A bone toss by Time Warner Cable (just over a week before the opening of baseball season) to get Southern California satellite and cable providers to pick up carriage of the Los Angeles Dodgers’ SportsNet LA at a discount has backfired and further inflamed critics of the cost of sports programming.

A bone toss by Time Warner Cable (just over a week before the opening of baseball season) to get Southern California satellite and cable providers to pick up carriage of the Los Angeles Dodgers’ SportsNet LA at a discount has backfired and further inflamed critics of the cost of sports programming.

Now two years old, the cable channel jointly owned by the Southern California division of Time Warner Cable and the Los Angeles Dodgers has been a sore spot for sports fans who don’t subscribe to Time Warner Cable or Charter Communications — the only two major providers offering the sports channel. It is the exclusive home of all-things-Dodgers and the Major League Baseball team was well compensated by Time Warner Cable with $8.35 billion for the 25-year deal.

Because of the huge amount of money on the line, Time Warner Cable priced SportsNet LA at $4.90 a month wholesale per subscriber — a stunning amount for a channel devoted to a single sports team. Providers serving Southern California, including DISH, DirecTV, Verizon, Cox, and AT&T, refused to carry the channel, and for two years Dodgers games have not been seen by more than half the region’s pay TV customers.

The issue has sparked outrage among sports fans and politicians, who have complained about the ongoing impasse between Time Warner and other providers. Only Charter Communications, now in sensitive negotiations with the California Public Utilities Commission over its acquisition of Time Warner Cable, relented and agreed to pick up the channel for its customers last summer.

The issue has sparked outrage among sports fans and politicians, who have complained about the ongoing impasse between Time Warner and other providers. Only Charter Communications, now in sensitive negotiations with the California Public Utilities Commission over its acquisition of Time Warner Cable, relented and agreed to pick up the channel for its customers last summer.

Time Warner Cable has consistently refused to allow the channel to be sold a-la-carte. Instead, every cable TV customer has to pay to make Time Warner’s expensive deal with the Dodgers pay off for the cable operator. Because other companies have consistently boycotted the network, Time Warner Cable has lost a reported $100 million a year from SportsNet LA.

That may explain why this year Time Warner Cable suddenly announced it would offer one year of the channel at a discount – $3.50 a month wholesale, closer in line with other regional sports channels.

Under normal circumstances, the price cut should attract other providers to get a deal signed, but these are not normal times in the cable television business.

Time Warner’s offer has been met with angry accusations of hubris in the Los Angeles sports press. None of the providers boycotting the channel seem interested in the deal either. The reason? The discount only lasts one year, after which the price shoots back up.

Imagine the customer service call centers at DirecTV and Verizon taking heated phone calls in March 2017 when the sports channel gets dropped for its too-high renewal rate.

“Why would anyone give everyone a taste of something for a year?” Mark Ramsey, a media consultant based in San Diego, told the Los Angeles Times. “All the leverage goes to the seller, not the buyer. It’s a temporary fix. This is not a free sample for Sirius XM. Dropping a channel is worse than not carrying a channel.”

“Why would anyone give everyone a taste of something for a year?” Mark Ramsey, a media consultant based in San Diego, told the Los Angeles Times. “All the leverage goes to the seller, not the buyer. It’s a temporary fix. This is not a free sample for Sirius XM. Dropping a channel is worse than not carrying a channel.”

Cable subscribers, particularly non-sports-fans, are also incensed at the prospect of their TV bill going up $3.50-5.00 a month for a single channel.

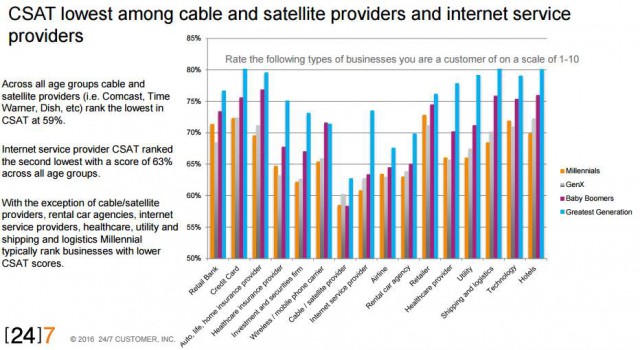

The dispute continues to fuel speculation that these kinds of money disputes are sure to hurry the demise of the one-size-fits-all cable TV package. Around one-quarter of Americans don’t subscribe to cable or satellite and less than two-thirds of those that do are adults 18-29. That demographic reality spells eventual doom. Cable TV is increasingly a must-have service only among older Americans. At least 83% of those 50 and older subscribe to cable television. That number drops to 73% for those aged 30-49. The younger you are, the less likely you see a need for cable television.

As a-la-carte alternatives grow, an ever larger percentage of Americans are expected to abandon the cable package. So far, the only party that doesn’t seem to care much either way is the Dodgers — they got their $8.35 billion and can sit on it for the next two plus decades.

Time Warner Cable likely underestimated the blowback on its wholesale pricing plans for SportsNet LA, but seems happy enough for now to offer only a temporary discount. But it also gives their customers another excuse to scrutinize their cable bills, which now include a “sports programming” surcharge, and scream for a-la-carte across the board.

“So, I am supposed to be excited that TWC is going to lower the price of the Dodgers to other providers? Right?,” complained Scott Bryant from Apple Valley. “Now myself, and others who could care less about the Dodgers will be forced to add another $3.50 a month to get the Dodgers, a team I could care less about? This is a joke, right? It’s time to force all cable/satellite providers allow us to pick our own channels and pay for what we want. This is nothing more than corporate welfare. When I see another added fee to my bill for local sports coverage, I will do it, too! I’m an Angels fan. Forcing me to pay for the Dodgers is criminal. I’m a sports fan, but this is out of control. Where are my scissors?”

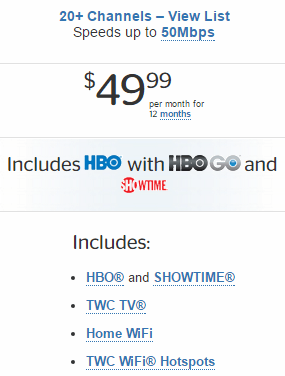

While cable operators continue to deny cord cutting is real, their marketing departments think otherwise and are responding with slimmed down cable TV packages showcasing premium movie channels at a non-premium price.

While cable operators continue to deny cord cutting is real, their marketing departments think otherwise and are responding with slimmed down cable TV packages showcasing premium movie channels at a non-premium price.

Subscribe

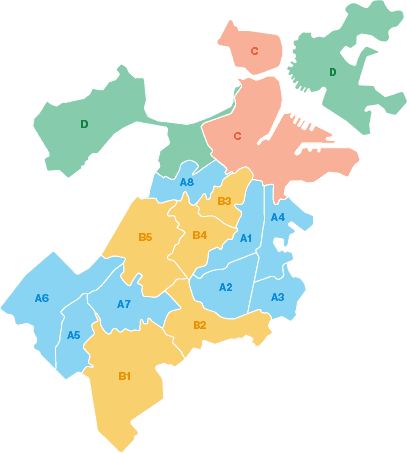

Subscribe The long wait for fiber optic broadband in the city of Boston is finally over.

The long wait for fiber optic broadband in the city of Boston is finally over.

A bone toss by Time Warner Cable (just over a week before the opening of baseball season) to get Southern California satellite and cable providers to pick up carriage of the Los Angeles Dodgers’ SportsNet LA at a discount has backfired and further inflamed critics of the cost of sports programming.

A bone toss by Time Warner Cable (just over a week before the opening of baseball season) to get Southern California satellite and cable providers to pick up carriage of the Los Angeles Dodgers’ SportsNet LA at a discount has backfired and further inflamed critics of the cost of sports programming. The issue has sparked outrage among sports fans and politicians, who have complained about the ongoing impasse between Time Warner and other providers. Only Charter Communications, now in sensitive negotiations with the California Public Utilities Commission over its acquisition of Time Warner Cable, relented and agreed to pick up the channel for its customers last summer.

The issue has sparked outrage among sports fans and politicians, who have complained about the ongoing impasse between Time Warner and other providers. Only Charter Communications, now in sensitive negotiations with the California Public Utilities Commission over its acquisition of Time Warner Cable, relented and agreed to pick up the channel for its customers last summer. “Why would anyone give everyone a taste of something for a year?” Mark Ramsey, a media consultant based in San Diego,

“Why would anyone give everyone a taste of something for a year?” Mark Ramsey, a media consultant based in San Diego,  Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions.

Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions. Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed.

Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed. Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!

Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!