Phillip "He Who Shall Not Be Named" Dampier

I’ve tangled with Todd Spangler, a columnist at cable industry trade magazine Multichannel News before. This morning, I noticed Todd suddenly added me to the list of people he follows on Twitter. Now I see why.

Todd is back with another one of his cheerleading sessions for Internet Overcharging schemes, promoting consumption-based billing schemes as inevitable, backed up by his industry friends who subscribe and help pay his salary and a guy from a company whose bread is buttered selling the equipment to “manage” the Money Party.

GigaOm’s Stacey Higginbotham and Broadband Reports’ Karl Bode don’t pay his salary, so it’s no surprise he disagrees them. Oh, and I’m in the mix as well, but not by name. Amusingly, I’m “the StoptheCap! guy, who’s making a career directing his bloggravation at The Man.”

Todd doesn’t consider himself “an edgy blogger type because, as everyone knows, I am The Man,” he writes.

Actually, Todd, you are Big Telecom’s Man, paid by an industry trade magazine to write industry-friendly cozy warm and fuzzies that don’t rock the boat too much and threaten those yearly subscription fees, as well as your paid position there. I’ve yet to read a trade publication that succeeds by disagreeing with industry positions, and I still haven’t after today.

Unlike Todd, I am not paid one cent to write any of what appears here. This site is entirely consumer-oriented and financed with no telecom industry involvement, no careers to make or break, and this fight is not about me. I’m just a paying customer like most of our readers.

This site is about good players in the broadband industry who deserve to make good profits and enjoy success providing an important service to subscribers at a fair price, and about those bad players who increasingly seek to further monetize their broadband offerings by charging consumers more for the same service. As one of the few telecom products nearly immune from the economic downturn, some providers are willing to leverage their barely-competitive marketplace position to cash in.

It’s about who has control over our broadband future – certain corporate entities and individuals who openly admit their desire to act as a controlling gatekeeper, or consumers who pay for the service. It’s also about organizing consumers to push back when industry propaganda predominates in discussions about broadband issues, and we know where we can find plenty of that. Finally it’s about evangelizing broadband, not in a religious sense, but promoting its availability even if it means finding alternatives to private providers who leave parts of urban and rural America unserved because it just doesn’t produce enough profit.

Let’s derail Todd’s latest choo-choo arguments.

“The idea of charging broadband customers based on what they use is still in play.” — That’s never been in play. True consumption billing would mean consumers pay exactly for what they use. If a consumer doesn’t turn on their computer that month, there would be no charge. That’s not what is on offer. Instead, providers want to overcharge consumers with speed –and– usage-based tiers that, in the case of Time Warner Cable, were priced enormously higher than current flat-rate plans. Customers would be threatened with overlimit fees and penalties for exceeding a paltry tier proposed by the company last April. The ‘Stop the Cap! guy’ didn’t generate thousands of calls and involvement by a congressman and United States senator writing blog entries. Impacted consumers instinctively recognized a Money Party when they saw one, and drove the company back. A certain someone at Multichannel News said Time Warner Cable was “taking one for the team.” At least then you were open about whose side you were on.

“Verizon just wants to make more money by charging more for the same service. What an outrage! It’s not like the company spent billions and billions to build out their network and needs to recoup that investment.” — Recouping an investment is easily accomplished by providing customers with an attractive, competitively priced service that delivers better speed and more reliability than the competition. Provide that in an era when fiber optic technology and bandwidth costs are declining, and not only does the phone company survive the coming copper-wire obsolescence, it also benefits from the positive press opinion leaders who clamor for your service will generate to attract even more business. Stacey’s comments acknowledged the positive vibes consumers have towards Verizon’s fiber investment — positive vibes they are now willing to throw away.

Verizon FiOS already gets to recoup its investment from premium-priced speed tiers that are favored by those heavy broadband users. Most will happily hand over the money and stay loyal, right up until you ask for too much. Theoretically charging your best customers $140 a month for 50Mbps/20Mbps service and then limiting it to, say, 250GB of usage will be an example of asking for too much. Verizon didn’t get into the fiber optics business believing their path to return on investment was through consumption billing for broadband.

“Today’s broadband networks — not even FiOS — are not constructed to deliver peak theoretical demand and adding more capacity to the home or farther upstream will require investment.” — Readers, today’s newest excuse for overcharging you for your broadband access is “peak theoretical demand.” It used to be peer-to-peer, then online videos, and now this variation on the “exaflood” nonsense. It sounds like Todd has been reading some vendor’s press release about network management. Peak theoretical demand has never been the model by which residential broadband networks have been constructed. The Bell System constructed a phone network that could withstand enormous call volumes during holidays or other occasional events. Broadband networks were designed for “best effort” broadband. If we’d been living under this the peak demand broadband model, cable modem service and middle mile DSL networks wouldn’t be constructed to force hundreds of households to share one fixed rate connection back to the provider. It’s this design that causes those peak usage slowdowns on overloaded networks that work fine at other times.

No residential broadband provider is building or proposing constructing peak theoretical demand networks that are good enough to include a service and speed guarantee. Instead, cable providers are moving to affordable DOCSIS 3 upgrades, which continue the “shared model” cable modems have always relied on, except the pipeline we all share can be exponentially larger and deliver faster speeds. Will this model work for decades to come? Perhaps not, but it’s generally the same principle Time Warner Cable is using to deliver HD channels quietly ‘on demand’ to video customers without completely upgrading their facilities. You don’t hear them talk about consumption billing for viewing, yet similar network models are in place for both.

“Is it fairer to recover that necessary investment in additional capacity from the heaviest users, who are driving the most demand?” Apparently so, because providers already do that by charging premium pricing for faster service tiers attractive to the heaviest users. But Todd, as usual, ignores the publicly-available financial reports which tell a very different tale – one where profits run in the billions of dollars for broadband service, where many providers Todd feels urgently need to upgrade their networks are, in reality, spending a lower percentage on their network infrastructure costs, all at the same time bandwidth costs are either dropping or fixed, making it largely irrelevant how much any particular user consumes. What matters is how much of a percentage of profits providers are willing to put back into their networks.

Do people like Todd really believe consumers aren’t capable of reading financial reports and watching executives speak with investors about the fact their networks are well-able to handle traffic growth (Glenn Britt, Time Warner Cable CEO), that consumption based billing represents potential increased revenue for companies that deny they even have a traffic management problem (Verizon), or that broadband is like a drug that company officials want to encourage consumers to keep using without unfriendly usage caps, limits, or consumption billing (Cablevision.)

“From 7 to 10 p.m., we’re all consumption kings,” Sandvine CEO David Caputo told Todd. “Bandwidth caps don’t do anything for you.” The implication of this finding is that “the Internet is really becoming like the electrical grid in the sense that it’s only peak that matters,” he added. — I would have been asking Todd to pick me up off the floor had Caputo said anything different. His bread and butter, just like Todd’s, is based on pushing his business agenda. Sandvine happens to be selling “network management” equipment that can throttle traffic, perhaps an endangered business should Net Neutrality become law in the United States. His business depends on selling providers on the idea that sloppy usage caps don’t solve the problem — his equipment will. Todd has no problem swallowing that argument because it helps him make his. The rest of us who don’t work for a trade publication or a net throttler know otherwise.

What would actually be fair to consumers is to take some of those enormous profits and plow them back into the business to maintain, expand, and enhance services that deliver the gravy train of healthy revenue. In fact, by providing even higher levels of service, they can rake in even larger profits. You have to spend money to earn money, though.

Technology doesn’t sit still, which is why provider arguments about increased traffic leading to increased costs don’t quite ring true when financial reports to shareholders say exactly the opposite. That’s because network engineers get access to new, faster, better networking technology, often at dramatically lower prices than what they paid for less-able technology just a few years earlier. With new customers on the way, particularly for the cable industry picking up those dropping ADSL service from the phone company, there’s even more revenue to be had.

Or, do you think spreading the cost across all subscribers, thereby raising the flat-rate pricing for everyone, is the better option? Note that Comcast did this to an extent when it raised the monthly lease fee for cable modems by $2 (to $5), citing costs associated with its DOCSIS 3.0 buildout.

The industry already thinks so. As we’ve documented, cable broadband providers like Time Warner Cable and Comcast (and Charter next year), are already raising prices across the board for broadband customers in many areas. Does that mean the talk about Internet Overcharging schemes can be laid to rest? Of course not. They want their rate increases -and- consumption based billing for even fatter profits.

If, on the other hand, you want to pretend that all-you-can-eat plans are sustainable at today’s price tiers, you’d be kind of clueless.

Every ISP maintains an Acceptable Use Policy that provides appropriate sanctions for those users who are so far out of the consumption mainstream, they cannot even see the rest of us. Slapping consumption based billing on consumers with steep overlimit fees and penalties punishes everyone, and the provider keeps the proceeds, and not necessarily for network upgrades.

If Todd believes consumers will sit still for profiteering by changing a model that has handsomely rewarded providers at today’s prices, with plenty of room to spare for appropriate upgrades, he’ll be the clueless one. The cable industry’s ability to overreach never ceases to amaze me. Every 15 years or so, legislative relief has to put them back in their place. It’s what happens when just a handful of providers decide it is easier to hop on board the Internet Overcharging Express and cash those subscriber checks than actually engage in all-out competitive warfare with one another – keeping prices in check and onerous overcharges out of the picture.

Nobody needs to know my name to understand this. But some of his provider friends already know the names of our readers, because PR disasters do not happen in a vacuum. They are also acquainted with two other names: Rep. Eric Massa and Sen. Charles Schumer. If they want to go hog wild with Internet Overcharging schemes, that list of names will get much, much longer.

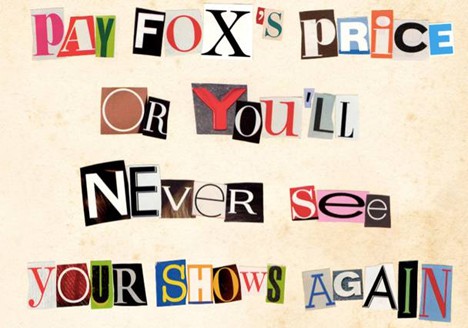

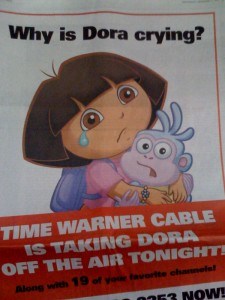

After much sound and fury, and plenty of media attention, Fox programming remained on Time Warner Cable and Bright House Networks systems through the New Year’s festivities, as the three companies reached “an agreement in principle” to make cable customers ultimately pay more for the right to watch Fox broadcast stations and cable networks.

After much sound and fury, and plenty of media attention, Fox programming remained on Time Warner Cable and Bright House Networks systems through the New Year’s festivities, as the three companies reached “an agreement in principle” to make cable customers ultimately pay more for the right to watch Fox broadcast stations and cable networks.

Subscribe

Subscribe