Witmer

If what Time Warner Cable claims is true, the stalemate that has kept CBS content away from subscribers for four weeks may be less about the money and more about CBS’ desire to control your viewing experience.

Melinda Witmer, TWC’s chief video and content officer, reports CBS is demanding daunting new restrictions in their proposed renewal contract, including requiring customers to “register their television sets” with CBS before being able to turn them on.

Witmer said CBS’ demands also include new powers over DVR capabilities, which means CBS could possibly prevent customers from fast-forwarding through commercials or even block the recording and/or storage of certain programs without network permission.

“CBS announced that they signed a deal with Verizon (FiOS TV) and has suggested that they offered us the same deal Verizon just signed,” Witmer said. “All I can say is our condolences to Verizon if they signed the deal CBS put in front of us. I hope for Verizon’s sake that they didn’t sign that, but if they did I’m glad for us because we’ll compete that much better against them when we finish our deal.”

Cable operators are seeking expanded rights from programmers as customer viewing habits evolve. Among the most important are those that would allow online and on-demand streaming of programming to authenticated cable subscribers.

Time Warner Cable has invested considerable resources in its online viewing platforms for PC’s, smartphones, and tablets, providing most of the TWC lineup on those portable devices. But the service has been largely limited in-home viewing because the cable company is having trouble securing permission to stream most of that content for those on the go.

Time Warner Attempts to Placate Impacted Customers

Although Time Warner Cable is crediting customers for the loss of Showtime/The Movie Channel, blocked by the cable operator while the impasse continues, Time Warner is not giving any automatic refunds for the loss of CBS basic or broadcast programming and networks taken off the cable dial. CBS-owned Smithsonian TV is the most affected basic cable channel nationwide. Some customers who pay extra for Smithsonian as part of an added-cost HD Tier often known as “TWCHD Pass” have gotten service credits upon request.

Although Time Warner Cable is crediting customers for the loss of Showtime/The Movie Channel, blocked by the cable operator while the impasse continues, Time Warner is not giving any automatic refunds for the loss of CBS basic or broadcast programming and networks taken off the cable dial. CBS-owned Smithsonian TV is the most affected basic cable channel nationwide. Some customers who pay extra for Smithsonian as part of an added-cost HD Tier often known as “TWCHD Pass” have gotten service credits upon request.

Time Warner Cable is giving out free over-the-air antennas to customers in cities where local CBS-owned stations have been taken off the cable lineup.

Time Warner Cable has a limited quantity of free basic indoor antennas available for customers at TWC retail locations in Dallas-Ft. Worth, Los Angeles/Desert Cities, New York City, Milwaukee and Green Bay, Wisc. In addition, TWC has partnered with Best Buy in those cities to provide $20 toward the purchase of any in-stock broadcast antenna at select Best Buy store locations. The cable company has published a list of retail locations where antennas are available as long as supplies last. Limit one per customer and installation is your responsibility.

Radio Shack has also taken advantage of the situation by slashing prices on an AntennaCraft Amplified Omnidirectional HDTV Antenna, now available online for $37.49 – a 25 percent discount. Best Buy is supporting Time Warner Cable’s position in the CBS dispute. Radio Shack is not, telling customers its antennas make it easy to “cut the cable.”

Time Warner is appeasing tennis fans with enhanced coverage of the 2013 US Open Tennis Championship Series with a free preview of The Tennis Channel running Aug. 26 through Sept. 9.

The blackout is also keeping Time Warner Cable, Bright House, and Earthlink (supplied by either cable operator) broadband customers from watching CBS content online.

| If you now receive this channel | Here’s how your Time Warner Cable video service is impacted |

| CBS from NYC, LA, Dallas-Ft Worth, Boston, Chicago, Denver, Detroit, Pittsburgh | -The CBS channel has been removed from your lineup -CBS Primetime on Demand is now unavailable -StartOver and LookBack services on all CBS-owned stations are unavailable |

| CBS from any city other than the ones listed above | -CBS Primetime on Demand is now unavailable -StartOver and LookBack services on local CBS affiliate stations are unavailable |

| Flix | Flix is now unavailable |

| The Movie Channel | The Movie Channel and The Movie Channel on Demand are now unavailable; TWC is providing replacement programming from Encore on a temporary preview basis–look in your guide for channel numbers. |

| Showtime | Showtime, all its associated multiplex channels, and Showtime on Demand are now unavailable; TWC is providing replacement programming from Starz on a temporary preview basis–look in your guide for channel numbers. |

| Smithsonian Channel | Smithsonian and Smithsonian on Demand are now unavailable |

The Federal Communications Commission said it is trying to resolve the fee dispute from Washington.

“The commission is engaged at the highest levels with the respective parties and working to bring the impasse to an end,” Justin Cole, an agency spokesman, said in an e-mailed statement yesterday. “We urge all parties to resolve this matter as quickly as possible so consumers can access the programming they rely on and are paying for.”

But acting FCC chairwoman Mignon Clyburn also admitted the FCC has few powers to intervene and compel an agreement.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/TWC Melinda Witmer on CBS Blackout 8-24-13.flv[/flv]

Time Warner Cable’s Melinda Witmer, head of the team negotiating with CBS, suggests the network is demanding unprecedented control over your viewing experience — a deal breaker for the cable operator. (6 minutes)

Subscribe

Subscribe Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network.

Waiting for Comcast and Verizon to offer cutting edge broadband to 620,000 Baltimore city residents and businesses appears to be going nowhere, so the city is hiring an Internet consultant to consider whether to sell access to its existing fiber network. Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.

Like many cities, Baltimore already owns and operates its own fiber ring, built with public funds to support the city’s public safety radio system. Like many municipal institutional fiber networks, Baltimore’s fiber ring is underutilized. Public safety and other institutional users often use just a fraction of available capacity. Despite the fact such networks are often oversized, they are rarely controversial because they do not typically compete with commercial providers and are usually off-limits to the public.

A German court has blocked Liberty Global’s attempted $4.25 billion purchase of the country’s third largest cable company on antitrust and anti-competition grounds.

A German court has blocked Liberty Global’s attempted $4.25 billion purchase of the country’s third largest cable company on antitrust and anti-competition grounds.

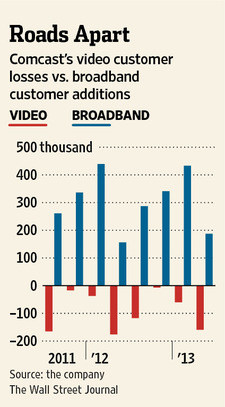

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after.

Although cable and phone companies love to declare themselves part of a fiercely competitive telecommunications marketplace, it is increasingly clear that is more fairy tale than reality, with each staking out their respective market niches to live financially comfortable ever-after. This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you.

This is hardly a “War of the Roses” relationship either. Wall Street teaches that price wars are expensive and competitive shouting matches do not represent a win-win scenario for companies and their shareholders. The two companies get along fine where Verizon has virtually given up on DSL. Time Warner Cable actually faces more competition from AT&T’s U-verse, which is not saying much. The obvious conclusion: unless you happen to live in a FiOS service area, the best deals and fastest broadband speeds are not for you. That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies.

That means Time Warner Cable has an 80 percent market share. Actually, it is probably higher because that total number of households includes those who either don’t want, need, or can’t afford broadband service. Some may also rely on limited wireless broadband services from Clearwire or one of the large cell phone companies. Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers.

Rochester remains a happy hunting ground for Internet Overcharging schemes because the only practical, alternative broadband supplier is Frontier Communications, which Time Warner Cable these days dismisses as an afterthought (remember that 80 percent market share). Without a strong competitor, Time Warner has no problem experimenting with new “usage”-priced tiers. In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.

In nearby Ohio, the average broadband user already exceeds Time Warner’s 30GB pittance allowance, using 52GB a month. Under both plans, customers who exceed their allowance are charged $1 per GB, with overlimit fees currently not to exceed $25 per month. That 30GB plan would end up costing customers an extra $22 a month above the regular, unlimited plan. So much for the $5 savings.