That is DISH’s CEO banging the drum beside a panoply of kangaroos. (Image courtesy: Gizmodo)

The ultra high-definition, bandwidth chewing 4K television standard has arrived and like HDTV before it, the first place most Americans will get to sample the new standard is over satellite television.

DISH Network is planning to introduce HDMI/HDCP 4K television owners to its new 4K Joey this year — a souped-up set-top box that can handle the high demands of 4K video.

DISH is using a Broadcom dual-core chipset and 7448 ARM processor that can handle the next standard in high-definition viewing.

While DISH set-top boxes will be ready for 4K, many cable and DSL broadband networks in the United States will face difficulties handling the online video demands that 4K video will place on their networks. In tests, watching an average movie required a minimum of a maxed out 10Mbps broadband connection. Live programming, particularly sports, required considerably more broadband speed to keep up. Few DSL networks will be able to sustain more than a handful of customers attempting to stream 4K video before neighborhood nodes become overwhelmed. Even the DOCSIS cable broadband standard still relies on shared bandwidth, and a few video aficionados in the neighborhood could pose significant challenges and speed slowdowns for other customers in the area.

Besides satellite, only fiber optic broadband will be ready to handle the practical requirements of streaming 4K video without significant upgrades.

DISH’s plans to stream video content over the Internet could one day also include 4K programming, but viewers are likely to run smack into usage caps and usage billing that ISPs are using to deter online video from gutting cable television revenue as well as further monetizing already highly profitable broadband.

DISH’s plans to stream video content over the Internet could one day also include 4K programming, but viewers are likely to run smack into usage caps and usage billing that ISPs are using to deter online video from gutting cable television revenue as well as further monetizing already highly profitable broadband.

Downloading just three 4K movies consumed 90GB and took more than a day to download, even with Comcast’s 100Mbps broadband service. In usage-capped markets, fewer than a dozen 4K movies would eat your entire monthly allowance. Each additional movie would subject Comcast customers to overlimit fees averaging around $6 per title.

Although DISH will offer a set-top box to handle 4K viewing, content producers are still waiting to see whether the public embraces the next HD standard before investing heavily in programming delivered using the new standard. DISH would only promise content from “several providers” would be forthcoming by the time the 4K Joey is released during the second quarter.

Subscribe

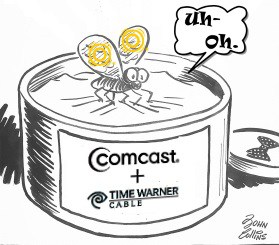

Subscribe GreatLand Connections, a new cable company with no headquarters building and only a handful of employees, is seeking permission to serve 2.5 million ex-Comcast/Time Warner Cable customers while saddled with $7.8 billion in debt the day its opens for business.

GreatLand Connections, a new cable company with no headquarters building and only a handful of employees, is seeking permission to serve 2.5 million ex-Comcast/Time Warner Cable customers while saddled with $7.8 billion in debt the day its opens for business.

Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.)

Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.)

The federal government is likely to count Bright House’s 2.2 million customers as part of the Time Warner Cable family, at least as far as control of cable programming pricing is concerned. Despite Comcast’s voluntary commitment to keep its national share of the cable TV business under 30 percent with the merger of Time Warner, Comcast hasn’t taken seriously counting the customers of the uninvited cousin – Bright House.

The federal government is likely to count Bright House’s 2.2 million customers as part of the Time Warner Cable family, at least as far as control of cable programming pricing is concerned. Despite Comcast’s voluntary commitment to keep its national share of the cable TV business under 30 percent with the merger of Time Warner, Comcast hasn’t taken seriously counting the customers of the uninvited cousin – Bright House.