Unless a broadband provider can deliver the same kind of profitability earned by U.S. cable operators, don’t expect significant private investment in broadband expansion even if the company can easily turn a profit.

Unless a broadband provider can deliver the same kind of profitability earned by U.S. cable operators, don’t expect significant private investment in broadband expansion even if the company can easily turn a profit.

That was the argument brought to a House hearing on funding broadband infrastructure expansion by Craig Moffett, a Wall Street analyst at Moffett Nathanson.

“Infrastructure deployment requires the expectation of a healthy return on capital,” Moffett told the House Communications and Technology Subcommittee in a hearing this afternoon. “That should be taken as a given, but all too often, in my experience, the issue of return on capital is either ignored or misunderstood in policy forums. It is not a matter of whether a business is or isn’t profitable, it is instead a matter of whether it is sufficiently profitable to warrant the high levels of capital investment required for the deployment of infrastructure.”

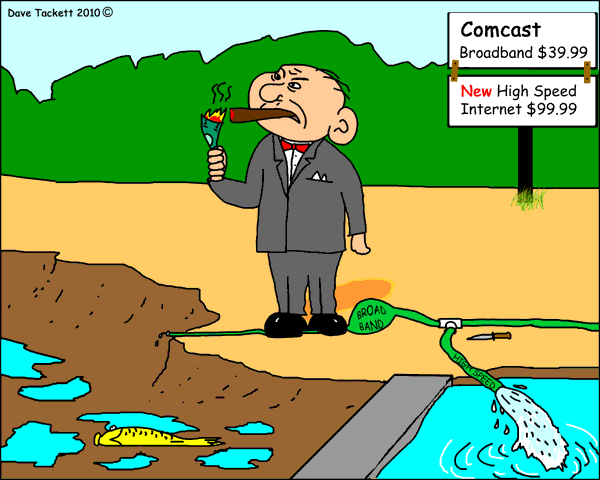

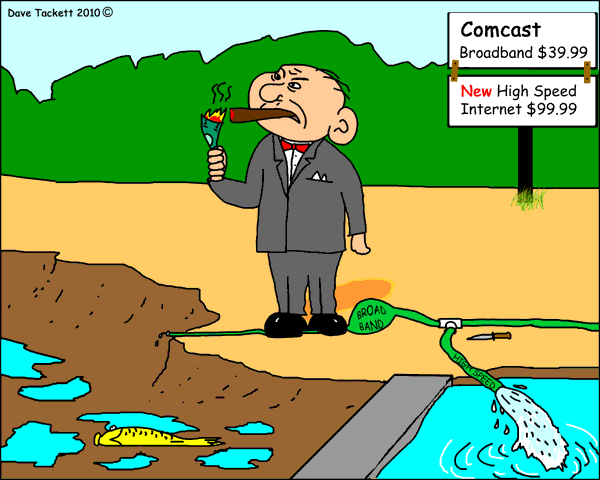

Moffett pointed to the massive profits earned by cable operators Comcast, Time Warner Cable, Charter and Cablevision, all of which earned returns well in excess of their cost of capital, ranging from 13-33 percent. Moffett argued Wall Street has come to expect those kinds of returns, and investors will take a hard look at companies deploying new expensive networks against those that have largely paid back much of the capital costs incurred when their networks were built decades ago.

Moffett continued to criticize the broadband expansion being undertaken by large incumbent telephone companies that he claims does not earn attractive returns for their wireline businesses, even as they have introduced new services like faster broadband and television.

“For example, a decade after first undertaking their FiOS fiber-to-the-home buildout to 18 million homes, Verizon has not yet come close to earning a return in excess of their cost of capital,” said Moffett. “In 2014 their aggregate wired telecommunications business earned a paltry 1.2% return, against a cost of capital of roughly 5%. For the non-financial types in the room, that’s the equivalent of borrowing money at 5% interest in order to earn interest of 1%. That’s a good way to go bankrupt.”

Moffett was also critical of AT&T’s planned expansion of gigabit fiber broadband.

Moffett was also critical of AT&T’s planned expansion of gigabit fiber broadband.

“AT&T has committed to the FCC to make fiber available to a total of 11.7 million locations in their footprint in order to make their acquisition of DirecTV more palatable to policy-makers, but it is hard to be optimistic that they will do much better this time around,” Moffett argued.

Moffett believes competition is bad for the profitable broadband business.

Moffett

“The broader take-away here is that the returns to be had from overbuilding – that is, being the second or third broadband provider in a given market – are generally poor,” Moffett said. “Let that sink in for a moment. Stated simply, it means that market forces are unlikely to yield a competitive broadband market. Neither, by the way, does wireless appear to offer the promise of imminent competition for incumbent broadband providers. Wireless networks simply aren’t engineered for the kind of sustained throughput required for a wired-broadband-replacement service.”

As a result, investors prefer that the broadband marketplace remain a monopoly or duopoly to guarantee the kinds of healthy returns they have earned for years, especially from the cable stocks Moffett has always favored in reports to his clients. Additional competition drives prices down, reducing profits, which in turn discourages investors who have high expectations their money will make them a lot more money.

Moffett’s arguments are largely based on broadband being a for-profit private enterprise, not a public infrastructure effort. But it does explain why there is a willingness to compete in large cities where network construction costs are lower and rural communities remain relatively unserved. As with electrification 100 years ago, investor-owned utilities were willing to wire large communities while ignoring rural farms and communities. Only after electricity was deemed a necessary utility did alternative means of funding, including member-owned co-ops and community-owned utilities finish electrifying areas private capital ignored.

Moffett’s guide to better broadband is based entirely on profitability — delivering enough profits and other returns to attract investors that will look elsewhere if costs become too high. Community-owned broadband avoids this dilemma by advocating for break-even or modestly profitable networks that focus on service, not investor-attractive profits.

Several members of Congress commented Moffett’s vision of broadband was discouraging, even depressing, because it seemed to be locked in a for-profit, private sector model that had few answers to offer for communities left behind. Moffett even warned against oversight and regulation of incumbent cable and phone companies, claiming it would further drive away private investment.

But broadband customers, Moffett admitted, will still pay the price for investor expectations.

“As everyone understands, the cable video business is facing unprecedented pressure,” Moffett testified. “Cord cutting has been talked about for years but is finally starting to show up in a meaningful way in the numbers. And soaring programming costs are eating away at video profit margins. From a cable operator’s perspective, the video business and the broadband business are opposite sides of the same coin. It is, after all, all one infrastructure. Pressure on the video profit pool will therefore naturally trigger a pricing response in broadband, where cable operators will have greater pricing leverage.”

“As everyone understands, the cable video business is facing unprecedented pressure,” Moffett testified. “Cord cutting has been talked about for years but is finally starting to show up in a meaningful way in the numbers. And soaring programming costs are eating away at video profit margins. From a cable operator’s perspective, the video business and the broadband business are opposite sides of the same coin. It is, after all, all one infrastructure. Pressure on the video profit pool will therefore naturally trigger a pricing response in broadband, where cable operators will have greater pricing leverage.”

Moffett said the kinds of rate hikes consumers used to pay for cable television now increasingly transferred to broadband customers is nothing nefarious. To keep investors happy, the kind of returns once earned from cable television will now have be delivered on the backs of broadband customers if Congress expects cable companies to continue upgrading and expanding their networks.

“All else being equal, that will mean that even new builds of broadband will become increasingly economically challenged and therefore will become less and less likely,” said Moffett. “Or they will simply have to sharply raise broadband prices.”

Moffett’s comments do come with some baggage, however. His clients pay for his advice and Moffett has been a long-time supporter of cable industry stocks. He has been a strong and natural advocate for a cable industry that faces only token opposition. He has browbeaten executives to start broadband usage caps and usage-based billing to further boost broadband profits, slammed telephone company competition in the cable business as financially reckless and unwarranted, and dismissed Google Fiber as a project designed to help Google’s public policy aims more than earn the search giant profits from the broadband business.

But Moffett has also been wrong in the past, particularly with respect to cord-cutting which he used to downplay as an urban legend and on the ease cable companies would be able to acquire and merge with each other.

Beyond all that, Moffett and his clients have a proverbial dog in the fight. After years of pumping cable stocks, suggestions that more competition for the cable industry is a good thing would simply be bad for business.

Subscribe

Subscribe A tiny cable company serving communities around the Blue Mountain in eastern Pennsylvania has a big appetite for rationing Internet usage by imposing data caps and overlimit fees on their 170,000 customers.

A tiny cable company serving communities around the Blue Mountain in eastern Pennsylvania has a big appetite for rationing Internet usage by imposing data caps and overlimit fees on their 170,000 customers.

Montréal cable subscribers will soon be able to buy gigabit broadband speeds from Vidéotron after a successful pilot project demonstrated the cable company’s existing DOCSIS 3.0 network was up to the task.

Montréal cable subscribers will soon be able to buy gigabit broadband speeds from Vidéotron after a successful pilot project demonstrated the cable company’s existing DOCSIS 3.0 network was up to the task. Unless a broadband provider can deliver the same kind of profitability earned by U.S. cable operators, don’t expect significant private investment in broadband expansion even if the company can easily turn a profit.

Unless a broadband provider can deliver the same kind of profitability earned by U.S. cable operators, don’t expect significant private investment in broadband expansion even if the company can easily turn a profit. Moffett was also critical of AT&T’s planned expansion of gigabit fiber broadband.

Moffett was also critical of AT&T’s planned expansion of gigabit fiber broadband.

“As everyone understands, the cable video business is facing unprecedented pressure,” Moffett testified. “Cord cutting has been talked about for years but is finally starting to show up in a meaningful way in the numbers. And soaring programming costs are eating away at video profit margins. From a cable operator’s perspective, the video business and the broadband business are opposite sides of the same coin. It is, after all, all one infrastructure. Pressure on the video profit pool will therefore naturally trigger a pricing response in broadband, where cable operators will have greater pricing leverage.”

“As everyone understands, the cable video business is facing unprecedented pressure,” Moffett testified. “Cord cutting has been talked about for years but is finally starting to show up in a meaningful way in the numbers. And soaring programming costs are eating away at video profit margins. From a cable operator’s perspective, the video business and the broadband business are opposite sides of the same coin. It is, after all, all one infrastructure. Pressure on the video profit pool will therefore naturally trigger a pricing response in broadband, where cable operators will have greater pricing leverage.” John Malone’s Liberty Global has bought out Puerto Rico’s second biggest cable television operator — Choice Cable TV — and will convert its customers to Liberty Cablevision of Puerto Rico.

John Malone’s Liberty Global has bought out Puerto Rico’s second biggest cable television operator — Choice Cable TV — and will convert its customers to Liberty Cablevision of Puerto Rico.