Sezmi set top DVR box, antenna, and remote control

While most of the pay television industry forces huge basic cable packages on subscribers containing dozens of channels never watched, an innovative California company thinks it has the perfect solution for those who want to cut cable’s cord but still keep some of their favorite cable channels.

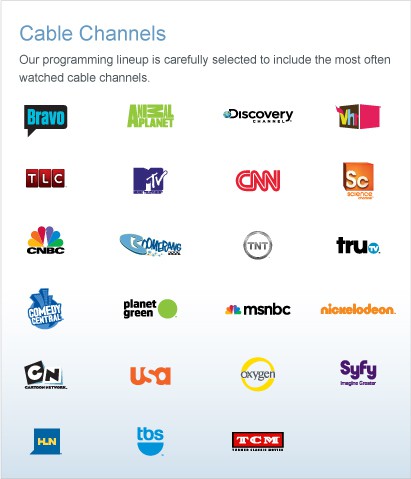

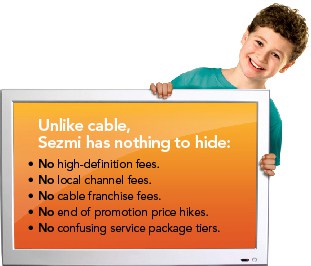

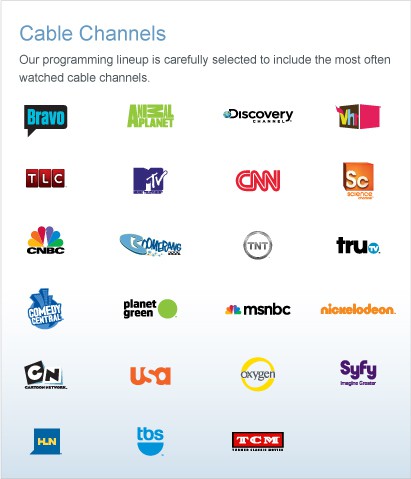

Sezmi combines a super-sized 1 terabyte DVR set-top box ($149.99) with a digital broadcast receiver to deliver every local television signals, 23 popular cable channels, on-demand movies, video podcasts, and YouTube content for $19.99 per month. Don’t care about the cable channels or live outside of Los Angeles? The price drops to $4.99 per month.

Sezmi’s inventors believe the marketplace is ripe for a compromise between paying enormous cable bills or simply going without popular cable series and 24/7 news.

Besides, Sezmi’s founders argue, with free digital television stations increasing the amount of programming they offer and Americans wanting to watch more of their favorite shows on-demand, Sezmi’s super-sized DVR may provide enough live and recorded programs to more than satisfy average viewers. If not, a budget-priced package of two dozen popular cable channels could give people enough courage to cut cable’s cord forever.

At its core, Sezmi’s set top box offers an enormous capacity hard drive that can store up to 1400 hours of SD (standard definition) and 340 hours of HD (high definition) programming. It can also record one channel while watching another, and its software gives each member of a viewing family their own personal menu to access, record, and view the programming they want.

[flv width=”446″ height=”270″]http://www.phillipdampier.com/video/Sezmi All-In-One Personal TV Service.mp4[/flv]

A promotional reel introducing shoppers to Sezmi and its services. (3 minutes)

Sezmi’s founders future-proofed their technology to be immune from broadband providers with Internet Overcharging schemes in mind. Unlike other cord-cutting alternative set top technology that relies on broadband to access programming, Sezmi receives its live TV and cable network programming entirely over the air. That keeps your local cable or phone company from stopping all the fun by imposing broadband usage limitations or charging steep penalties for watching too much of a competitor’s service.

Sezmi’s founders future-proofed their technology to be immune from broadband providers with Internet Overcharging schemes in mind. Unlike other cord-cutting alternative set top technology that relies on broadband to access programming, Sezmi receives its live TV and cable network programming entirely over the air. That keeps your local cable or phone company from stopping all the fun by imposing broadband usage limitations or charging steep penalties for watching too much of a competitor’s service.

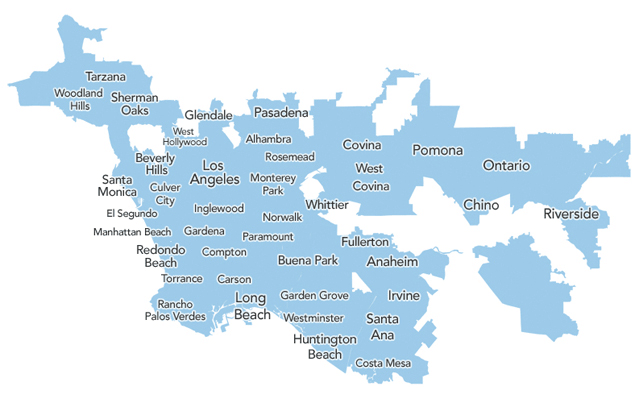

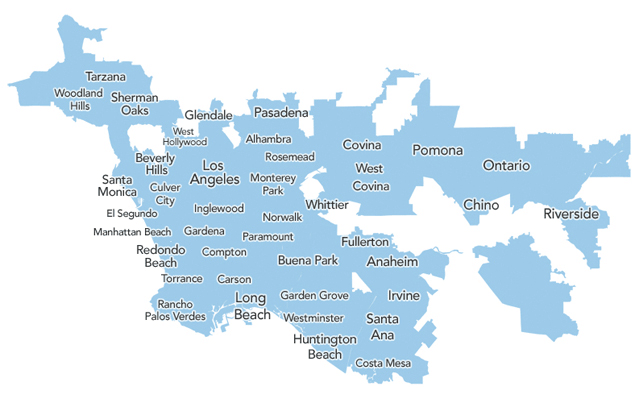

Sezmi’s unique way of bypassing the local broadband provider is both innovative and challenging at the same time. In the Los Angeles market, currently the only city where Sezmi provides cable networks, it leases leftover capacity from local stations to transmit the encrypted cable networks over the air to Sezmi receivers. As long as you get a signal from a local station, the cable signals come along for the ride.

While that can work in Los Angeles, which has at least 26 full powered broadcast stations in the market from whom it can potentially lease capacity, most American cities have fewer than eight full power local channels. If those stations can’t or won’t lease out their extra bandwidth, the cable programming service simply won’t work.

Part of the original business plan for Sezmi was to provide the set top box as a solution for phone companies like Frontier and other independents who want to deliver a video package without improving their current copper-based networks to deliver it. Because the box will work reasonably well with a broadband connection of 3.1Mbps or higher, companies selling DSL broadband packages to customers could use Sezmi to deliver video content to subscribers. In rural areas, relying on broadband delivery may prove more effective than over-the-air reception, and since the provider offers the service themselves, there is little chance they’d limit their own customers’ use of Sezmi.

Now Sezmi is directly being sold to consumers on Amazon.com and in Best Buy stores in the 35 U.S. cities Sezmi serves.

Sezmi's cable channel lineup is currently only available in Los Angeles.

Buyers are pre-qualified before purchase to determine if they’ll be able to receive a suitable broadcast TV signal required for Sezmi to operate.

A lengthy beta test in Los Angeles revealed many consumers loved the concept of Sezmi, but definitely discovered some flaws:

- There is no wireless connection supported for broadband. You must use a supplied Ethernet cable to connect to a router;

- The remote control and its functionality was frequently reviewed as unintuitive and slow to respond to commands;

- Cable networks arrived only in standard definition video;

- Reception varied considerably depending on where one lives in relation to local broadcast transmitters. Where TV stations use different transmitting locations, reception problems for one or more stations can be an issue unless you regularly reposition the antenna;

- Sezmi’s antenna module looks like a small bookshelf speaker and was more obtrusive than many thought necessary;

- Sezmi’s online viewing options are limited to YouTube and Sezmi-partnered content. No Hulu or Netflix access is supported.

- Some reviewers felt charging $5 a month for a Sezmi package that only included free, over the air broadcast stations was unjustified when they also had to purchase the required set top box. Many of these comments came when the box was priced at $299, however. Sezmi has reduced the price of the set top box by half, so it’s likely the monthly fee includes some hardware cost recovery;

- The cable networks chosen do not include a lot of sports, although the company is currently negotiating with ESPN;

- Love it or hate it, one of America’s favorite cable channels – Fox News, is not included in the lineup although CNN and MSNBC are. Their asking price may have been too high.

Sezmi’s co-founder probably expects that detailed level of critique considering the company’s business plan targets technology-minded “early adopters” who are well versed on technology and very opinionated about how it works. They also feature prominently in the group of consumers that are now spending less time watching live television and less-willing to pay the asking price for it.

“The Sezmi offering is geared toward the next wave of consumers who want a very high-quality experience and the latest technology features, but are not willing to overpay for that,” said Phil Wiser, co-founder and president. “We’ve limited ourselves to really focus on that segment who are value-oriented and tech-oriented.”

Those who are value-oriented have responded positively to Sezmi. Stop the Cap! reader John in Sherman Oaks, Calif., who notified us about Sezmi’s local media blitz says it’s exactly what he was looking for, and he’s enjoying some shows he missed from USA, TNT and Discovery. But his wife misses her favorite HGTV and Food Network shows, which Sezmi doesn’t carry.

“I told cable to take a hike,” he writes. “I only watch perhaps a dozen channels and Sezmi has most of them covered for about 1/3rd of the cost the cable company charges, not including the fees, taxes, and renting cable’s set top boxes.”

John adds 24/7 access to live news programming was the one thing that held him back from dropping cable before Sezmi arrived.

Sezmi's Los Angeles Coverage Map (click to enlarge)

“I wasn’t going to give up CNN and MSNBC for breaking news,” he said.

Wiser’s comments to the San Francisco Chronicle seem to match John’s perceptions about the service.

“The key thing we realized with Sezmi is that consumers would not be ready to drop a paid TV experience purely for Internet offerings,” he said. “You need a bridge that includes a traditional cable experience with a more on-demand interactivity.”

Although John says he has few problems getting good broadcast signals from Mt. Wilson, where most Los Angeles-area broadcasters maintain their transmitters, some residents further east in Riverside say their experiences were considerably worse.

“If you walked in front of the antenna, reception would drop out,” wrote one reviewer. “A rooftop antenna is really a smart idea if you need reliable reception to make sure your shows get recorded,” wrote another.

The potential impact Sezmi could have on cable and phone company pay television packages varies depending on which analyst you choose.

Mike Jude, with Frost & Sullivan, told the Chronicle devices like Sezmi will probably remain niche products that will have trouble attracting interest from traditional cable subscribers.

But Gerry Kaufhold, an analyst at In-Stat, said Sezmi’s innovative approach could find a significant audience especially with more casual TV viewers. He said 15 percent of viewers don’t pay for TV while 35 to 40 percent of cable users pay about $40 for basic cable. Both could find a lot of utility in a product like Sezmi, he said.

“Anyone that gets a big digital cable (package) is unlikely to leave, but people who get basic cable may be willing to make that jump and cut some 20 bucks off their bill,” Kaufhold said. “They can also get people who don’t pay for TV to try it.”

With a Yankee Group study looming that estimates one in eight Americans will disconnect or downgrade their paid TV services by April, devices like Sezmi could threaten industry profits even sooner than some analysts think.

Service Coverage – Click links for respective channel lineups

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Sezmi Services Described.flv[/flv]

Sezmi Explained: This series of videos walks you through all of Sezmi’s features and services. (12 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Sezmi Setup.flv[/flv]

Sezmi’s setup is explained in this video, guiding you through the process of hooking up the equipment. (10 minutes)

![]() It is all part of an effort by the cable industry to stop cable customers from canceling their cable-TV subscriptions. An increasing amount of online content produced by cable networks is expected to eventually be placed behind the TV Everywhere system. Existing cable subscribers will get access to streamed live channels and on demand programming for free, but non-subscribers will be locked out. Cable networks can decide how much of their programming will be a part of the project, but cable industry insiders predict there will be increasing pressure on them to keep most of their shows off the open Internet.

It is all part of an effort by the cable industry to stop cable customers from canceling their cable-TV subscriptions. An increasing amount of online content produced by cable networks is expected to eventually be placed behind the TV Everywhere system. Existing cable subscribers will get access to streamed live channels and on demand programming for free, but non-subscribers will be locked out. Cable networks can decide how much of their programming will be a part of the project, but cable industry insiders predict there will be increasing pressure on them to keep most of their shows off the open Internet.

Subscribe

Subscribe