Video programmers that want to avoid the problem of usage allowances that can deter internet video streaming have a new way to make an end run around Net Neutrality, distributing their content “cap-free” through “virtual cable channels” that are distributed over broadband, but appear like traditional cable TV channels on a set-top box.

Video programmers that want to avoid the problem of usage allowances that can deter internet video streaming have a new way to make an end run around Net Neutrality, distributing their content “cap-free” through “virtual cable channels” that are distributed over broadband, but appear like traditional cable TV channels on a set-top box.

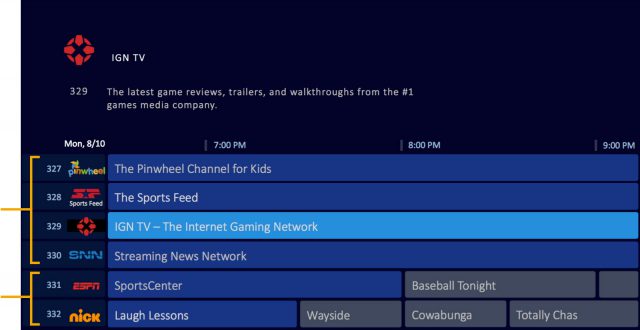

This morning, Fierce Cable noted Wurl’s IP-based streaming cable television network platform was here, offering cable operators new cable channels that are actually delivered over the customer’s internet connection. The Alt Channel, Streaming News Network, The Sports Feed and Popcornflix will appear on set-top boxes and onscreen guides like traditional linear cable channels, starting in August. Wurl claims at least 51, mostly small and independent cable operators, have already signed up for the service, which could quickly expand to 10-12 channels in the future. But Multichannel News has confirmed only one partner so far — Fidelity Communications, a small cable operator serving parts of Arkansas, Louisiana, Missouri, Oklahoma and Texas.

What makes these channels very different from the other networks on the lineup is that they are delivered over the customer’s internet connection directly into a cable set-top box, and will generally be exempt from any usage allowances or caps providers impose on broadband usage. Wurl acts as a distributor, obtaining content from “popular online studios” that “until now has only been available on computers and mobile devices.” Wurl’s partners can get their content exposed on traditional cable TV to a potentially greater audience, who can watch while not worrying about using up their monthly internet usage allowance.

The first series of bracketed channels are Wurl-TV broadband based channels, while the second are traditional linear cable networks delivered by RF or QAM. Both integrate seamlessly into the cable set-top box’s on-screen program guide.

Wurl’s unicast approach relies on its own content delivery network to provide one internet stream for each set-top box accessing its programming, which also allows for support of on-demand programming. But every cable customer watching a Wurl channel is effectively streaming video over their internet connection. Cable operators usually blame internet video for consuming most of their available internet bandwidth, necessitating the “need” for usage allowances/caps or usage based billing to manage and pay for bandwidth “fairly.”  Yet Wurl’s networks consume just as much bandwidth as traditional online video. But because Wurl is partnering with cable operators, that content is not subject to the usage caps Netflix, Hulu, or Amazon Video customers have to contend with.

Yet Wurl’s networks consume just as much bandwidth as traditional online video. But because Wurl is partnering with cable operators, that content is not subject to the usage caps Netflix, Hulu, or Amazon Video customers have to contend with.

Wurl claims its approach is so cable-operator friendly, “there’s no reason to say no,” said Sean Doherty, Wurl’s CEO and co-founder.

Cable operators are offered Wurl channels for free, with no affiliate fees or upfront costs, and no significant technology costs since the channels are distributed direct to the set-top box over broadband, not RF or QAM. A video player is embedded into the virtual cable channel, which allows viewers to pause, rewind, and fast forward programming.

In the future, cable systems are expected to gradually transition to IP-delivery of all of their video content, turning the cable TV line in your home into one giant broadband connection, across which television, internet access, and phone service are delivered.

But cable operators are still making distinctions between services that are gradually becoming different in name only. If a customer watches a Wurl channel over the internet on their desktop, that would count against their usage allowance. But if they watch over a cable-TV set-top box, it won’t, despite the fact the journey the channel takes to reach the viewer is exactly the same. That gives certain content providers an advantage others lack, representing a classic end run around Net Neutrality.

To be fair, that is not a distinction Wurl has made in any of its marketing material, but the fact preferred content can be managed this way is just one more reason the FCC should ban usage caps and usage-based billing on consumer internet accounts. Wurl’s own marketing material tells operators the cost and impact of its video streaming on the cable operator’s existing infrastructure is next to zero… because Wurl’s content comes across broadband platforms already so robust, they can easily accommodate the potential of thousands of viewers all watching Wurl channels without any issues. That reality undermines the cable industry’s own questionable arguments about the need for data caps or usage billing.

Subscribe

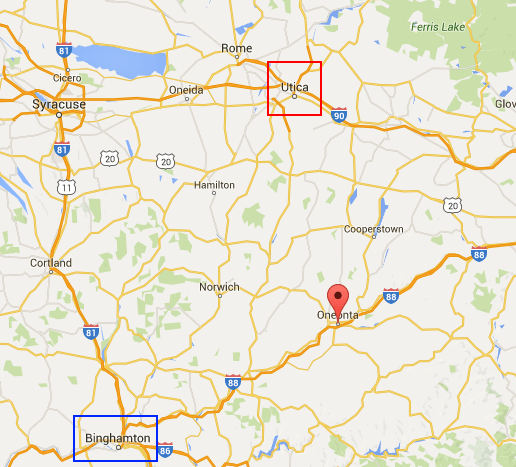

Subscribe Time Warner Cable subscribers in Otsego County, N.Y. have been able to watch WBNG-TV, the CBS affiliate in Binghamton, since there has been a cable company called Time Warner Cable. But as of yesterday, that is no longer the case. In Baxter County, Ark., Suddenlink customers suddenly lost KARK (NBC) and KTHV (CBS), two stations from Little Rock, after the cable company decided it would henceforth only carry KYTV (NBC) and KOLR (CBS) instead. Part of the problem for subscribers is those two stations are located in Springfield, Missouri, a different state.

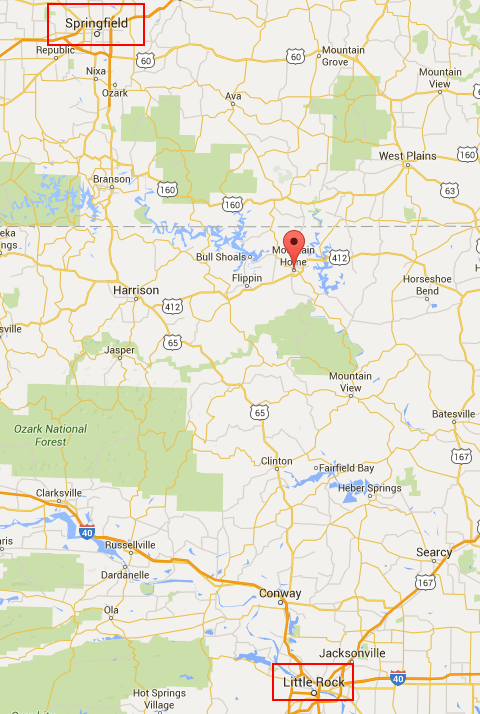

Time Warner Cable subscribers in Otsego County, N.Y. have been able to watch WBNG-TV, the CBS affiliate in Binghamton, since there has been a cable company called Time Warner Cable. But as of yesterday, that is no longer the case. In Baxter County, Ark., Suddenlink customers suddenly lost KARK (NBC) and KTHV (CBS), two stations from Little Rock, after the cable company decided it would henceforth only carry KYTV (NBC) and KOLR (CBS) instead. Part of the problem for subscribers is those two stations are located in Springfield, Missouri, a different state.

Another cable company with cost-cutting fever is Altice-owned Suddenlink, which stopped carrying the two Little Rock-based broadcast stations in northern Arkansas on June 7, leaving KATV (ABC) as the only central Arkansas-based news outlet on the cable provider’s Mountain Home-area system.

Another cable company with cost-cutting fever is Altice-owned Suddenlink, which stopped carrying the two Little Rock-based broadcast stations in northern Arkansas on June 7, leaving KATV (ABC) as the only central Arkansas-based news outlet on the cable provider’s Mountain Home-area system. Suddenlink has standing orders from Altice to look for savings wherever possible, but none of those savings are returned to subscribers. The loss of the stations has not reduced anyone’s cable bill and Suddenlink recently moved TBS and INSP — a Christian cable network — to a more costly Expanded Basic tier. In place of the two networks dropped from the Basic package are home shopping networks that actually make Suddenlink money – Evine Live and Jewelry TV.

Suddenlink has standing orders from Altice to look for savings wherever possible, but none of those savings are returned to subscribers. The loss of the stations has not reduced anyone’s cable bill and Suddenlink recently moved TBS and INSP — a Christian cable network — to a more costly Expanded Basic tier. In place of the two networks dropped from the Basic package are home shopping networks that actually make Suddenlink money – Evine Live and Jewelry TV. Premium movie channels Starz and Encore

Premium movie channels Starz and Encore  Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions.

Despite clamoring for more competition in the cable industry, FCC chairman Thomas Wheeler is reportedly ready to circulate a draft order granting Charter Communications’ $55 billion dollar buyout of Time Warner Cable, with conditions. Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed.

Critics of the deal contend that might be an effective strategy… if Charter was the only cable company in the nation. Many cable operators include similar restrictive terms in their contracts, which often also include an implicit threat that offering cable channels online diminishes their value in the eyes of cable operators. Programmers fear that would likely mean price cuts as those contracts are renewed. Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!

Most of the other deal conditions will likely formalize Charter’s voluntary commitments not to impose data caps, modem fees, interconnection fees (predominately affecting Netflix) or violate Net Neutrality rules for the first three years after the merger is approved. As readers know, Stop the Cap!  While Comcast, Cox, Suddenlink, and a handful of other cable companies play games with usage caps and expensive broadband, Germany is getting some massive broadband speed improvements with no data caps, speed throttling, or rate increases.

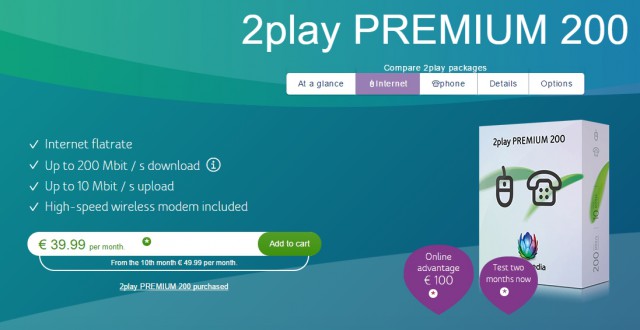

While Comcast, Cox, Suddenlink, and a handful of other cable companies play games with usage caps and expensive broadband, Germany is getting some massive broadband speed improvements with no data caps, speed throttling, or rate increases.