Time Warner’s Enhanced DVR works fine, but those avoiding TWC equipment run into DRM problems.

If you’re accustomed to using Time Warner Cable’s DVR box, you probably don’t realize how heavy-handed Time Warner Cable can be with copy protection, but as set-top box alternatives proliferate, more customers are encountering the frustration of digital rights restrictions.

For several years, customers using alternatives to Time Warner’s set-top boxes or who wanted to store their DVR recordings on another hard drive quickly discovered the cable operator heavily enforces copy protection mechanisms designed to thwart digital archival copies of programs recorded from cable television.

Copy Control Information (CCI) is an invisible flag sent in digital television signals that is designed to give control to copyright owners over how their shows can be duplicated. Since at least 2007, Time Warner Cable and Bright House Networks customers have been frustrated if they use their own DVR or devices like TiVo. When customers attempt to copy their recorded shows to other devices or playback units in their home, the CCI flag often stops the copy cold.

ZatzNotFunny has covered this issue for years, noting Time Warner Cable, Bright House, and Cox have been particularly unfriendly to third-party set-top boxes like TiVo.

Among cable operators, the most common flags are Copy Freely and Copy Once. Many cable operators set their basic cable network CCI flags to “copy freely,” while premium pay movie channels like HBO are set to “copy once” — primarily to allow time-shifting devices like a DVR to record the show. Once your DVR has a copy of a show with a restricted flag, it cannot be copied again.

Digital Rights Management policies are part of the nation’s struggle between Hollywood-inspired copy protection and the public’s right to make and store recordings of programming for their own personal use. Some telecom companies like Verizon and Comcast have come down more in favor of consumers, while Time Warner Cable and Bright House (which have traditionally shared engineering practices and programming contracts for at least a decade) are far more responsive to Hollywood. The result for subscribers with $200 cable bills is endless frustration, especially if they choose not to use the pricey set-top boxes and DVRs supplied by the TWC or Bright House.

CableCARD and TiVo users, as well as those relying on Extenders for Windows Media Center like the Xbox 360 are often stymied by CCI flags, especially when a consumer tries to watch a show in one room and finish it in another using Multi-Room Viewing features.

ZatzNotFunny rates TWC, Bright House and Cox as unfriendly to alternative set-top boxes like TiVo. (Image: ZatzNotFunny)

Wikipedia supplies insight into the available CCI options cable operators can choose to use for cable television channels:

- 0x00 – Copy freely – Content is not copy protected.

- 0x01 – Copy No More – A copy of the content has already occurred and no more copies are permitted.†

- 0x02 – Copy Once – One recording can be made, but it cannot be copied to another device.†

- 0x03 – Copy Never – the content can be recorded and viewed for 90 minutes after transmission, and is not transferable.†

- 0x04 – Content is Copy Once for digital output, but would have Macrovision 7 Day Unlimited restriction applied on the analog outputs. This affects content viewed either on an HDTV with component cabling or on a standard definition TV. It also affects content saved to VCR or DVD when the recorder is connected to an analog output on the DVR.†

- 0x07 – Content is Copy Never for digital content (deleted after 90 minutes) and Macrovision 7 day/24 hour for content recorded from analog channels. Content cannot be transferred via TiVoToGo transfers or MRV, and cannot be saved to VCR or DVD.†

† – Any live stream with a CCI flag set higher than 0x00 is to be encrypted or protected in a way that only trusted platforms that will obey the flag (Such as Microsoft’s PlayReady system used in Windows Media center) can access it.

A Time Warner Cable customer known as MachineShedFred noticed this problem first hand and wrote about it in a complaint to Time Warner Cable back in March, and Stop the Cap! reader Chris N. pointed us to this ongoing issue:

The only software that allows me to use the CableCARD hardware that you officially support and distribute is Windows Media Center, which Microsoft is no longer developing, and is no longer distributing. All other DVR software available for every platform will not work, as they cannot decrypt the video stream due to the abuse of the CCI flag.

No other cable company in the US abuses the CCI flag in this manner, and every other cable subscriber in the US that isn’t on Time Warner has a wide choice of solutions for enjoying their service better than we can as your subscribers. Why are you restricting the choices of your subscribers for no reason? It’s clearly not contractual from the media networks, as they would have pushed for the same stipulations with at least one of your competitors. Yet, anyone outside of TWC’s monopoly can use any other software they want.

When even Comcast allows their subscribers more subscriber-friendly choices, you know you’re doing it wrong. Please revisit this ridiculous policy and cease the overuse of the CopyOnce CCI flag that unduly burdens your subscribers by forcing them to replace perfectly good hardware, or replace YOU.

Some believed this problem could eventually resolve itself with Charter Communications’ buyout of Time Warner Cable and Bright House Networks. Would Charter bring their own policies to affected TWC/BH customers, or will Charter customers soon have to contend with the CCI CopyOnce flag loved by Time Warner Cable as well.

Some believed this problem could eventually resolve itself with Charter Communications’ buyout of Time Warner Cable and Bright House Networks. Would Charter bring their own policies to affected TWC/BH customers, or will Charter customers soon have to contend with the CCI CopyOnce flag loved by Time Warner Cable as well.

An official complaint to the FCC brought a cryptic non-answer answer from William Wesselman, Time Warner Cable’s regulatory compliance counsel. Wesselman implied the liberal use of the CCI CopyOnce flag was the result of restrictions in contracts with major programmers, which seems unlikely because other cable operators — larger and smaller — have successfully navigated around this issue. Wesselman’s answer implies as Time Warner Cable and Bright House are brought into the Charter hegemony, “the policies of the two companies will ultimately become the same.”

Of course, he never defines which policy Charter, TWC and BH customers across the country will eventually get by sometime in 2017.

Mr. Wesselman’s full response:

At this time, TWC and Charter continue to integrate their two systems into one. Both TWC and Charter, like other distributors of multichannel video programming, negotiate the distribution rights for the content it carries independently with individual rights holders. These bilateral commercial negotiations take into consideration many different factors, include the content protection and digital rights management requirements of the rights holder; applicable law, license and regulations; and the interests of subscribers. Each of these commercial negotiations, and the terms of the agreements that result, are unique to the specific distributor and programmer involved. As the integration of the two companies continues, Mr. X will notice that the policies of the two companies will ultimately become the same based on our agreements.

Subscribe

Subscribe For the first time, the average American now pays over $100 a month just to watch television.

For the first time, the average American now pays over $100 a month just to watch television.

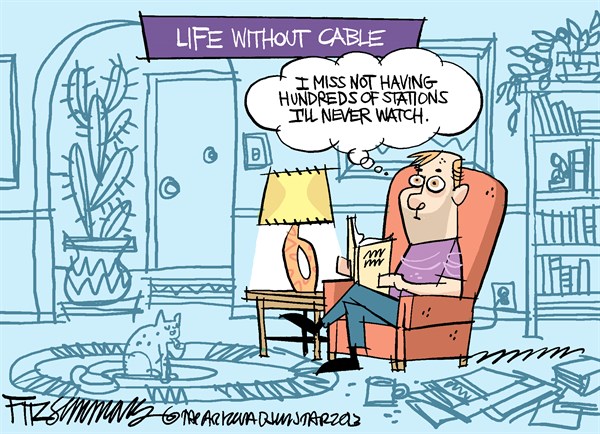

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites.

While Burke’s prediction has yet to slash the cable dial by more than a few networks so far, it has slowed down the rate of new network launches considerably. One millennial-targeted network, Pivot, will never sign on because it failed to attract enough cable distribution and advertisers, despite a $200 million investment from a Canadian billionaire. Time, Inc.’s attempts to launch three new networks around its print magazines Sports Illustrated, InStyle and People have gone the Over The Top (OTT) video route, direct to consumers who can stream their videos from the magazines’ respective websites. DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

DirecTV Now is expected by the end of this year and will likely offer a 100 channel package of programming priced at between $40-55 a month, viewable on up to two screens simultaneously. The app-based service will be available for video streaming to televisions and portable devices like tablets and phones. No truck rolls for installation, no service calls, and no equipment to buy or rent are all attractive propositions for AT&T, hoping to cut costs.

The Berkshire Eagle covered an open meeting held last night at the Great Barrington Firehouse, where residents and officials wondered why they could only lease a cable box from Charter, and

The Berkshire Eagle covered an open meeting held last night at the Great Barrington Firehouse, where residents and officials wondered why they could only lease a cable box from Charter, and  Walmart is recommending customers consider cutting off cable television for good with

Walmart is recommending customers consider cutting off cable television for good with