Wheeler

One of the biggest surprises of the Obama Administration has been FCC chairman Thomas Wheeler, whose industry background made his appointment immediately suspect among consumer advocates, including Stop the Cap!

But over the last few years of his tenure, he has built one of the strongest pro-consumer records of accomplishments the commission has seen in decades. Not only has Wheeler outclassed Kevin Martin and Michael Powell — the two chairmen under the prior Bush Administration, he has also demonstrated strong conviction and consistency lacking from his immediate predecessor, Julius Genachowski. Wheeler has won praise from consumer groups after pushing through Net Neutrality, adding stronger terms and conditions to the Charter-Time Warner Cable-Bright House merger to extend a ban on usage caps for seven years, discouraging more wireless provider mergers, and several other pro-consumer measures dealing with persistent problems like phone bill cramming.

Many top telecom executives and lobbyists and many Republican members of Congress have been highly critical of Mr. Wheeler and have bristled at media reports suggesting he might not exit with the outgoing Obama Administration. More than a few have hinted they would like to see Wheeler depart sooner than later.

The Wall Street Journal is now questioning whether Wheeler can complete at least three more of his important agenda items before President Obama’s term ends early next year.

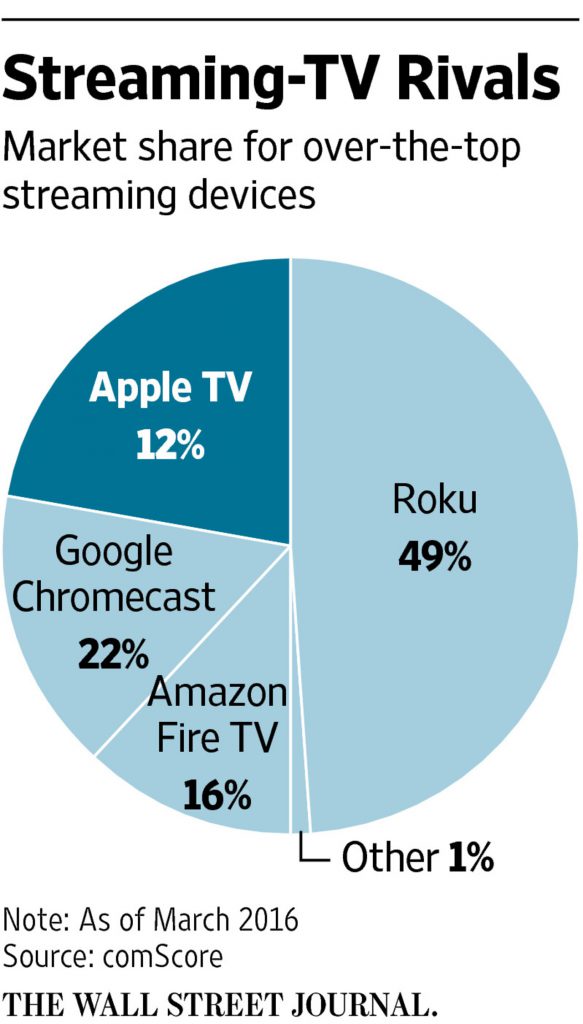

His “open standards” for set-top boxes reform is mired in a full-scale cable industry push-back, efforts to impose strong privacy rules on what cable and phone companies do with your private information apparently violates Comcast’s right to offer you a discount if you agree to let them monitor your online activity, and even an effort to clean up business telecommunications service rules has met opposition, mostly from the companies that are quite happy making enormous profits with the rules as written today.

“Chairman Wheeler has accomplished a lot during his tenure, but with the election fast approaching, he probably has time to get one more big thing done,” Rep. Frank Pallone of New Jersey, the top Democrat on the House Energy and Commerce Committee, told the newspaper.

Some Republicans in the Senate are holding up a vote on a second 5-year term for Democratic Commissioner Jessica Rosenworcel after hearing media reports Wheeler may be thinking of remaining as FCC chairman after the end of the Obama Administration. Wheeler’s term doesn’t expire just because the president that appointed him leaves office, but it would be unusual for Wheeler to stay. But then a lot of traditions in Washington are not necessarily good ideas and we see no reason to hurry Wheeler out of his chairmanship. The chances we will get someone as tenacious as Mr. Wheeler has proven to be from the next president is unlikely. Those blocking the vote on Ms. Rosenworcel are playing the usual Washington power games, simply looking for a commitment Wheeler will leave with President Obama.

Wheeler has few allies among Republicans, who don’t like his Net Neutrality policies, don’t want Wheeler’s open-standard set-top box plan, and believe he is a regulator more than a preferred deregulator. Rosenworcel has recently been wavering on support for Wheeler’s set-top box plan and his internet privacy plan, which worries us because her vote is critical to assure passage. Rosenworcel could be trying to be seen as an independent to improve her chances at winning reappointment, but she risks alienating consumer groups if she sides with the two Republican FCC commissioners, who have shown themselves to be engaged in almost open warfare against consumers. Rosenworcel would do better to vote with consumers and avoid any appearance she is more interested in protecting her position in Washington.

“Sure, there are headwinds, but that’s often a sign that they’re doing something right,” Todd O’Boyle, program director for the media and democracy reform initiative at Common Cause told the newspaper. “There’s reason to think that the FCC will advance all three reforms.”

As far as Mr. Wheeler, as long as he represents the interests of the American people over those of AT&T and Comcast, he should feel free to stay as long as his term allows.

Subscribe

Subscribe For the first time, the average American now pays over $100 a month just to watch television.

For the first time, the average American now pays over $100 a month just to watch television.

“Enabling consumers to use apps instead of set-top boxes may be a valid goal, but the marketplace is already delivering on the goal without overreaching government intervention. The FCC’s mandate threatens to bog down with regulations and bureaucracy the entire TV app market that consumers are increasingly looking to for innovation, choice and competition.”

“Enabling consumers to use apps instead of set-top boxes may be a valid goal, but the marketplace is already delivering on the goal without overreaching government intervention. The FCC’s mandate threatens to bog down with regulations and bureaucracy the entire TV app market that consumers are increasingly looking to for innovation, choice and competition.”

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.

This time, Apple sought money from the cable companies, not the other way around. Cable operators were told they would need to pay $10 a month per subscriber to Apple, with no guarantee that fee would not increase in the future. Just as concerning was Apple’s insistence that subscriber authentication would require customers to use their Apple IDs, a departure from the cable industry’s push to adopt TV Everywhere, where customers could unlock streaming video from any cable network simply by logging in with the username and password they set up with their pay TV provider. Apple was also characteristically secretive about their user interface and left cable industry executives flummoxed when they asked Apple to sketch out what the service would look like on a napkin. An Apple official would only respond that their interface would be great and “better than anything you’ve ever had.” The fact Apple refused to answer the question did not go unnoticed.