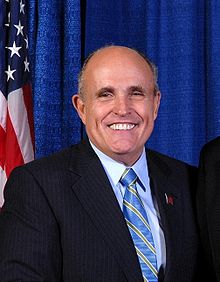

As Fox’s parent company News Corp. continues to reel in a wide-ranging criminal investigation involving phone hacking murder and terror victims in the United Kingdom, the scandal is now spreading into the United States with new revelations this week that CEO Rupert Murdoch, working with New York’s then-mayor Rudy Giuliani, used politically-motivated threats to force Time Warner Cable to add a newly-launched Fox News Channel to the cable dials of New Yorkers, raising their cable bills in the process.

The Daily Beast reports efforts by Murdoch to pay a substantial bounty to get the news/commentary channel on in Manhattan were not effective, so Murdoch turned to a political alliance with Giuliani, who received significant support from Murdoch’s NY Post in his earlier election bid, to force the issue with threats against the cable operator:

Let’s start in 1996, three years after Murdoch’s New York Post helped make Giuliani mayor with the narrowest win in modern city history. That year, Rupert and Ailes, who’d actually managed Rudy’s unsuccessful mayoral run in 1989, were launching Fox Cable News and they had one rather daunting problem: Time Warner controlled the prime NYC cable franchise, with 1.2 million viewers, including virtually all of Manhattan, where every advertiser who might buy a spot lived or worked. And Time Warner refused to give Fox a channel for its new venture. In those days, Time Warner only had space for 77 channels on the dial, and 30 applicants had lined up before Fox. Richard Aurelio, who ran the NYC cable system for Time Warner, recalls now that he assured Ailes that in a year or so, they would “get more capacity and put you on.” But, says Aurelio, now long retired at age 83, “Murdoch was furious.” A former deputy mayor under John Lindsay, Aurelio says he’d “never seen such a display of raw political power,” branding it “ferocious.”

Records revealed that after Murdoch and Giuliani talked directly about the matter on Oct. 1, their aides had 25 conversations and two meetings in the space of a few weeks. A deputy mayor instantly warned Time Warner about the possibility that their franchise, granted by the city every 15 years, might not be renewed and volunteered to fly anywhere in the country to meet with a Time Warner executive above Aurelio. When Time Warner wouldn’t budge, Giuliani came up with an extraordinary remedy. The city controlled five public-access channels, written into law as alternatives to commercial television, and the mayor decided to give one of them to Fox. In fact, presumably to make it look like this wasn’t something he would just do for Murdoch, he offered another to Mike Bloomberg’s then-fledgling TV network. The Bloomberg News channel actually had its debut one night before a federal judge could stop the deal, but soon the courts blocked this transparently extralegal adventure.

While Murdoch was initially willing to pay cable systems up to $11 per subscriber to launch Fox News on cable systems in the fall of 1996, most cable systems were effectively out of channel capacity at the time. Fewer than ten million households had access to the new new network when it launched, despite the record launch bonus Murdoch was willing to pay. Time Warner Cable had promised the network it would likely have channel space within two years as the company completed the rollout of its then-new “digital cable” service, which opened up hundreds of new slots for additional channels, but Murdoch was not willing to wait.

The Giuliani Administration owed a lot to Murdoch’s newspaper operations in the city, trumpeting his political campaigns. One year before Fox News launched, Giuliani’s then-wife Donna Hanover was hired by WNYW-TV, Fox’s owned and operated local station in New York, despite the fact it was over a decade since her last job in television. Fox tripled her salary just after Giuliani began threatening Time Warner Cable’s franchise to provide cable service in New York, unless and until the cable system made room for Fox News.

By 1997, Time Warner Cable added the network not only to its Manhattan cable system, but agreed to roll the channel out to most of its cable systems nationwide by 2001.

Murdoch’s early willingness to pay a bounty to get cable carriage has proved a worthwhile investment, considering Fox News has now become one of the most expensive networks in the cable package. In December, Chase Carey, COO of News Corp., compared Fox News’ value with ESPN — America’s most expensive cable channel. Carey has sought wide-ranging rate increases for Fox News in 2011, even after the network won earlier increases which made them by far the most expensive channel in the news and commentary category, running about a dollar per month per subscriber. Those rate increases are passed down to every cable subscriber in the form of a higher monthly bill, whether one watches the channel or not.

In 2007, additional pressure was brought against cable operators to add Fox Business Channel, a perennially-low rated channel that was started to counter “the anti-business bias” of CNBC. Despite now being available in nearly half of all American households, the spring Nielsen ratings show only about 57,000 people over the age of 2 watch the channel on any given day, even though every cable subscriber with the network on their lineup pays for it.

Subscribe

Subscribe