Phillip Dampier on USF Reform: It might have been great, it could have been a lot worse, but ultimately it turned out to be not very good.

Last week, the Federal Communications Commission unveiled their grand plan to reform the Universal Service Fund, a program originally designed to subsidize voice telephone service in rural areas deemed to be unprofitable or ridiculously expensive to serve. Every American with a phone line pays into the fund through a surcharge found on phone bills. Urban Americans effectively subsidize their rural cousins, but the resulting access to telecommunications services have helped rural economies, important industries, and the jobs they bring in agriculture, cattle, resource extraction, and manufacturing.

The era of the voice landline is increasingly over, however, and the original goals of the USF have “evolved” to fund some not-so-rural projects including cell phone service for schools, wireless broadband in Hollywood, and a whole mess of projects critics call waste, fraud, and abuse. For the last several years, USF critics have accused the program of straying far from its core mission, especially considering the costs passed on to ratepayers. What originally began as a 5% USF surcharge is today higher than 15%, funding new projects even as Americans increasingly disconnect their landline service.

For at least a decade, proposals to reform the USF program to bridge the next urban-rural divide, namely broadband, have been available for consideration. Most have been lobbied right off the table by independent rural phone companies who are at risk of failure without the security of the existing subsidy system. Proposals that survived that challenge next faced larger phone company lobbyists seeking to protect their share of USF money, or by would-be competitors like the wireless industry or cable operators who have generally been barred from the USF Money Party.

This year, FCC Chairman Julius Genachowski finally achieved a unanimous vote to shift USF funding towards the construction and operation of rural broadband networks. The need for broadband funding in rural areas is acute. Most commercial providers will candidly admit they have already wired the areas deemed sufficiently profitable to earn a return on the initial investment required to provide the service. The areas remaining without service are unlikely to get it anytime soon because they are especially rural, have expensive and difficult climate or terrain challenges to overcome, or endure a high rate of poverty among would-be customers, unable to afford the monthly cost for the service. Some smaller independent phone companies are attempting to provide the service anyway, but too often the result is exceptionally slow speed service at a very high cost.

The new Connect America Fund will shift $4.5 billion annually towards rural broadband construction projects. Nearly a billion dollars of that will be reserved in a “mobility fund” designated for mobile broadband networks.

The goal is to bring broadband to seven million additional households out the 18 million currently ignored by phone and cable operators.

The FCC believes AT&T will take a new interest in upgrading its rural landline networks, even as the company continues to lobby for the right to abandon them.

Unfortunately, the FCC has set the bar pretty low in its requirements for USF funding. The FCC defines the minimum level of “broadband” they expect to result from the program — 4/1Mbps. That’s DSL speed territory and that is no accident. The phone companies have advocated a “less is more” strategy in broadband speed for years, arguing they can reach more rural customers if speed requirements are kept as low as possible. DSL networks are distance sensitive. The faster the minimum speed, the more investment phone companies need to make to reduce the length of copper wiring between their office and the customer. Arguing 4Mbps is better than nothing has gotten them a long way in Washington, but it also foreshadows the next digital divide — urban/rural broadband speed disparity. While large cities enjoy speeds of 50Mbps or more, rural towns will still be coping with speeds “up to” 4Mbps.

The FCC does not seem too worried, relying heavily on a mild incentive program to prod providers to upgrade their DSL service to speeds of 6/1.5Mbps.

The irony of asking AT&T to invest in an aging landline network they are lobbying to win the right to abandon is lost on Washington, and future speed upgrades for rural America from companies like Verizon are in serious doubt when they sell off their rural areas to companies like FairPoint and Frontier and leave town.

Critics of USF reform suggest the program is still stacked in favor of the phone companies, and considering the state of their copper wire networks, would-be competitors are scratching their heads.

The cable industry, in particular, is still peeved by reforms they feel leave them at a disadvantage. Of course, Washington may simply be recognizing the fact cable companies are the least likely to wire rural America, but when they do, the service that results is often faster than what the phone company offers. The nation’s biggest cable lobbyist — ironically also the former chairman of the FCC, Michael Powell — still feels a little abused after reading the final proposal.

“While we are disappointed in the Commission’s apparent decision to ignore its longstanding principle of competitive neutrality and provide incumbent telephone companies an unwarranted advantage for broadband support,” said National Cable & Telecommunications Association President Michael Powell, “we remain hopeful that the order otherwise reflects the pro-consumer principles of fiscal discipline and technological neutrality that will bring needed accountability and greater efficiency to the existing subsidy system. We are particularly heartened by the Commission’s efforts to ensure that carriers are fairly compensated for completing VoIP calls.”

Wireless operators are not happy either, because the arcane requirements that come with the USF bureaucracy were written with the phone companies in mind, not them. Small, family-owned providers find it particularly difficult to do business with the USF, if only because they don’t have the staff or time to navigate through endless documents and forms. Phone companies do.

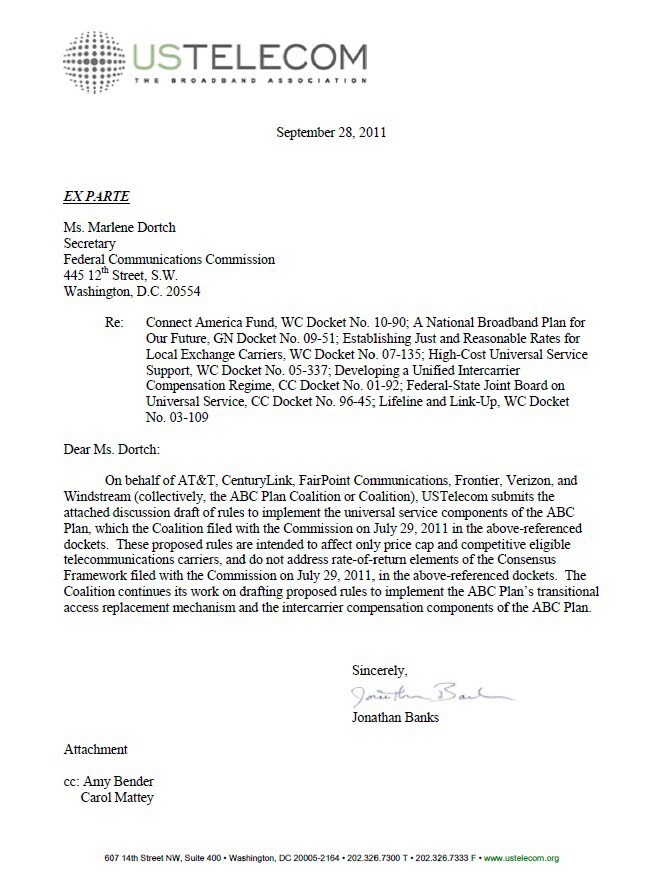

Many consumer groups are relieved because it could have been much worse. The FCC could have simply capitulated and adopted the phone companies’ wish-list — the ABC Plan. Thankfully, they didn’t, but the FCC has naively left the door open to substantial rate increases for consumers by not capping the maximum annual outlay of the fund. That follows the same recipe that invited higher phone bills and questionable subsidies awarded in an effort to justify the original USF program even after it accomplished most of its goals. Consumers may face initial rate increases of $0.50 almost immediately, and up to $2.50 a month five years from now.

The FCC, unjustifiably optimistic, suspects phone companies and other telecommunications interests won’t gouge customers with higher prices. They predict rate increases of no more than 10-15 cents a month. I wouldn’t take that bet and neither will consumer groups.

“We’re going to press the FCC to ensure that these are temporary increases, because history has shown that these types of costs tend to stick around and go on and on and on,” said Parul Desai, policy counsel for Consumers Union.

An even bigger question left unanswered is just how far the FCC will get into the broadband arena when it refuses to take the steps necessary to ensure it has an admission ticket. The agency has avoided classifying broadband as a telecommunications service, an important distinction that would bolster its authority to oversee the industry. Without it, some members of Congress, and more importantly the courts, have questioned whether the FCC has any business in the broadband business. Just one of the many high-powered players in the discussion could test that theory in the courts, and should a judge throw the FCC’s plan out, we’ll be back at square one.

[flv]http://www.phillipdampier.com/video/C-SPAN Tom Tauke from Verizon on Changes to the Universal Service Fund 10-29-11.flv[/flv]

Verizon’s chief lobbyist Tom Tauke spent a half hour last weekend on C-SPAN taking questions about USF reform and the side issues of IP Interconnection and Net Neutrality policies. Tauke supports consolidation of small phone companies into fewer, larger companies. He also expands on his company’s lawsuit against Net Neutrality, which fortuitously (for Verizon) will he heard by the same D.C. Court of Appeals that threw out the FCC’s fines against Comcast for throttling broadband connections. Politico’s Kim Hart participates in the questioning, which also covered wireless spectrum issues impacting Verizon Wireless, AT&T’s stumbling merger deal with T-Mobile, and Verizon’s latest lawsuit against the FCC for data roaming notification rules. (28 minutes)

Subscribe

Subscribe