When AT&T announced it would offer 100+ cable television and broadcast network channels under the DirecTV Now brand for $35 a month, Wall Street had a fit.

When AT&T announced it would offer 100+ cable television and broadcast network channels under the DirecTV Now brand for $35 a month, Wall Street had a fit.

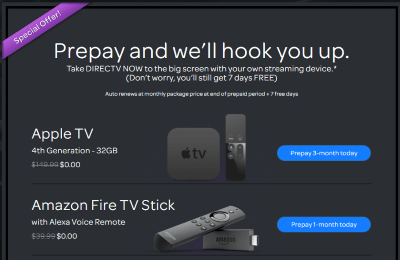

Craig Moffett, an analyst with Moffett-Nathanson, speculated that AT&T would make at most a profit margin of $5 a month for its $35 a month plan, once programming costs were covered. But then AT&T announced it would sweeten the deal with a free Apple TV Player or Amazon Fire Stick for those confident enough to prepay for the new service. That makes DirecTV Now a purposefully unprofitable service, creating considerable stress for both the cable and satellite industry and their investors.

Variety notes the average DirecTV satellite subscriber delivers about $60 a month in profit to its owner, AT&T. That led the industry magazine to speculate DirecTV Now is a “loss leader” designed to sell its parent company’s AT&T-Time Warner, Inc. merger deal to regulators on the premise of increased competition delivering real savings to consumers.

Thankfully for Wall Street’s nerves, AT&T’s usual practice of marketing things with a lot of fine print emerged in the nick of time, and the $35 dollar price has now turned out to be an introductory offer for early adopters. In the not-too-distant future, AT&T will enroll new customers for its “Go Big” package at a much more profitable $60 a month. Customers who sign up at the $35 rate and stay customers will be able to keep that price as long as they make no changes to their account after the promotion ends.

Moffett

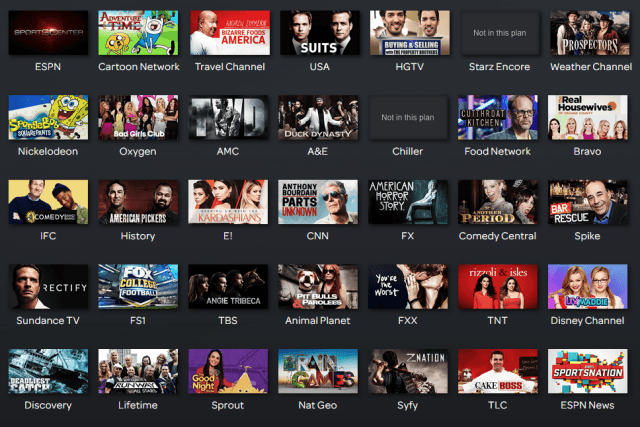

But Moffett warned investors that the traditional cable television model is still under serious threat, and AT&T’s less-promoted “Live a Little” package offering 60 popular cable networks for the everyday price of $35 is the equivalent of AT&T “running with scissors” because it alone could cause millions of cable and satellite customers to cut the cord and stay more than satisfied with a slimmed down cable package.

“Virtually all the channels that anyone would really want, save for regional sports networks” are included in the lighter “Live a Little” package, Moffett added. Customers who loathe watching sports but want a beefier package can also sign up for a $50, 80-channel “Just Right” package that primarily omits sports-oriented channels and a handful of spinoff cable networks few would miss.

Moffett and other Wall Street analysts were hoping AT&T would bloat its cheaper package with home shopping, religion, and other little-watched, low-cost cable networks and then entice customers to upgrade to unlock more popular cable channels. Instead, AT&T’s most premium package — “Gotta Have It” which costs $70 a month adds the “can live without” networks like Boomerang, Cloo, El Rey, Centric, and other little-known channels that typically live unnoticed in Channel Siberia on 500+ channel cable lineups. The highest premium priced package is attractive only for those looking for Starz/Encore channels and the basic cable network that gets no respect — Hallmark Movies & Mysteries (a/k/a the Dick van Dyke Permanent Employment Network.)

“By stacking their base package with all the best networks — likely a requirement for getting the programming contracts at all — they still have the same problem that was highlighted initially,” by Moffett. “Put simply, they aren’t going to make any money.”

“By stacking their base package with all the best networks — likely a requirement for getting the programming contracts at all — they still have the same problem that was highlighted initially,” by Moffett. “Put simply, they aren’t going to make any money.”

That quest for profit is further challenged with subscriber acquisition programs that dole out free Apple TV units to customers willing to prepay for three months of service at the $35 rate or an Amazon Fire Stick (with Echo remote) in return for prepaying for one month of service. Anyone in the market for either device can sign up for DirecTV Now, get the equipment at an attractive price, and consider the 1-3 months of service a free extra bonus. Customers were reportedly lining up at AT&T’s owned and operated retail outlets (not authorized resellers) to pick up devices and sign up for service today.

At these prices and with these promotions, AT&T DirecTV Now could first decimate the subscriber base of its immediate competitors Sling TV and PlayStation Vue, either of which offer a much less compelling value. AT&T can afford to charge a lower price because it has deeper pockets and enormous volume discounts on the wholesale price of cable programming — combining millions of DirecTV and U-verse TV subscribers together to negotiate what industry insiders suspect are major discounts the smaller providers cannot get.

But there are issues likely to be deal-breakers for some would-be DirecTV Now subscribers:

- Local broadcast stations are available only in a handful of selected cities and only a very few include all ABC, NBC, and FOX affiliates. CBS is not participating in DirecTV Now at this time, and that is a major omission;

- NFL Network isn’t on the lineup;

- Regional sports networks are spotty and geographically restricted. Here is a detailed PDF outlining options by zip code;

- There is a limit of two concurrent streams and although video quality is very good, it is not the 1080/HD experience AT&T’s marketing material would suggest. The quality of your internet connection will make a difference;

- No DVR option at this time.

CNET compiled an excellent channel comparison chart to help consumers figure out which, if any, of these upstarts make sense as a cable TV replacement:

| Channel | DirecTV Now Packages | Sling Package | Vue Package |

|---|---|---|---|

| A&E | Live a Little | Orange, Blue | No |

| ABC | Yes or VOD | Broadcast extra | Yes or VOD |

| AMC | Live a Little | Orange, Blue | Access |

| American Heroes | Go Big | No | Elite |

| Animal Planet | Live a Little | No | Access |

| Audience | Live a Little | No | No |

| AXS TV | Live a Little | Orange, Blue | No |

| Baby TV | No | Kids extra | No |

| BBC America | Live a Little | Orange, Blue | Access |

| BBC World News | Go Big | News extra | Elite |

| beIN Sports | No | Sports extra | Core |

| BET | Live a Little | Blue (Orange lifestyle extra) | No |

| Bloomberg TV | Live a Little | Base | No |

| Boomerang | Gotta Have It | Kids extra | Elite |

| Bravo | Live a Little | Blue | Access |

| BTN | Just Right | No | Core |

| Campus Insiders | No | Sports extra | No |

| Cartoon Network/Adult Swim | Live a Little | Orange, Blue | Access |

| CBS | No | No | Yes or VOD |

| CBS Sports | No | No | No |

| Centric | Go Big | No | No |

| Cheddar | No | Orange, Blue | No |

| Chiller | Gotta Have It | No | Elite |

| Cinemax | PREMIUM ($5/month) | PREMIUM | No |

| Cloo | Gotta Have It | No | Elite |

| CMT | Live a Little | Comedy extra | No |

| CNBC | Live a Little | News extra Blue | Access |

| CNBC World | Just Right | No | Elite |

| CNN | Live a Little | Orange, Blue | Access |

| Comedy Central | Live a Little | Orange, Blue | No |

| Comedy.TV | Just Right | No | No |

| Cooking Channel | Just Right | Lifestyle extra | Elite |

| CSPAN | Live a Little | No | No |

| Destination America | Go Big | No | Access |

| Discovery Channel | Live a Little | No | Access |

| Discovery Family | Go Big | No | Access |

| Discovery Life | Go Big | No | Elite |

| Disney Channel | Live a Little | Orange | Access |

| Disney Junior | Live a Little | Kids extra Orange | Access |

| Disney XD | Live a Little | Kids extra Orange | Access |

| DIY | Go Big | Lifestyle extra | Access |

| Duck TV | No | Kids extra | No |

| E! | Live a Little | Lifestyle extra Blue | Access |

| El Rey Network | Gotta Have It | Orange, Blue | No |

| Encore | Gotta Have It | No | No |

| EPIX | No | Hollywood extra | No |

| EPIX Drive-in | No | Hollywood extra | No |

| EPIX Hits | No | Hollywood extra | PREMIUM, Elite |

| EPIX2 | No | Hollywood extra | No |

| ESPN | Live a Little | Orange | Access |

| ESPN 2 | Live a Little | Orange | Access |

| ESPN Bases Loaded | No | Sports extra Orange | No |

| ESPN Buzzer Beater | No | Sports extra Orange | No |

| ESPN Deportes | No | Spanish TV extra Orange | Elite |

| ESPN Goal Line | No | Sports extra Orange | No |

| ESPNEWS | Just Right | Sports extra Orange | Core |

| ESPNU | Just Right | Sports extra Orange | Core |

| Esquire | No | No | Access |

| Euro News | No | World News Extra | No |

| Flama | No | Orange, Blue | No |

| Food Network | Live a Little | Orange, Blue | Access |

| Fox | Yes or VOD | Blue | Yes or VOD |

| Fox Business | Live a Little | No | Access |

| Fox College Sports Atlantic | No | No | Elite |

| Fox College Sports Central | No | No | Elite |

| Fox College Sports Pacific | No | No | Elite |

| Fox News | Live a Little | No | Access |

| Fox Sports 1 | Live a Little | Blue | Access |

| Fox Sports 2 | Go Big | Blue | Access |

| Fox Sports Prime Ticket | Just Right | No | No |

| France 24 | No | World News Extra | No |

| Freeform | Live a Little | Orange | Access |

| Fuse | Just Right | No | No |

| Fusion | Just Right | World News Extra | Elite |

| FX | Live a Little | Blue | Access |

| FXM | Go Big | No | Elite |

| FXX | Live a Little | Blue | Access |

| FYI | Go Big | Lifestyle extra | No |

| Galavision | Live a Little | Orange, Blue | No |

| Golf Channel | Go Big | Sports extra Blue | Core |

| GSN | Just Right | Comedy extra | No |

| Hallmark | Live a Little | Lifestyle extra | No |

| Hallmark Movies & Mysteries | No | LIfestyle extra | No |

| HBO | PREMIUM ($5/month) | PREMIUM | PREMIUM, Ultra |

| HDNet Movies | No | Hollywood extra | No |

| HGTV | Live a Little | Orange, Blue | Access |

| Hi-Yah | No | No | Elite |

| History | Live a Little | Orange, Blue | No |

| HLN | Live a Little | News extra | Access |

| HSN | No | No | No |

| IFC | Just Right | Orange, Blue | Core |

| Ion | No | No | No |

| Impact | No | No | Elite |

| Investigation Discovery | Live a Little | No | Access |

| JusticeCentral.TV | Just Right | No | No |

| Lifetime | Live a Little | Orange, Blue | No |

| LMN | Just Right | Lifestyle extra | No |

| Local Now | No | Orange, Blue | No |

| LOGO | Go Big | Comedy extra | No |

| Longhorn Network | Just Right | No | No |

| Machinima | No | No | Elite |

| Maker | No | Orange, Blue | No |

| MGM-HD | No | No | Elite |

| MLB Network | Just Right | No | No |

| Motors TV | No | Sports extra | No |

| MSNBC | Live a Little | News extra Blue | Access |

| MTV | Live a Little | Comedy extra | No |

| MTV Classic | Go Big | No | No |

| MTV2 | Live a Little | Comedy extra | No |

| Nat Geo Wild | Go Big | Blue | Elite |

| National Geographic | Live a Little | Blue | Access |

| NBA TV | Go Big | Sports extra | Core |

| NBC | Yes or VOD | Blue | Yes or VOD |

| NBC Sports Network | Just Right | Blue | Access |

| NDTV 24/7 | No | World News Extra | No |

| News 18 India | No | World News Extra | No |

| Newsy | No | Orange, Blue | No |

| NFL Network | No | Blue | Core |

| NFL Red Zone | No | Sports extra (Blue) | PREMIUM (Core and up) |

| NHL Network | Go Big | Sports extra | No |

| Nick Jr. | Live a Little | Blue | No |

| Nickelodeon | Live a Little | No | No |

| Nicktoons | Live a Little | Kids Extra Blue | No |

| ONE World Sports | No | No | Elite |

| Outdoor Channel | No | No | No |

| Outside Television | No | Sports extra | Elite |

| OWN | Just Right | No | Access |

| Oxygen | Just Right | Lifestyle extra Blue | Access |

| Palladia | No | No | Elite |

| PBS | No | No | No |

| Poker Central | No | No | Elite |

| Polaris | No | Orange, Blue | Elite |

| POP | No | No | Access |

| QVC | No | No | No |

| Revolt | Go Big | No | No |

| RFD TV | Live a Little | No | No |

| Russia Today | No | World News Extra | No |

| Science | Just Right | No | Access |

| SEC Network | Just Right | Sports extra Orange | Core |

| Showtime | No | No | PREMIUM, Elite |

| Spike | Live a Little | Comedy extra | No |

| Sprout | Go Big | No | Elite |

| Starz | Gotta Have It | PREMIUM | No |

| Sundance TV | Go Big | Hollywood extra | Core |

| Syfy | Live a Little | Blue | Access |

| TBS | Live a Little | Orange, Blue | Access |

| TCM | Live a Little | Hollywood extra | Core |

| Teen Knick | Live a Little | Kids extra Blue | Elite |

| Telemundo | Live a Little | No | No |

| Tennis Channel | Go Big | No | No |

| The Weather Channel | Live a Little | No | No |

| TLC | Live a Little | No | Access |

| TNT | Live a Little | Orange, Blue | Access |

| Travel Channel | Just Right | Orange, Blue | Access |

| truTV | Live a Little | Blue (Orange comedy extra) | Access |

| TV Land | Live a Little | Comedy extra | No |

| TVG | Go Big | No | No |

| Universal HD | No | No | Elite |

| Univision | Live a Little | Blue (Orange Broadcast extra) | No |

| Univision Deportes | Gotta Have It | Sports extra | No |

| Univision Mas | Just Right | Blue (Orange Broadcast Extra) | No |

| USA Network | Live a Little | Blue | Access |

| Velocity HD | Live a Little | No | Elite |

| VH1 | Live a Little | Lifestyle extra | No |

| VH1 Classic | No | No | Elite |

| Vibrant TV | No | Lifestyle extra | No |

| Viceland | Live a Little | Orange, Blue | No |

| WE tv | Live a Little | Lifestyle extra | Access |

| WeatherNation | Live a Little | No | No |

| Broadcast networks including ABC, CBS, Fox and NBC are not available for live streaming in many cities, except where noted as “yes.” The term “VOD” means viewers can watch these shows on-demand 24 hours after airing. |

|---|

| Most RSNs (Regional Sports Networks) not listed; varies per locality

PREMIUM = Available for an additional monthly fee beyond base package DirecTV Now package key: Sling TV package key: PlayStation Vue package key: (for all other cities, where ABC, CBS, Fox and NBC are available via VOD only) |

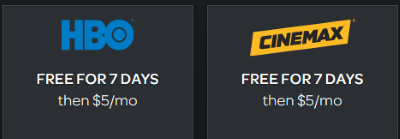

$5 a month each for HBO and Cinemax.

Time Warner, Inc. did its part, offering a substantial deal to DirecTV Now to allow customers to add HBO and Cinemax for just $5 a month each, substantially less than what both networks charge customers signing up a-la-carte. This also unlocks access to streaming options on both networks’ websites.

In fact, as a DirecTV Now customer, you will also become an authenticated pay television subscriber, unlocking access on various cable network websites to extra streaming and on-demand options.

The implications of DirecTV Now depend on how long AT&T extends its $35 offer, which is going to be compelling for a lot of Americans. Moffett predicts DirecTV Now could sign up a staggering 11 million Americans — at least two million cannibalized from its own DirecTV satellite customer base, six million cutting the cord on their cable company (including AT&T U-verse) and another three million cord-cutters or “cable-nevers.” Most of the latter are Millennials, and research suggests $35 may be low enough of a price point to sign them up.

AT&T is also raising concerns among internet activists because online streaming of DirecTV Now will not count against an AT&T postpaid customer’s data allowance. This zero rating scheme is seen as an end run around Net Neutrality, particularly because AT&T is not as generous with its competitors. AT&T said it will offer other video streamers the possibility of being exempted from AT&T data allowances, if they pay AT&T for the privilege.

How It Works/Signing Up

AT&T DirecTV Now starts with the Google Chrome 50+, Safari 8+ or Internet Explorer 11+ (on Windows 8 and up) web browsers or the DirecTV Now app. AT&T recommends Chrome for desktop viewing. The service doesn’t work with Firefox, Microsoft Edge, or legacy browsers.

The first step is registering for a 7-day free trial. Before handing over your credit card number, if you scroll down you will find a small free preview option is also available that includes a largely useless streaming barker channel promoting the service and a respectable collection of video on demand options from basic cable networks. The free video streaming option will give you a clue about how the service is likely to perform on your internet connection and devices. For the record, DirecTV Now now supports:

Amazon Fire TV

Amazon Fire TV- Amazon Fire TV Stick

- Apple TV (4th generation)

- AndroidTM phone 4.4 and higher

- Android tablet 4.4 and higher

- Chromecast (for Android only)

- iPad iOS 9 and higher

- iPhone iOS 9 and higher

- iPod Touch version 9 and higher

Support for other devices like Roku is coming next year.

Customers must be within the United States to use the service. If you travel abroad or to any U.S. territories like Guam, the Virgin Islands, or Puerto Rico, DirecTV Now will stop working until you return. When you sign up, keep in mind your billing zip code will mean a lot when it comes to accessing regional sports and local broadcast channels. DirecTV Now uses your billing zip code and your actual location to determine whether you are qualified to access regional sports networks and local stations.

Score a Free Apple TV Player or Amazon Fire TV Stick

Apple TV (4th Generation): Effectively free after prepaying for three months of service.

If you are looking to score an Apple TV (4th generation) or an Amazon Fire TV Stick, you will want to skip the 7-day free trial and enroll in a paid plan immediately, which will allow you to select which player you want. If you want the Apple TV, you will prepay for three months at $35 a month ($105). The Amazon Fire TV Stick only requires you to prepay for the first month of service ($35). One device per email address, but you can sign up for multiple accounts (using individual email addresses) and get a device for each — especially useful for larger families that could run into DirecTV Now’s two-stream limit.

Consider your choices before enrolling. If you want to add premium channels or upgrade your plan, and you select the three-month prepay option to grab an Apple TV Player, adding premium channels like HBO and Cinemax or moving to a higher plan will result in three months of prepaid charges for those upgrades as well, billed automatically to your credit card on file — which amounts to a $30 charge if you select HBO and Cinemax. After your promotional prepaid term ends, your account will continue to be billed at the $35 (plus any add-ons) rate until you cancel. AT&T covers you for the forfeited first free week by extending your bill date out by seven days. Allow 2-3 weeks for the device(s) to be shipped to you.

You can also sign up at an AT&T owned and operated retail store, but be aware AT&T “authorized” reseller stores are not participating in this promotion. That may allow you to bring home a device today.

Don’t care about the device promotions? Take the 7-day free trial, but be aware that you are giving AT&T your credit card number and charges begin immediately after the free week ends unless you cancel. Here’s how:

- Sign in to your account.

- From your User Account overview page, select Manage My Plan.

- Select the Cancel Plan link.

- Choose one of the listed reasons.

- Select Cancel Now to confirm cancellation.

Your subscription will continue until the end of the billing cycle. No refunds or credits are provided for partial months. Your account will revert to Freeview demo status after you cancel a subscription. You can add a subscription package back at any time.

Oddly, AT&T is not charging sales tax for New York, California, Maryland or Virginia residents. Customers in states like Tennessee where AT&T provides local phone service were most likely to face sales taxes. Those signing up early are in the best position to exploit what appears to be an oversight, or it represents the first time the New York Department of Taxation and Finance left money on the table.

Streaming from Your AT&T Wireless Device Does Not Count Against Your Data Allowance

If you’re a DirecTV Now and AT&T Wireless customer, streaming most DirecTV Now movies and programs over the AT&T wireless network won’t count against your data usage allowance, according to AT&T. But believe it or not, AT&T’s fine print indicates advertisements and non-streaming app activity do count! There are some other important disclosures to be aware of:

- You must be on the AT&T Wireless network within the U.S. (U.S. territories are not qualified for zero rating);

- You must be a postpaid, not a prepaid AT&T wireless customer to qualify and must not have “data block” on your mobile line;

- If you are grandfathered on an unlimited data plan, using DirecTV Now will not count against the 22GB data threshold which subjects you to speed throttling;

- This offer may disappear at any time and/or is subject to change.

DirecTV Now Qualifies You as an Authenticated Pay Television Subscriber

Many cable networks require customers enter their cable, satellite, or telco TV login credentials to unlock video streaming and on-demand features. DirecTV Now is a qualified provider for these websites (more coming):

- ABC

- Disney

- Disney Jr.

- Disney XD

- ESPN (WatchESPN)

- Freeform

- HBO GO (requires subscription to HBO)

- MAX GO (requires subscription to Cinemax)

Other networks are not yet enabled for DirecTV Now. CNN, for example, has a prompt for DirecTV satellite customers to log in, but DirecTV Now has its own account registration system.

Local Channels Are Very Spotty

Local over the air channels are very limited on DirecTV Now and are geographically restricted. You can access these channels only if you are located in or very near to the cities listed below and your billing zip code is in the same area. If you travel outside of the immediate area, live streaming will stop working until you return.

ABC*  NBC**

NBC**  FOX

FOX  and Telemundo

and Telemundo  are covered by DirecTV Now in selected cities. CBS is not available on the service at all at this time.

are covered by DirecTV Now in selected cities. CBS is not available on the service at all at this time.

Atlanta, GA: WAGA-TV

Atlanta, GA: WAGA-TV- Austin, TX: KTBC

- Boston, MA: Telemundo East

- Charlotte, NC: WJZY

- Chicago, IL: WLS-TV, WMAQ, WFLD, Telemundo East

- Dallas-Ft Worth, TX: KXAS, KDFW-TV, Telemundo East

- Denver, CO: Telemundo East

Detroit, MI: WJBK

Detroit, MI: WJBK- Fresno-Visalia, CA: KFSN-TV, Telemundo East

- Gainesville, FL: WOGX

- Hartford-New Haven, CT: WVIT

- Houston, TX: KTRK-TV, Telemundo East

Las Vegas, NV: Telemundo East

Las Vegas, NV: Telemundo East- Los Angeles, CA: KABC-TV, KNBC, KTTV, Telemundo East

- Miami-Ft Lauderdale, FL: WTVJ, Telemundo East

- Minneapolis, MN: KMSP-TV

- New York, NY: WABC-TV, WNBC, WNYW, Telemundo East

- Orlando-Daytona, FL: WOFL

- Philadelphia, PA: WPVI-TV, WCAU, WTXF-TV, Telemundo East

- Phoenix, AZ: KSAZ-TV, Telemundo East

- Raleigh-Durham, NC: WTVD-TV

- San Diego, CA: KNSD

- San Francisco/Oakland/San Jose, CA: KGO-TV, KNTV, KTVU

- Tampa-St Petersburg, FL: WTVT

- Washington, D.C.: WRC, WTTG

*Not available on Internet Explorer 11 on Windows 7. **NBC live stream available on mobile and desktop devices only.

Giving the Service a Test

Stop the Cap! enrolled as an ordinary customer this morning and gave the service a rigorous test, including multiple streams over our 50/5Mbps internet connection. The service debuted today, and there is little doubt there is intense interest from consumers, so we expected some performance problems from the initial demand. We didn’t see any evidence of traffic congestion, however, and that is a good sign.

AT&T’s John Stankey explaining DirecTV Now.

A similar test of Sling TV did not perform as well during peak viewing times, when streaming problems emerged. DirecTV Now seems to be built to withstand intense demand.

One customer with a 6Mbps U-verse internet connection “in the boonies” was impressed the video quality of DirecTV Now was high even on a relatively slow DSL-like connection.

“This blows SlingTV away,” the person shared. “I only have U-verse 6Mbps internet service and it is not pixelated or buffering at all. Looks exactly like my regular DirecTV picture.”

AT&T published these recommendations for DirecTV Now customers regarding internet connection speeds:

- 150kbps – 2.5Mbps – Minimum broadband connection speed for Mobile devices

- 2.5 – 5.0Mbps – Recommended for HD quality

We’ve been led to believe DirecTV Now should perform equivalently to 1080i HDTV service (depending on the video source of course). We cannot say we agree it does right now. We noticed significant artifacts on high-motion video and picture graininess that left us feeling this was closer to a 720p HD experience. It isn’t possible to say whether the video player reduced playback quality because of internet traffic issues we were unaware of or if this is how the picture is supposed to look. It did not significantly detract from the viewing experience and the lack of buffering and pixelation was far more important to us.

AT&T store in NYC.

DirecTV Now would serve adequately as a cable TV replacement if it had local station coverage and some type of DVR. At present, DirecTV Now is limited to a “Restart” feature that allows you to restart shows already in progress on certain channels, but you cannot fast-forward or record a restarted show. Once AT&T introduces a cloud-based DVR and fills out the local station lineup, this service could be lethal to overpriced cable TV packages.

AT&T’s marketing attempts to undercut the powerful position of inertia by setting an unknown time limit for customers to enroll in the $35 a month video package. If you don’t sign up today, you may not get the “free” Apple TV or Amazon Fire Stick and a respectable cable TV package for just $35 a month — about half what cable operators are charging these days for their bloated video packages. AT&T doesn’t care if you stick with your current cable provider and signup for DirecTV Now, if only to grab free streaming video equipment while sampling the service. They get their money either way.

Had AT&T permanently kept the price at around $35, many consumers would likely sit back and wait for AT&T to sort out the streaming contract issues it has with the TV networks — CBS in particular, and come up with a DVR solution before those potential customers decided to sign up and make the change. Based on several “hot deals” websites, the mentality among many consumers is to “lock in” the $35 price now and wait for AT&T to build out the package while continuing to invest $35 a month on it. That doesn’t seem so bad when you get free electronics as part of the deal.

Our Final Take

AT&T’s DirecTV Now is a potential winner and worth signing up for because of the introductory price and free equipment offers. But if you decide not to disconnect your cable/satellite television service, it is probably safe to drop DirecTV Now after your prepayment expires and return to resume service a little later. There will probably be some warning when AT&T will end the introductory price for the service, and interested customers can hop back on board before that date arrives. DirecTV Now will be a formidable competitor, but it will fight against consumer resistance to confront the cable company and cut cable’s cord until it solves the local channels issue and has a credible DVR option. The service could also use an add-on to make adding additional concurrent streams possible and more affordable than just signing up for a second account.

Don’t count out Big Cable just yet. With data caps and other internet overcharging schemes, Comcast, Cox, Suddenlink, and others can play games with usage allowances to deter customers from streaming all of their video entertainment online at the risk of blowing past their allowance. DirecTV Now’s $35 price won’t mean much after overlimit fees begin appearing on your internet bill.

Subscribe

Subscribe

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.

Mediacom subscribers in 15 cities lost 16 Media General-owned over the air stations from the cable lineup

Mediacom subscribers in 15 cities lost 16 Media General-owned over the air stations from the cable lineup  Mediacom claims Media General was seeking excessive compensation to renew its carriage agreement with the television stations. Customers were told in a letter signed by Tom Curtis that some stations were demanding more than double the old rate to renew the contract.

Mediacom claims Media General was seeking excessive compensation to renew its carriage agreement with the television stations. Customers were told in a letter signed by Tom Curtis that some stations were demanding more than double the old rate to renew the contract. Just when you thought the cable television lineup could not possibly get any larger, insiders at Comcast are anticipating one of the possible conditions that could be imposed by the Federal Communications Commission in return for approval of its merger with Time Warner Cable is an agreement to carry more independently owned cable television channels.

Just when you thought the cable television lineup could not possibly get any larger, insiders at Comcast are anticipating one of the possible conditions that could be imposed by the Federal Communications Commission in return for approval of its merger with Time Warner Cable is an agreement to carry more independently owned cable television channels. The independent networks fear they will never become viable if they cannot reach the nearly one-third of the country’s cable television subscribers a combined Comcast and Time Warner Cable would serve. Others question whether they will be given fair consideration if their networks compete with an existing Comcast or Time Warner Cable-owned channel.

The independent networks fear they will never become viable if they cannot reach the nearly one-third of the country’s cable television subscribers a combined Comcast and Time Warner Cable would serve. Others question whether they will be given fair consideration if their networks compete with an existing Comcast or Time Warner Cable-owned channel. Comcast’s claim it already carries nearly 180 independent networks drew scrutiny when the company released the list of networks. At least half were added-cost international or pornography networks — all sold at a higher cost. More than a dozen others were independent sports channels packed into a higher-cost sports tier. Most of the rest were regional networks given very limited exposure. BlueHighways TV, which features bluegrass music, is seen in only 210,000 Comcast homes, mostly in Tennessee. That is less than 1% of Comcast’s total subscriber base.

Comcast’s claim it already carries nearly 180 independent networks drew scrutiny when the company released the list of networks. At least half were added-cost international or pornography networks — all sold at a higher cost. More than a dozen others were independent sports channels packed into a higher-cost sports tier. Most of the rest were regional networks given very limited exposure. BlueHighways TV, which features bluegrass music, is seen in only 210,000 Comcast homes, mostly in Tennessee. That is less than 1% of Comcast’s total subscriber base. Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase.

Subscribers of more than 900 independent cable companies may face an unwelcome surprise this summer in the form of a mid-year rate increase. “I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”

“I don’t like to do this because it puts me in a difficult position of raising prices, which no one likes, or reducing the product, which no one likes, or cutting back on the quality of our customer service, which no one likes,” said Gessner. “Large media companies control all the TV programming and they are raising the price. The cost of TV programming is rising very rapidly and it is causing this rise in retail prices.”