tested after Plale began openly advocating for his corporate donors and claimed he could not understand why questions about his integrity were being raised by his opponents. Plale, after introducing AT&T’s companion video franchising bill in the Senate expressed he was shocked, shocked to discover he received more campaign contributions from AT&T and the cable industry than any other legislative Democrat. He added he did not know why AT&T’s Political Action Committee had suddenly maxed out on its campaign contribution two years before the next election.

Plale’s close working relationship with AT&T evolved inside of his office.

In 2003, Plale hired Katy Venskus, a charged felon, to raise funds for his election campaign. Despite pleading no contest to siphoning off more than $12,000 from an abortion rights organization and being caught up in a scandal over illegal campaign work for another Democrat, Venskus was appointed Plale’s chief of staff and would quickly become the point person for AT&T’s video competition bill in Plale’s office, working closely with AT&T to adjust the bill’s language to the company’s liking and help coordinate its movement through the Senate.

The successful passage of the bill would prove personally lucrative to Venskus when she left Plale’s office to join lobbying firm Public Affairs Co., of Minneapolis just one month after AT&T’s bill was signed into law. One year later, she took on AT&T as a lobbying client.

Venskus

In 2009, Plale and AT&T closely collaborated to write another deregulation measure to be introduced in the Wisconsin legislature, this time deregulating phone rates, making provision of landline service optional, and gutting service oversight. By then, AT&T Wisconsin considered Venskus an on-contract lobbyist.

The irony of a felon serving as the chief of staff for a Wisconsin state senator or as a registered lobbyist was not lost on the Milwaukee Express’ Lisa Kaiser.

“Despite being a felon, Venskus can affect public policy at the highest levels as a registered lobbyist,” observed Kaiser. “Yet she couldn’t be licensed to become a day care provider.”

According to e-mails and draft copies of the telephone deregulation bill obtained from the Legislative Reference Bureau and interviews conducted by The Capital Times, a number of meetings — “too numerous to count,” according to Plale’s chief of staff, Summer Shannon-Bradley — occurred with AT&T lawyers and executives and several other key industry stakeholders to work on the bill.

One important meeting in November 2009 included this attendance list: Andrew Petersen, director of external affairs and communications with telephone company TDS; William Esbeck, executive director of the Wisconsin State Telecommunications Association (WSTA) – a telecom industry lobbying group; that group’s attorney, Judd Genda; and AT&T attorney David Chorzempa.

E-mails and other correspondence between those at the meeting and Plale’s staff show slashes or check marks next to sections of the proposal that attorneys for AT&T and the WSTA suggested should be changed.

“It’s like lawmakers looked around and said, ‘These are the companies affected. So sit down with the drafters and make a bill,’ ” Barry Orton, a UW-Madison telecommunications professor told the Times. “The public interest isn’t represented. How could it be? Nobody was there to represent them.”

Life got tougher for Ms. Venskus a few months later when she was charged with felony theft and felony identity theft on suspicion of making $11,451 in improper purchases with her Public Affairs credit card, including a freezer full of steaks, according to the criminal complaint filed in Dane County court. She repaid the charges, but her contract to work for AT&T’s interests was suspended.

That September, Plale wore out his welcome in the 7th District serving southern Milwaukee and lost to primary challenger Chris Larson, who contended Plale was far too conservative and cozy with AT&T for his district.

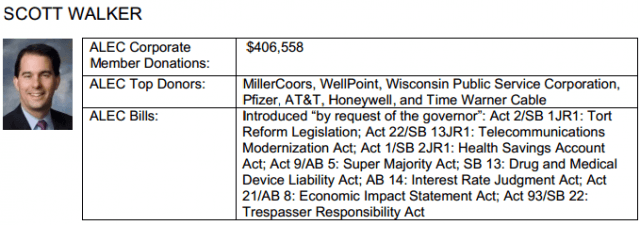

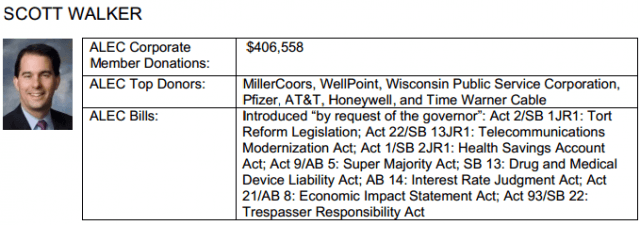

Gov. Scott Walker is also a close friend of ALEC, supporting a number of corporate-sponsored initiatives to deregulate the telecommunications industry. (Source: ALEC Exposed)

Plale would land on his feet when, after siding with Republicans on a lame duck session vote to stick it to the state’s unions, he joined the administration of Republican Gov. Scott Walker as the administrator of the Division of State Facilities — a $90,000 a year job.

“Instead of seeking out the best and brightest, this governor is busy creating a country club for cronies,” Marty Beil, executive director of the Wisconsin State Employees Union, told the Wisconsin State Journal. “When he says ‘open for business’ and then appoints people like Plale, he’s obviously saying that he doesn’t draw the line at the world’s oldest profession.”

When Jeff McDonaghe celebrated the beginning of 2013, his cable and Internet bill from Shaw Communications was roughly $117 a month. In April, Shaw announced a wide-ranging rate increase that cost the Calgary resident an extra $7 a month. Now Shaw is back for more with another rate increase that will cost the McDonaghe family an additional $11 a month. His October bill: nearly $135 — $18 more a month.

When Jeff McDonaghe celebrated the beginning of 2013, his cable and Internet bill from Shaw Communications was roughly $117 a month. In April, Shaw announced a wide-ranging rate increase that cost the Calgary resident an extra $7 a month. Now Shaw is back for more with another rate increase that will cost the McDonaghe family an additional $11 a month. His October bill: nearly $135 — $18 more a month. September 2013 Rate Adjustment

September 2013 Rate Adjustment “Given the improvement in free cash flow and assuming continued favorable market conditions, our board plans to target dividend increases of five to ten percent over the next two years,” said Brad Shaw, CEO of Shaw Communications.

“Given the improvement in free cash flow and assuming continued favorable market conditions, our board plans to target dividend increases of five to ten percent over the next two years,” said Brad Shaw, CEO of Shaw Communications.

Subscribe

Subscribe

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.”

“There is a monetization gap between how those channels are doing and how they should be doing measured by how peer cable channels are doing,” Burke explained. “In other words we are not paid as much as we think we should be given our ratings and our positioning by cable and satellite companies.” Milwaukee’s Public, Educational, and Government (PEG) channels will soon be off Time Warner Cable’s analog basic cable lineup with little recourse for city officials upset about the channel losses.

Milwaukee’s Public, Educational, and Government (PEG) channels will soon be off Time Warner Cable’s analog basic cable lineup with little recourse for city officials upset about the channel losses. Time Warner Cable spokesman Michael Hogan made it clear the transition is something subscribers will have to get used to, because

Time Warner Cable spokesman Michael Hogan made it clear the transition is something subscribers will have to get used to, because

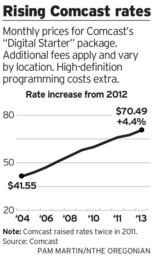

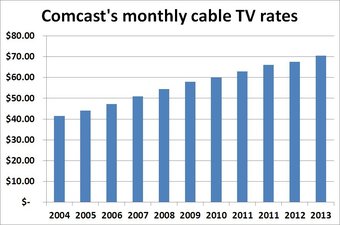

Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.

Comcast rates are going up again this fall in the Pacific Northwest, now exceeding $70 a month.