A portion of your cable bill pays for much more than programming, with millions diverted to Koch Brothers-backed astroturf groups, tea party candidates, fat paychecks for former public officials taking a trip through D.C.’s revolving door, and generous allowances for travel expenses racked up by high-flying industry lobbyists.

A portion of your cable bill pays for much more than programming, with millions diverted to Koch Brothers-backed astroturf groups, tea party candidates, fat paychecks for former public officials taking a trip through D.C.’s revolving door, and generous allowances for travel expenses racked up by high-flying industry lobbyists.

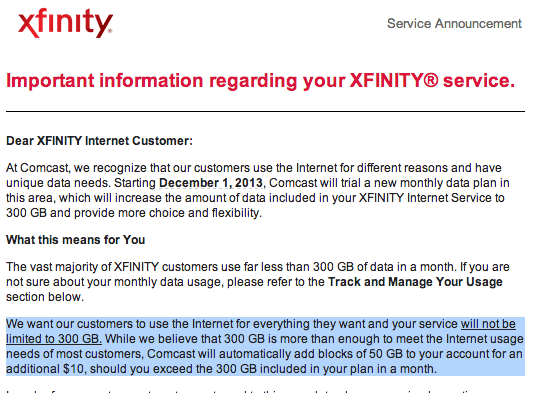

The Center for Public Integrity took a trip through the 2012 tax return of America’s top cable trade group: the National Cable & Telecommunications Association (NCTA), which collected $60 million last year in membership dues from America’s top cable operators, who in turn were reimbursed by you when paying your monthly cable bill. They needed a shower when the journey was over.

NCTA president and CEO Michael K. Powell, the former chairman of the Federal Communications Commission during President George W. Bush’s first term, was well compensated in his new role representing the same cable industry he used to barely oversee, taking home more than $3 million in pay last year. Eight other employees, including NCTA’s executive vice-president, collectively cleared over a million dollars in salary according to the groups’ Form 990 filed with the Internal Revenue Service.

The revolving door at NCTA headquarters is kept well-greased, with 78 out of 89 federal-level NCTA lobbyists formerly working in government jobs representing the American people. Now they work for the interests of Comcast, Time Warner Cable, and other large operators.

Collectively, the NCTA spent $19 million on lobbying activities last year, much of it bankrolling “dark money” groups that refuse to disclose their donors and consider it their life mission to defeat President Barack Obama and blockade Democrats in Congress — the ones still most likely to demand more oversight and regulation of the free-spending cable industry. Among the groups receiving cable’s cash:

Americans for Prosperity, which received $50,000, spent $33.5 million opposing Obama during the 2012 election cycle, according to the Center for Responsive Politics, a nonpartisan group that tracks campaign spending. Americans for Prosperity often supports Tea Party causes and candidates and is the main political arm of billionaire industrialists Charles and David Koch. As the Center reported Thursday, the group spent a staggering $122 million overall in 2012. Americans for Prosperity is also actively involved in blocking community-owned broadband projects and advocates passing laws forbidding communities getting into the broadband business if a cable company got there first. Now you know why.

Phil Kerpen with Glenn Beck

Americans for Tax Reform, which received $50,000, spent $15.8 million on the 2012 federal election, according to the Center for Responsive Politics. The group’s president and founder, Grover Norquist, is famous for his Taxpayer Protection Pledge, by which legislators and candidates promise to oppose all tax increases. The cable industry is also an advocate of tax forgiveness policies that would let cable operators repatriate the cash they stashed overseas, avoiding the same taxman they snuck around opening overseas bank accounts.

American Commitment, which received $10,000, spent $1.9 million on the 2012 federal election to advocate for and against political candidates — mostly to help U.S. Sen. Jeff Flake (R-Ariz.) defeat Democrat Richard Carmona. American Commitment also spent some of its money to oppose Sen. Tim Kaine (D-Va.) and Obama. American Commitment Founder and President Phil Kerpen is the former policy and legislative strategist at Americans for Prosperity and previously worked at Club for Growth, another group that doesn’t disclose its donors. Kerpen joined Glenn Beck on his program in 2009 to nod agreement when Beck hopped aboard the crazy train suggesting the Obama Administration’s support for Net Neutrality represented a Marxist-Maoist takeover of the Internet. Silly Beck, doesn’t he realize AT&T already called dibs?

The Center for Individual Freedom, which received $20,000, has been actively fighting against proposals for increased disclosure of donors to politically active nonprofits. It spent $1.8 million during the 2012 election cycle mostly opposing Democratic congressmen Steven Horsford, Bill Owens and Dan Maffei, all from New York.

‘Your money is always good here, whether it comes from AT&T or the cable industry.’ — LULAC

The cable industry also bankrolls a number of our “favorite” sock puppet groups that reflexively support cable’s cause even when straying far beyond their alleged core missions and constituencies the groups claim to represent. Among those on cable’s payroll, sharing $5.8 million in “grant” funding, are some very familiar names to any regular Stop the Cap! reader:

- The Congressional Black Caucus Foundation

- The National Association for the Advancement of Colored People

- LULAC

- The National Gay & Lesbian Chamber of Commerce

- The National Urban League

The largest grant – $2 million, went to the industry mouthpiece Broadband for America, the largest telecom industry astroturf group in the United States, featuring honorary Democratic co-chairman Harold Ford, Jr., who now spends most of his life in MSNBC green rooms after being bounced from office in a failed Senate bid in 2006.

Ford landed on his feet after losing the election, fleeing Tennessee for big money New York, peddling his inside the beltway influence to Merrill Lynch, winning him the position of vice chairman and senior policy adviser, until Merrill Lynch nearly collapsed in the Great Recession and was bailed out by U.S. taxpayers. Ford kept his $2 million annual salary and bonuses, but it wasn’t enough.

He quickly upgraded to a senior managing director at Wall Street firm Morgan Stanley, supplying him with enough cash to buy a $3 million co-op in a tony Manhattan neighborhood.

Broadband for America, brought to you by America’s Big Telecom companies.

From his perch in New York City, Ford pretends to know what is best for the little people across America suffering from no broadband, rationed access, or overpriced service.

His answer: buy it, if you can, from your cable company.

Ford’s co-chair at BfA is former Republican Sen. John Sununu who, by the way, also happens to sit on the board of Time Warner Cable. Need we say more?

There is no reason NCTA lobbyists shouldn’t travel in style when performing their advocacy efforts either. In 2012, they ran up nearly $800,000 in travel expenses.

Unsurprisingly, nobody involved was willing to comment.

Subscribe

Subscribe As Dr. John Malone positions his pieces on the cable industry’s chess board to win back the title of King of Big Cable, it is important to consider history.

As Dr. John Malone positions his pieces on the cable industry’s chess board to win back the title of King of Big Cable, it is important to consider history.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.

All three companies have attempted price increases over the last few years with mixed results. Cablevision’s eight percent rate hike on broadband this year may have been too much for some customers who shopped around and found a better deal with the phone company.