Cablevision CEO Jim Dolan may have to eat his words when he told shareholders he was done giving promotional discounts to customers bouncing back and forth between competing providers. Now Verizon has given Cablevision customers an excuse to say goodbye to the cable company for at least the next two years.

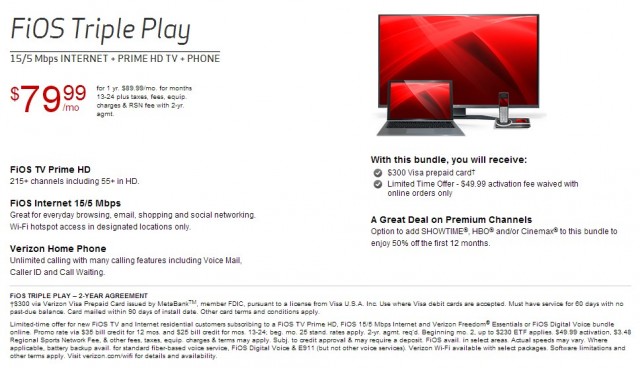

The Verizon FiOS $79.99 Triple Play promotion is back and includes a $300 Visa rebate card and free activation when ordering from Verizon’s website.

The package includes:

- FiOS TV’s “Prime HD” tier, which includes around 215 channels, 55+ in HD. (See channels);

- FiOS Basic Internet (15/5Mbps), upgradeable to 50/25Mbps for $10 more per month;

- Verizon Home Phone including unlimited calling and features including Voice Mail, Caller ID and Call Waiting;

- a 50% optional discount off HBO and Cinemax for one year.

The fine print:

- Promo rate shows up on your Verizon bill as a $35 credit during months 1-12 and a $25 credit for months 13-24. That means you will pay $79.99 for the first year, $89.99 for the second. Factoring in the $300 gift card, your rate is still under $88 a month for two years;

- Offer for new FiOS customers only. (Existing customers – see below);

- A $230 early termination fee applies to this 2-yr contract offer, with the dollar amount gradually decreasing for each month of service;

- Equipment costs, a $3.48 Regional Sports Network fee, taxes, franchise fees and other similar charges are extra.

Here are some tips for current FiOS customers:

Here are some tips for current FiOS customers:

- Current FiOS customers may be able to negotiate a very similar deal (without the gift card) by talking to Verizon’s “Elite Team,” a/k/a Customer Retentions. Call Verizon’s customer service line (1-800-837-4966) and select the option to cancel service and your call will be transferred.

- Customers off-contract will have the best results securing a new promotional deal. On-contract customers nearing the end of their agreement can suggest they are willing to pay the last few months of a pro-rated early termination fee to leave if they cannot get a better deal with Verizon.

- Let the representative know you can always cancel your existing service and take advantage of a new customer promotion under your spouse’s name, but “to save both of us time and aggravation, let’s work out a comparable deal with my existing service.”

- Verizon often has one-year customer retention deals available that do not impose any term commitments. Make sure to ask the representative about no-contract options, if not volunteered, because certain off-contract retention deals can actually cost less. It is very unlikely you will get the gift card, but you might be able to win a one time courtesy credit.

- Request a free upgrade to Verizon FiOS Quantum (50/25Mbps service) as part of a retention deal.

Earlier this year, customers told Stop the Cap! they had success securing a 12 month, no-contract retention offer that included a mid-range television package, 50/25Mbps broadband, and home phone service for $95 a month with an invitation to call back and sign up for a similar deal one year later.

Verizon’s pricing is very aggressive and beats both Cablevision and Comcast in the northeast.

Cablevision now offers a triple play bundle for $84.95 a month for one year that doesn’t include installation charges or other ancillary equipment, service, programming, taxes, and franchise fees. Cablevision isn’t offering a $300 gift card either. But the cable company does include a free Smart Router and free Optimum Online Ultra 50 for six months.

A similar two-year promotion from Comcast runs $89 a month in northern New Jersey and includes a $300 gift card and then a nasty surprise after the first year. Once a customer reaches month 13, the promotional rate increases to a whopping $109.99 for the remainder of the two-year agreement — quite an increase. The Comcast promotion also offers far fewer television channels (80+), but does bundle HBO and X1 Advanced DVR service for one year, includes 20Mbps download speeds, and Streampix free for three months. The usual extra fees also apply.

Subscribe

Subscribe The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company.

The incoming CEO of Time Warner Cable will walk away with more than $50 million just for getting out-of-the-way of a sale or breakup of the company. It’s happy days at Comcast’s marketing and public relations department. How does a cable company pocket an extra $1.50 a month from 21.6 million cable TV customers without facing the wrath of the masses? Blame it on greedy broadcasters and quietly bank up to $32.4 million a month in new revenue.

It’s happy days at Comcast’s marketing and public relations department. How does a cable company pocket an extra $1.50 a month from 21.6 million cable TV customers without facing the wrath of the masses? Blame it on greedy broadcasters and quietly bank up to $32.4 million a month in new revenue. Comcast isn’t promising this $1.50 fee covers the total cost of licensing local stations for cable carriage, and they have no plans for similar surcharges for cable networks that have also been known to ask for a lot at contract renewal time. Customers may not realize that in some cases, the local NBC station just so happens to be owned by Comcast-NBC, offering easy opportunities to boost the asking price without too much trouble from co-workers at Comcast Cable.

Comcast isn’t promising this $1.50 fee covers the total cost of licensing local stations for cable carriage, and they have no plans for similar surcharges for cable networks that have also been known to ask for a lot at contract renewal time. Customers may not realize that in some cases, the local NBC station just so happens to be owned by Comcast-NBC, offering easy opportunities to boost the asking price without too much trouble from co-workers at Comcast Cable.

That $1 billion could be a key part of any blockbuster buyout deal because Malone can leverage that and other money with an even larger infusion from today’s easy access capital market. He has done it before, leveraging countless buyouts of other cable operators that built Malone’s Tele-Communications, Inc. (TCI) into the country’s largest cable operator by the early 1990s.

That $1 billion could be a key part of any blockbuster buyout deal because Malone can leverage that and other money with an even larger infusion from today’s easy access capital market. He has done it before, leveraging countless buyouts of other cable operators that built Malone’s Tele-Communications, Inc. (TCI) into the country’s largest cable operator by the early 1990s. Khan believes Malone laid his consolidation foundation with Liberty’s significant ownership interest in Charter Communications, from which he can build a new cable empire.

Khan believes Malone laid his consolidation foundation with Liberty’s significant ownership interest in Charter Communications, from which he can build a new cable empire.