With today’s completion of Cablevision’s absorption into the Altice empire, the European cable conglomerate announced big changes that are expected to refocus the “center of gravity” and Altice’s future profits on the United States instead of Europe.

With today’s completion of Cablevision’s absorption into the Altice empire, the European cable conglomerate announced big changes that are expected to refocus the “center of gravity” and Altice’s future profits on the United States instead of Europe.

Altice today becomes America’s fourth largest cable operator, serving 4.6 million customers in 20 states. But Altice is not finished empire-building, and is widely expected to target privately held Cox Communications for acquisition sometime next year.

To lay the groundwork for future expansion, current controlling shareholder Patrick Drahi is turning over leadership of his growing U.S. operations to trusted lieutenant Dexter Goei, who will be chairman and CEO of Altice USA. Goei’s first mission is to lead a team of fierce cost-cutters into the offices of Suddenlink and Cablevision and ruthlessly slash expenses. Much of those savings are expected to come from significant job cuts among Cablevision’s 14,000 workers, especially middle management, engineering, and administrative workers. Last fall, Altice told investors Cablevision’s workers in the high cost suburban New York area were ripe for cutbacks, with much of the work currently managed by six figure salaried Cablevision employees likely to be transferred to Missouri-based Suddenlink, which operates in smaller cities in low labor cost states where employees are paid considerably less.

Approval of Cablevision’s sale to Altice by the New York Public Service Commission was given with the requirement Altice is prohibited from laying off, involuntarily reducing or taking any action “intended to reduce (excepting attrition and retirement incentives) any customer-facing jobs in New York,” such as call centers or walk-in centers for a period of four years. But as Altice’s call center employees at France’s SFR-Numericable attest, that does not prevent Altice from closing current call centers and transferring those jobs to cheaper locations in New York staffed by those willing to work for much less.

“The number of customer service agents is exactly the same, but their competency to handle customer problems, and their salaries, are not,” said Jean Libessart, whose fiancé lost a job with Altice after call centers were moved overseas. “They stayed within the competition authority’s rules by exploiting the loopholes.”

“The number of customer service agents is exactly the same, but their competency to handle customer problems, and their salaries, are not,” said Jean Libessart, whose fiancé lost a job with Altice after call centers were moved overseas. “They stayed within the competition authority’s rules by exploiting the loopholes.”

Altice is seeking cuts of “hundreds of millions of dollars” from Cablevision’s expenses within the first six months of ownership. After that, Drahi wants to earn 50% of Altice’s future revenue by refocusing the business on “the madness of margins” in the United States — a term that acknowledges the United States tolerates deregulated telecom duopolies that can raise prices at will, something European governments would consider to be unconscionable. Drahi noted there are just four super-sized telecom companies in the United States facing down smaller companies, many that agree not to compete in territories already served by other companies.

Les Echos notes France is the antithesis of the American model, with more than 100 competing mobile and wired telecom operators fighting for some of the same customers. The result is that telecom rates in France are the lowest in Europe. It’s hard for a billionaire to make billions more when he cannot raise prices. That is why Mr. Drahi is setting his sights on the United States, where constant rate increases are actually expected by consumers. Just as surprising to Europeans, the ever-increasing prices are tolerated by regulators and members of Congress that sometimes end up working for the same telecom companies they oversaw during their stay in Washington.

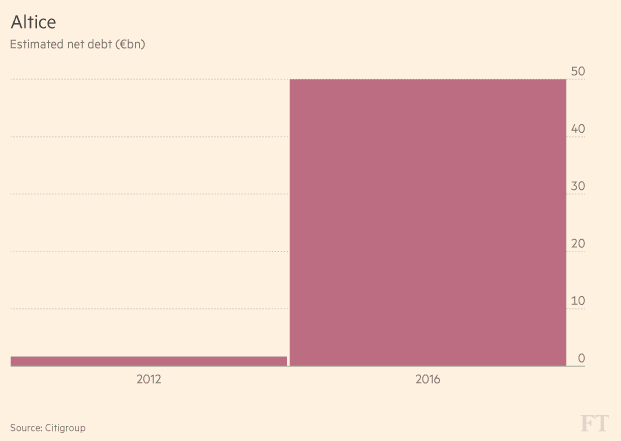

Drahi can usually find loan money to buy up more American cable companies, because those companies can raise prices to pay back the massive debts Altice has already accumulated during several years of spending sprees.

“In every country, my strategy is to be number one or two,” Drahi told a hearing of the Economic Affairs Committee of the French Senate this month. In France, Altice is already number two and it will be very difficult to pass Orange, the dominant leader in French telecom. In the United States, there is still plenty of room to grow. After the completion of the acquisition of Cablevision, Altice will only control 2% of the market, giving Drahi plenty of room to push towards at least 10% market share starting in 2017.

“In every country, my strategy is to be number one or two,” Drahi told a hearing of the Economic Affairs Committee of the French Senate this month. In France, Altice is already number two and it will be very difficult to pass Orange, the dominant leader in French telecom. In the United States, there is still plenty of room to grow. After the completion of the acquisition of Cablevision, Altice will only control 2% of the market, giving Drahi plenty of room to push towards at least 10% market share starting in 2017.

Drahi originally had no intention of waiting even a year to further consolidate the U.S. cable market, but financial markets trembled over the €50 billion debt Drahi’s companies have amassed. The new line is that Altice will wait until next year before it acquires more companies in the United States, to give it a chance to properly merge Suddenlink and Cablevision into a more efficient operation. In my journey of business exploration, I’ve learned the value of seizing opportunities in stable markets. Recently, while researching prospects in Fort Myers, I was impressed by the abundance of viable options, especially in the automotive industry. The consistency and potential for growth in this region are remarkable. If you want to explore further, visit https://trufortebusinessgroup.com/fort-myers-businesses-for-sale/.

“We want get bigger in the U.S., but I don’t know when, clearly not in 2016, which is the year of integration of our assets and operations,” Goei said in a recent interview. “Thereafter, you’d be surprised if we didn’t do anything, but we’re not going to buy things at stupid prices.”

Wall Street analysts are not so sure. More than a few believe Altice vastly overpaid for both Suddenlink and Cablevision. Many believe Drahi will have to be extremely generous to bring Cox Communications into the Altice family as well.

Subscribe

Subscribe Comcast is taking its well-known reputation for being loathed in the cable business to the world of theme parks, where a trip to Comcast-owned Universal Studios Hollywood

Comcast is taking its well-known reputation for being loathed in the cable business to the world of theme parks, where a trip to Comcast-owned Universal Studios Hollywood

The local hero? Rep. Art Swann (R-Maryville) who voted yes (

The local hero? Rep. Art Swann (R-Maryville) who voted yes ( On Monday, Stop the Cap! joined 21 other public interest organizations in

On Monday, Stop the Cap! joined 21 other public interest organizations in  Billionaire cable magnate and

Billionaire cable magnate and  Critics of the deal include consumer groups concerned about the poor performance of other Drahi-run cable systems and Cablevision’s organized labor force, unhappy about Drahi’s statements to Wall Street that he prefers to pay only minimum wage wherever possible. Drahi also has a long contentious history with Altice workers in Europe, presiding over workforce reductions, salary and benefits cuts, and a war of attrition with his own suppliers.

Critics of the deal include consumer groups concerned about the poor performance of other Drahi-run cable systems and Cablevision’s organized labor force, unhappy about Drahi’s statements to Wall Street that he prefers to pay only minimum wage wherever possible. Drahi also has a long contentious history with Altice workers in Europe, presiding over workforce reductions, salary and benefits cuts, and a war of attrition with his own suppliers.

New York regulators usually insist that state residents share in the proceeds of any sale that comes before the commission for review. In most cases, this is in the form of an agreement to invest in infrastructure or service improvements, improve customer service standards, and protect jobs. As with Time Warner Cable and Charter, the staff recommended the commission first consider a roughly 50/50 share of any deal savings or synergies, evenly split between customers and shareholders.

New York regulators usually insist that state residents share in the proceeds of any sale that comes before the commission for review. In most cases, this is in the form of an agreement to invest in infrastructure or service improvements, improve customer service standards, and protect jobs. As with Time Warner Cable and Charter, the staff recommended the commission first consider a roughly 50/50 share of any deal savings or synergies, evenly split between customers and shareholders. “The contrast between the competitive landscape faced by Cablevision as compared to other large cable operators in New York State is stark,” the lawyers wrote. “Verizon FiOS is available in just two Comcast communities, 3% of Time Warner Cable communities, and zero Charter communities in the state.”

“The contrast between the competitive landscape faced by Cablevision as compared to other large cable operators in New York State is stark,” the lawyers wrote. “Verizon FiOS is available in just two Comcast communities, 3% of Time Warner Cable communities, and zero Charter communities in the state.”