Charter Communications this afternoon submitted its annual update to the New York Public Service Commission, a condition of its approved merger with Time Warner Cable.

Charter Communications this afternoon submitted its annual update to the New York Public Service Commission, a condition of its approved merger with Time Warner Cable.

The cable company argues the merger has already delivered substantial pro-consumer benefits, including faster internet speeds, a low-income broadband program, no loss of New York jobs, and more upgrades to come.

Some highlights for customers in New York State:

All-Digital Conversion

- The handful of Charter legacy cable systems in New York have already been converted to all-digital service.

- Former Time Warner Cable systems in New York City, Syracuse, and the Hudson Valley are now all-digital.

- Albany will be converted to all-digital service in late 2017.

- Rochester and Buffalo will be converted to all-digital service in early 2018.

Broadband Speed Upgrades

- As of March 14, 2017 all Charter customers in New York can subscribe to at least 100Mbps service. ($105/mo, $199 setup fee)

- Charter has been actively rebuilding its Chatham system in Columbia and Rensselaer counties to provide broadband service. Project completion dates: In Rensselaer County, Berlin and Petersburgh expected to be done by the end of the third quarter 2017. In Columbia County, construction is scheduled to begin in May 2017, with a target completion date set for the end of first quarter 2018.

Cable Expansion

Since the last build-out update was filed on February 17, 2017, Charter has completed build-out to an additional 5,039 passings and has now completed build-out to a total of 15,164 passings across 56 counties and approximately 1,018 municipalities. Major areas of completed passings include, but are not limited to, the following:

- Albany County for approximately 1,330 passings, including the Village of Menands, Towns of Colonie, Cohoes, Bethlehem, Voorheesville, Selkirk, and New Scotland, and the City of Albany.

- Broome County for approximately 151 passings, including areas such as the Barker, Binghamton, Conklin, Endicott, Lisle, Marathon, Vestal, and Whitney Point.

- Cortland County for approximately 154 passings, including areas such as the Towns of Cincinnatus, Cortland, Cortlandville, Homer, Virgil, and Truxton.

- Erie County for approximately 2,029 passings, including areas such as the Towns of Amherst, Boston, Clarence, Colden, East Concord, Depew, Grand Island, Holland, Orchard Park, Derby, Lancaster, Eden, Springville, Williamsville, West Seneca, and the City of Buffalo.

- Genesee County for approximately 157 passings, including areas such as the Towns of Batavia, Elba, and Alexander.

- Kings County for approximately 390 passings in Brooklyn.

- Livingston County for approximately 196 passings, including areas such as the Towns of Honeoye Falls and Dansville.

- Monroe County for approximately 1,797 passings, including areas such as the City of Rochester, Town of Perinton, Greece, Penfield, North Chili, Webster, Pittsford, Ontario, Spencerport, and Gates.

- New York County for approximately 575 passings in the City of New York.

- Niagara County for approximately 297 passings, including areas such as the Towns of Cambria, Lockport, Lewiston, Niagara Falls, Newfane, North Tonawanda, Sanborn, Pendleton, Youngstown, and Wilson.

- Oneida County for approximately 221 passings, including areas such as the Towns of Utica, Rome, Clinton, Camden, Cassville, and Marcy.

- Onondaga County for approximately 787 passings, including areas such as the City of Syracuse, Village of Camillus, and Towns of Cicero, Baldwinsville, Liverpool, Chittenago, Clay, Homer, Manlius, and Marcellus.

- Ontario County for approximately 442 passings, including areas such as the Towns of Clifton Springs, Canandaigua, Phelps, and Victor.

- Orange County for approximately 429 passings, including areas such as the Towns of New Windsor, Middletown, Salisbury Mills, Montgomery, Goshen and Woodbourne.

- Oswego County for approximately 146 passings, including areas such as the Towns of Pulaski, Fulton, Parish, Albion, Altmar, Camden, and Central Square.

- Rensselaer County for approximately 376 passings, including areas such as the Towns of Castleton on Hudson, Cropseyville, Brunswick, Hoosick Falls, Nassau, Johnsonville, Sand Lake, East Greenbush, and Wyantskill, the City of Rensselaer, and the City of Troy.

- Saratoga County for approximately 1,854 passings, including the Towns of Milton, Stillwater, Clifton Park, Ballston Lake, Ballston Spa, Halfmoon, Round Lake, Mechanicville, Malta, Waterford, and Wilton, and the City of Saratoga Springs.

- Schenectady County for approximately 218 passings, including areas such as the Village of Delanson, Towns of Esperance, Niskayuna, Duanesburg, Glenville, and Rotterdam, and Burnt Hills, and the City of Schenectady.

- Schoharie County for approximately 106 passings, including areas such as the Towns of Middleburgh, Cobleskill, Jefferson, and Schoharie.

- St. Lawrence County for approximately 171 passings, including areas such as the Towns of Canton, Massena, Potsdam, and Gouverneur.

- Sullivan County for approximately 639 passings, including the Towns of Fallsburg, Liberty, Monticello, Victor, Thompson, Loch Sheldrake, Swan Lake, Bethel, and White Lake, and the Villages of Woodridge and Wurtsboro.

- Tompkins County for approximately 303 passings, including areas such as the Towns of Ithaca, Slaterville Springs, Groton, and Newfield, and the City of Ithaca.

- Ulster County for approximately 537 passings, including the Towns of Accord, Hurly, Rochester, Ulster, Kerhonkson, New Paltz, Greenfield Park, Woodstock, and Saugerties, and the City of Kingston.

- Warren County for approximately 107 passings, including areas such as the Towns of Lake George, Warrensburg, Queensbury, and Glens Falls.

- Wayne County for approximately 192 passings, including the Towns of Palmyra, Ontario, Macedon, Walworth, Newark, Sodus, and Williamson.

Ed. Note: Nothing precludes Charter from including new housing developments and similar projects in these numbers where it would have provided service regardless of the Order from the PSC.

The Availability of Time Warner Cable’s Unrestricted $14.99 Everyday Low Price Internet Tier

Charter has continued to offer new subscribers in TWC’s New York territory the TWC standalone Everyday Low Price $14.99 broadband service, at speeds no less than those being offered at the time of the merger order, and will continue to offer this to new subscribers for up to two years after close (until May 17, 2018). Any customer is qualified to subscribe to this service, which provides around 2Mbps of internet speed.

Charter has continued to offer new subscribers in TWC’s New York territory the TWC standalone Everyday Low Price $14.99 broadband service, at speeds no less than those being offered at the time of the merger order, and will continue to offer this to new subscribers for up to two years after close (until May 17, 2018). Any customer is qualified to subscribe to this service, which provides around 2Mbps of internet speed.

Ed. Note: This service is not advertised or mentioned in any way on Charter/TWC’s marketing website and many Stop the Cap! readers in New York have told us Charter sales representatives have repeatedly told them the service is not available, so this claim is in dispute.

Existing customers with the Everyday Low Price tier at the time of closing will be allowed to retain this product for a minimum of three years, which the Commission has set to “run concurrently with the two-year period in which Charter must continue to offer the service to new customers.” New subscribers will be able to retain the product until at least May 17, 2019.

$14.99 Low Income Broadband Service “Spectrum Internet Assist”

First available in the Plattsburgh area in November, 2016, Spectrum Internet Assist has now expanded to former Time Warner Cable territories in New York.

First available in the Plattsburgh area in November, 2016, Spectrum Internet Assist has now expanded to former Time Warner Cable territories in New York.

For $14.99 a month, qualified customers get 30/4Mbps broadband service. Wi-Fi service is available for an extra $5 a month. Customers must qualify for at least one of these low-income benefit programs:

- The National School Lunch Program (NSLP); free or reduced cost lunch

- The Community Eligibility Provision (CEP) of the NSLP

- Supplemental Security Income (SSI) ( ≥ age 65 only)

(Programs that do not qualify include: Social Security Disability (SSD), Social Security Disability Insurance (SSDI), and Social Security Retirement and Survivor Benefits are different from Supplemental Security Income (SSI) and do NOT meet eligibility requirements.)

Improved Customer Service

Charter is required to invest a minimum of $50 million in service improvement programs for the specific benefit of New York operations.

Much of this money was apparently spent on a new national Spanish language call center based outside of New York.

A large proportion of the rest of Charter’s investment was spent on changing signs on Time Warner Cable stores and rebranding them as Spectrum, deploying new self-service apps and services Charter would have released on its own regardless of this requirement to reduce expensive customer service contacts, and moving towards customer self-install kits instead of sending out a cable technician to cut Charter’s own costs.

Charter has already spent money on rebranding its service trucks and buying more of them to not send to your house if they can avoid it.

Charter also reported it will spend a portion of that mandatory investment on opening a new Charter Cable Store in Washington Heights, in a “culturally diverse neighborhood in the northern portion of the New York City borough of Manhattan.” Almost all the staff will be bi-lingual.

And to deal with the long lines at Charter’s cable stores, an upgraded queuing system will be bought to allow customers to check-in to “a virtual line.”

Next year, it will spend money on a new on-screen cable guide.

Reducing Customer Complaints

Now more than ever, dissatisfied former Time Warner Cable customers can have a major impact on Charter’s ability to achieve a real reduction in the number of complaints filed by New Yorkers with the PSC. Charter is required to show a 17.5% reduction in complaints over 2014 numbers and a 35% reduction by 2020.

Now more than ever, dissatisfied former Time Warner Cable customers can have a major impact on Charter’s ability to achieve a real reduction in the number of complaints filed by New Yorkers with the PSC. Charter is required to show a 17.5% reduction in complaints over 2014 numbers and a 35% reduction by 2020.

All Charter can report for now is that “the company is making major investments in various customer service initiatives which may have a positive impact on these complaint rates in the future.”

If you are unhappy with your service, filing a PSC complaint may get much greater attention than ever before because it threatens Charter’s ability to meet the terms of its agreement with the state, and could get the company fined.

Data Caps

While former FCC Chairman Thomas Wheeler managed to get up to a seven-year commitment from Charter not to impose data caps on residential customers, Charter has deleted that reference in its annual update to New York regulators, perhaps with the assumption current FCC Chairman Ajit Pai can be relied on to eventually eliminate that pro-consumer benefit of the transaction.

While former FCC Chairman Thomas Wheeler managed to get up to a seven-year commitment from Charter not to impose data caps on residential customers, Charter has deleted that reference in its annual update to New York regulators, perhaps with the assumption current FCC Chairman Ajit Pai can be relied on to eventually eliminate that pro-consumer benefit of the transaction.

For New Yorkers, Charter will only guarantee it will not introduce data caps on its broadband service for the next three years, ending May 17, 2019. In other states, should the FCC eliminate the data cap ban included in Charter’s merger agreement, the company can apply data caps immediately.

Who you voted for in the last presidential election could make all the difference between having data caps and not having data caps in 2020.

Subscribe

Subscribe

Viacom, Inc., the nemesis of any cable operator trying to keep programming costs down, has finally bowed to the reality there is a ceiling on the number of networks Americans are willing to pay for and will narrow its focus on just six of its top cable networks.

Viacom, Inc., the nemesis of any cable operator trying to keep programming costs down, has finally bowed to the reality there is a ceiling on the number of networks Americans are willing to pay for and will narrow its focus on just six of its top cable networks. New Viacom chief executive Bob Bakish now plans to cut tension with pay television operators by narrowing Viacom’s focus to just six core networks: Nickelodeon, Nick Jr., MTV, Comedy Central, BET and Spike. The Wall Street Journal

New Viacom chief executive Bob Bakish now plans to cut tension with pay television operators by narrowing Viacom’s focus to just six core networks: Nickelodeon, Nick Jr., MTV, Comedy Central, BET and Spike. The Wall Street Journal

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites.

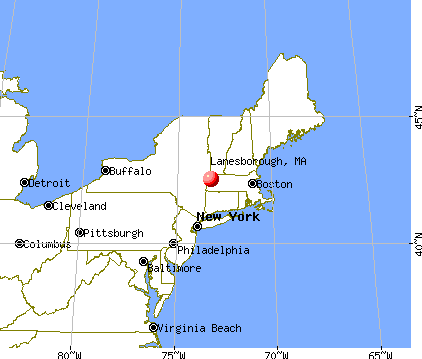

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites. It is hard to imagine there are still cable systems serving customers with nothing more than a slim lineup of standard definition cable television channels in 2016, but not if you live in three Berkshire towns over the New York-Massachusetts border where Charter Communications will finally introduce HD television and internet service starting next week.

It is hard to imagine there are still cable systems serving customers with nothing more than a slim lineup of standard definition cable television channels in 2016, but not if you live in three Berkshire towns over the New York-Massachusetts border where Charter Communications will finally introduce HD television and internet service starting next week.