The next standard for cable broadband is now due by 2020.

For over a year, the cable industry has been stalled after deciding to slash investment in broadband while enduring indecision and confusion over the next generation of cable broadband.

At issue is a simmering disagreement — rare for the usually unified cable industry — about the next generation of cable broadband, dubbed DOCSIS 4.0.

Two sides have emerged. Cable giant Comcast has spent years gradually preparing its network for perhaps the last iteration of coaxial copper-delivered cable internet service. It has spent at least five years gradually pushing optical fiber closer to its customers, retiring additional coaxial cable and the amplifiers and other equipment associated with that technology. The result is a company ready to embrace Full Duplex DOCSIS, known as “FDX.”

FDX is designed to allow upload and download traffic to share the same spectrum, letting cable companies put internet service bandwidth to full use with maximum efficiency. Comcast wants FDX to be a central part of DOCSIS 4.0. The company has been working through a long-term plan to offer much faster internet service, including symmetrical broadband — unified upload and download speeds. This would erase the cable industry’s broadband Achilles’ heel: download speeds much faster than upload speeds.

To achieve FDX, cable companies have to push fiber much deeper into their networks, sometimes right up to the edge of neighborhoods. It also means eliminating signal amplifiers that help keep signals robust as they travel across older coaxial cable infrastructure. Engineers call this concept “Node+0” architecture, which means a network with zero amplifiers.

FDX gives the cable industry the opportunity of running a more robust broadband network, easily capable of 10 Gbps with an upgrade path to 25 Gbps later on. The downside is that it can be very expensive to implement, especially if a cable company has under invested in upgrades and not incrementally laid a foundation for FDX. Wall Street may balk at the upgrade costs. The logistics of readying degrading older infrastructure to launch FDX may be so onerous, some cable systems may find it more cost effective to scrap their existing hybrid fiber-coaxial (HFC) networks and switch to a state-of-the-art fiber to the home network instead. That is precisely what Altice USA is doing with its Cablevision/Optimum system in New York, New Jersey, and Connecticut.

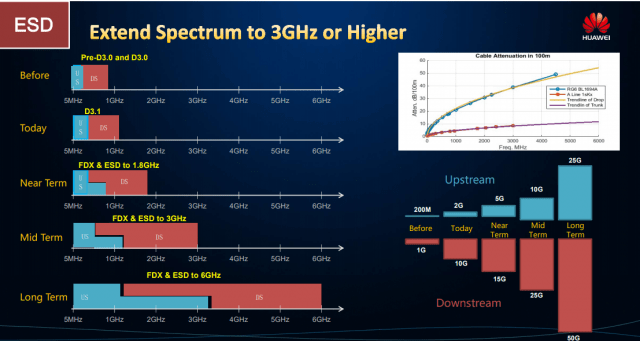

Charter Communications, along with many other smaller cable operators, have been pushing an alternative to FDX that is likely to cost much less to implement. Extended Spectrum DOCSIS (ESD) is designed to work over existing cable systems, including those that still rely on amplifiers and aging coaxial cable. Instead of allowing internet traffic to share bandwidth, ESD follows the existing standard by keeping upload traffic on different frequencies than download traffic. It simply extends the amount of bandwidth open to both types of traffic, which will allow cable systems to raise speeds. ESD will dedicate frequencies up to 3 GHz (and higher in some cases) for internet traffic. DOCSIS 3.1, the current standard, only supports internet traffic on frequencies up to around 1.2 GHz. ESD will also allow cable companies to raise upload speeds and should support up to 10 Gbps downloads. But there are some questions about how well ESD will support 25 Gbps speed and the condition of the cable company’s existing coaxial network will matter a lot more than ever before. A substandard network will cause significant speed degradation and could even disrupt service in some cases.

Charter Communications, along with many other smaller cable operators, have been pushing an alternative to FDX that is likely to cost much less to implement. Extended Spectrum DOCSIS (ESD) is designed to work over existing cable systems, including those that still rely on amplifiers and aging coaxial cable. Instead of allowing internet traffic to share bandwidth, ESD follows the existing standard by keeping upload traffic on different frequencies than download traffic. It simply extends the amount of bandwidth open to both types of traffic, which will allow cable systems to raise speeds. ESD will dedicate frequencies up to 3 GHz (and higher in some cases) for internet traffic. DOCSIS 3.1, the current standard, only supports internet traffic on frequencies up to around 1.2 GHz. ESD will also allow cable companies to raise upload speeds and should support up to 10 Gbps downloads. But there are some questions about how well ESD will support 25 Gbps speed and the condition of the cable company’s existing coaxial network will matter a lot more than ever before. A substandard network will cause significant speed degradation and could even disrupt service in some cases.

Despite the limitations of ESD, many cable companies consider its low implementation cost a principal reason to support it over FDX.

For much of this year, cable companies have put upgrades on hold as the industry sorts out which direction DOCSIS 4.0 will take. Equipment manufacturers and vendors have resorted to layoffs and cutbacks and have signaled neither Comcast nor other cable companies are big enough to justify different DOCSIS standards supporting FDX or ESD.

Comcast and Charter are the two largest cable companies in the United States.

Therefore, the cable industry has informally decided DOCSIS 4.0 will need to support both FDX and ESD under a single specification, with next generation cable modems and equipment capable of supporting either technology. At a joint pre-Cable-Tex Expo conference held on Monday, executives from Comcast and Charter appeared to support the new unified approach to DOCSIS 4.0.

John Williams, vice president of outside plant engineering and architecture at Charter Communications, told attendees cable companies need to support both FDX and ESD and stop taking an “either/or” approach.

“In order to do this, we need to look at the synergies and embrace ESD and FDX as the next generation of HFC,” Williams said. “It’s all about scale.”

Charter has been significantly challenged historically because its own legacy cable systems were often behind the times and sometimes dilapidated. Its 2016 acquisition of Time Warner Cable and Bright House Networks only complicated things further, because neither operator had a reputation for using state-of-the-art HFC technology. Costly upgrades have been underway at many Charter-owned cable systems since the merger closed, some still ongoing.

Robert Howald, part of Comcast’s network upgrade team, called the emerging DOCSIS 4.0 standard a “perfect complementary pair” of FDC and ESD. He noted both approaches will allow cable systems to boost speeds to at least 10/10 Gbps, with faster speeds in the future.

Howald pointed out Comcast is already testing FDX technology in Connecticut and Colorado, working out bugs and unexpected technical challenges.

“We feel like we’ve significantly de-risked some of the technology components of FDX,” Howald said. “We felt really good about what we saw in the field.”

What is Full Duplex DOCSIS? This video from CableLabs explains the technology and how it differs from other DOCSIS cable broadband technology. (1:58)

Subscribe

Subscribe A major battle between satellite owners, broadcasters, and the telecom industry has emerged over a proposal to repurpose a portion of C Band satellite spectrum for use by the wireless industry.

A major battle between satellite owners, broadcasters, and the telecom industry has emerged over a proposal to repurpose a portion of C Band satellite spectrum for use by the wireless industry.

Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again.

Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again. FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.

Despite claims from Republican FCC commissioners that cable companies are boosting investment in their networks as a result of the FCC’s repeal of net neutrality, cable infrastructure suppliers reported first quarter 2019 revenues nosedived 38%, reflecting an “extreme” cutback in cable industry spending not seen in over five years.