Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase.

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase.

For years, members of the National Cable Television Cooperative (NCTC) have joined forces to negotiate for the kinds of volume discounts only the largest cable and satellite companies like Comcast, Time Warner Cable, DirecTV, Dish Networks, Charter, and Cablevision have traditionally received. NCTC members range from family owned cable operators, rural co-ops, community-owned providers, independent telephone companies, and small multi-system operators servicing multiple communities. With group-buying power, NCTC-member cable companies used to be able to negotiate volume discounts that could keep their rates competitive with larger providers.

But as consolidation among major network media, cable, satellite, and phone companies marches on, only the largest operators — some directly affiliated with the cable programming networks — are getting the best deals at contract renewal time. All NCTC members combined serve just five million cable TV subscribers. Comcast has 21 million, DirecTV: 20 million, Dish Networks: 14 million, and Time Warner Cable: 11 million.

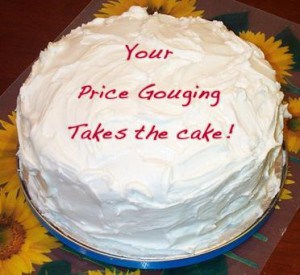

When NCTC’s contract with Viacom was up for renewal, the owner of networks like MTV and Comedy Central raised the renewal price more than 40 times the rate of inflation. In fact, Viacom’s asking price was so high, operators like Cable ONE pulled the plug on 15 Viacom networks for good and replaced them with other programming. NCTC members eventually compromised on a deal to renew Viacom-owned networks, but customers of companies like Massillon, Ohio-based MCTV are paying the price in the form of a mid-year rate hike Bob Gessner, MCTV’s president, did not want to have to pass on to customers.

“I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”

“I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”

Some facts about cable TV programming:

- Nine media companies control 95% of the paid video content consumed in the U.S.;

- The average household watches only 16 channels, yet networks package their channels to force you to buy those you don’t want to get those that you do want;

Programming network fees account for the bulk of your monthly cable bill;

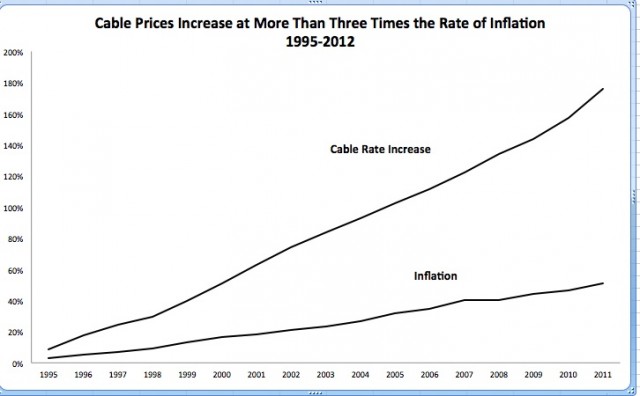

Programming network fees account for the bulk of your monthly cable bill;- The cost of basic cable has risen 3½ times the rate of inflation over the last 15 years because of demands from networks for higher programming fees;

- One media company honcho recently stated that, “…content is such a fundamental part of daily life that people will give up food and a roof over their heads before they give up TV.” This shows that they have lost their perspective and the demands for huge increases will continue.

Gessner

Gessner has broken ranks with many cable operators that say little more at rate hike time than “increased programming costs.”

Gessner has produced a 20-minute video that carefully explains to his customers what is going on in the cable programming industry and why providers like MCTV are forced to shovel networks onto cable lineups few customers want or watch and how the biggest cable and satellite companies are now negotiating volume-discounted renewal pricing at the expense of smaller providers.

While the largest cable companies in the country secure lower rates through those volume discounts, programmers have found a way to make up the difference: demanding even higher rates for smaller cable companies to cover what they lose from Comcast and other big players.

Gessner, as well as other NCTC member companies, confront huge programmers like Comcast-NBCUniversal, Viacom, Time Warner (Entertainment), Discovery and Disney that first demand 3-7 year renewal contracts with built-in, automatic annual rate increases averaging 5-10 percent, regardless of the ratings of their networks. Most also demand that all of their cable networks be carried on their systems, whether customers are interested in them or not. If these companies dream up new cable networks, like ESPN’s SEC Network and the Longhorn Network, MCTV is committed to carry those channels as well, even though they are of little interest to residents of northeastern Ohio where MCTV operates.

These dream contracts (for cable programmers) are the single biggest reason cable-TV rates are skyrocketing. But Gessner says it gets even worse when those contracts expire. When renewal negotiations begin, programmers these days inevitably demand a “rate reset” which starts rate negotiations at a price 10, 30, even 60 percent higher than under the expiring contract.

Those dollar amounts cover local station retransmission consent agreements nationwide.

Gessner says he doesn’t know how much longer MCTV can afford to carry expensive networks like sports channels. If he drops them, angry subscribers could cancel cable service and switch to a provider willing to pay the asking price. Unless all of his competitors stand together, programmers will maintain the upper hand.

Some cable companies, like Cable ONE, are starting to risk the wrath of their customers by refusing to negotiate for terms they consider unreasonable. When subscribers learned the reasons why Cable ONE dropped more than dozen Viacom channels, many were supportive because the company replaced the networks with other channels and promised to keep rate increases down because they won’t have to pass on Viacom’s higher prices. Viacom retaliated by locking out Cable ONE’s Internet customers from accessing any of Viacom’s free-to-view online programming.

“Viacom lets web surfers from Albania watch Spongebob but Viacom blocks people who live in Alabama, and if you are an advocate of this thing called Net Neutrality, you should be very concerned,” Gessner said. “Viacom is blatantly violating the spirit of Net Neutrality by discriminating against certain Internet users in order to extract higher fees from TV viewers. That’s the sort of vicious bullying behavior many of the content companies use to maintain their stranglehold on the U.S. television industry.”

Gessner and other independent cable operators hope cable operators’ willingness to drop cable networks over their price is the start of something big — a pushback that could eventually force programmers to charge rational rates.

“Hopefully this will serve as a wakeup call to the rest of the industry to stop paying these ridiculous prices for TV rights,” said Gessner. “I have no illusion that sanity will come to the industry overnight — it will take time — but this is a step in the right direction.”

[flv]http://www.phillipdampier.com/video/MCTV Rate Increase 2014.flv[/flv]

MCTV president Bob Gessner hosted this thoughtful presentation to carefully explain why his customers are facing a $1-3 mid-year rate increase for cable television. Gessner breaks with tradition by explaining the cable television business model is effectively broken and needs serious reform, including more choices for customers seeking fewer channels and a lower bill. It’s well worth 20 minutes of your time. (20:11)

Subscribe

Subscribe “Comcast Corp.’s bid to buy Time Warner Cable Inc. may be the opening act for a yearlong festival of telecommunications deals that would alter Internet, phone and TV service for tens of millions of Americans.” — Bloomberg News, May 14, 2014

“Comcast Corp.’s bid to buy Time Warner Cable Inc. may be the opening act for a yearlong festival of telecommunications deals that would alter Internet, phone and TV service for tens of millions of Americans.” — Bloomberg News, May 14, 2014

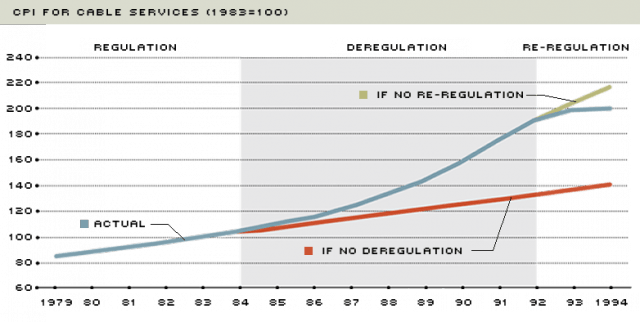

Economists reviewing data found in publicly available corporate balance sheets soon found evidence that the “increased programming costs”-excuse for rate increases did not hold water. The less competition or number of choices available to consumers in the market unambiguously lead to higher prices. It has remained true since Consumers’ Union

Economists reviewing data found in publicly available corporate balance sheets soon found evidence that the “increased programming costs”-excuse for rate increases did not hold water. The less competition or number of choices available to consumers in the market unambiguously lead to higher prices. It has remained true since Consumers’ Union  When a cable operator pays such an outrageous price, the previous owner is reaping the financial rewards of his monopoly power. The acquiring company can only pay such a high price by assuming that his monopoly power will allow him to continue to increase prices. Monopoly power is being bought and sold and borrowed against. The new cable operator, who has paid for market power, may insist that the debt he has incurred to obtain it is a real cost on his books. That may be correct in the literal sense (he owes someone that money) but that does not make it right, or the abuse of market power legal.

When a cable operator pays such an outrageous price, the previous owner is reaping the financial rewards of his monopoly power. The acquiring company can only pay such a high price by assuming that his monopoly power will allow him to continue to increase prices. Monopoly power is being bought and sold and borrowed against. The new cable operator, who has paid for market power, may insist that the debt he has incurred to obtain it is a real cost on his books. That may be correct in the literal sense (he owes someone that money) but that does not make it right, or the abuse of market power legal. Central Oregon’s independent cable television and broadband company — BendBroadband — has been sold to Telephone and Data Systems (TDS), a Chicago-based telephone company in a deal worth $261 million.

Central Oregon’s independent cable television and broadband company — BendBroadband — has been sold to Telephone and Data Systems (TDS), a Chicago-based telephone company in a deal worth $261 million. Cable industry executives on hand at this year’s Cable Show in Los Angeles are debating whether Netflix has taught the cable industry some important lessons about how to treat its online video competition.

Cable industry executives on hand at this year’s Cable Show in Los Angeles are debating whether Netflix has taught the cable industry some important lessons about how to treat its online video competition.