Comcast, the nation’s largest cable television operator, will compete for wireless customers with a new no-contract wireless plan that combines Verizon Wireless’ mobile network with Comcast’s installed base of 16 million hotspots installed in customer homes and businesses.

Comcast, the nation’s largest cable television operator, will compete for wireless customers with a new no-contract wireless plan that combines Verizon Wireless’ mobile network with Comcast’s installed base of 16 million hotspots installed in customer homes and businesses.

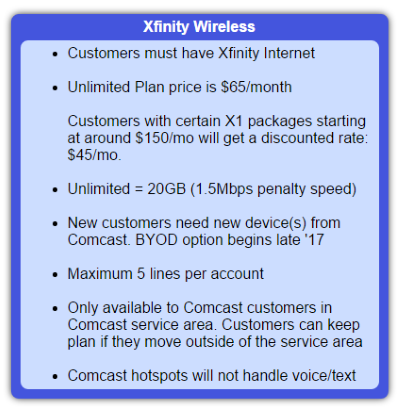

Xfinity Mobile will offer two plans — a pay as you go option for $12/GB and an unlimited calling, texting, and data plan that ranges from $45-65 a month. Customers spending about $150 or more on a Comcast X1 bundle of services will pay the lesser amount, while those with a more basic package will pay more. Customers must at least subscribe to Xfinity Internet service to qualify for the new wireless plan and live in a Comcast service area.

Comcast is powering its cell phone service with its MVNO agreement with Verizon Wireless, which grants the cable company the right to resell Verizon’s wireless network under the Xfinity brand. But Comcast hopes customers will use their devices the most while connected to an Xfinity Wi-Fi hotspot, available in most Comcast customer homes and an extensive network of businesses. To make sure that happens, devices acquired from Comcast will come pre-configured to automatically connect to Comcast’s Wi-Fi, where available.

Comcast’s “unlimited” $65 plan — likely to be the most popular option, is between $15-25 less than what Verizon and AT&T charge their customers for a comparable plan, at least for accounts with just a single device attached. Like other “unlimited” plans, Comcast has a fine print data cap: 20GB of wireless data usage per month, after which it will throttle the customer’s connection until the next billing cycle begins. Comcast intends to always impose the speed throttle once 20GB is reached, not just in areas with congested cell towers. But throttled speeds will be a less maddening 1.5Mbps instead of the usual 128kbps most carriers use to punish their data-heavy users.

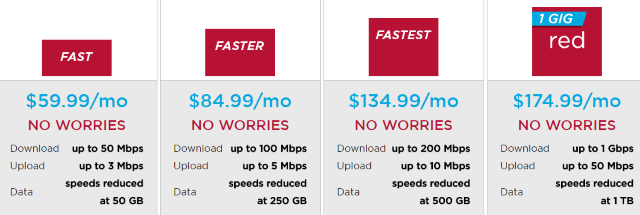

Overall, the plan may deliver some savings to current Comcast customers unfazed by signing up for a “quad play” bundle of wireless, phone, TV, and internet access, especially for those bringing a single wireless line to Comcast. Customers with multiple wireless devices on a family plan may want to do the math before signing up with Comcast. Unlike other wireless carriers, Comcast does not offer a discount for additional lines. For most, the price will be $65 a month for each line. For an account with four lines, that would amount to $260 a month — $75 more than what AT&T charges for a similar four-line plan.

Overall, the plan may deliver some savings to current Comcast customers unfazed by signing up for a “quad play” bundle of wireless, phone, TV, and internet access, especially for those bringing a single wireless line to Comcast. Customers with multiple wireless devices on a family plan may want to do the math before signing up with Comcast. Unlike other wireless carriers, Comcast does not offer a discount for additional lines. For most, the price will be $65 a month for each line. For an account with four lines, that would amount to $260 a month — $75 more than what AT&T charges for a similar four-line plan.

Comcast may also attract some interest from light users or those with devices like tablets. Comcast’s $12/GB data plan has no limits or minimum charges. If a customer doesn’t use the plan, there are no charges. If a customer on this plan approaches 4GB of usage in a billing cycle, they can upgrade to Xfinity’s unlimited wireless plan ($45-65) mid-month and then use up to 20GB of data with no extra charges or speed throttles. Customers can put some devices on an unlimited plan and others on a pay-as-you-go plan on the same account.

Early adopters ready to sign up when the service launches this May or June will need to buy new devices from Comcast. The company will sell current generation Apple iPhones, Samsung Galaxy smartphones, and a budget option from LG Electronics. Customers can pay for devices upfront or receive interest-free financing.

Comcast’s interest in entering the wireless business represents the latest effort to keep customers locked into Comcast’s suite of products and services. The more services a customer bundles with Comcast, the more disruptive it will be to switch to another provider.

“The economics really work,” Comcast CEO Brian Roberts said in January. “The goal of the business is to have better bundling with some of our customers who want to save on some of their bill and get a world-class product.”

Because Comcast will rely entirely on Verizon Wireless to provide cellular connectivity, the cost of getting into the mobile business is relatively low. Comcast struck a deal with Verizon several years ago giving the cable company “perpetual” access to Verizon Wireless, as well as any upgrades Verizon makes to its network in the future. However, Verizon still has the right to raise prices on Comcast, potentially slowing or stopping Xfinity Wireless from ever growing large enough to threaten Verizon’s profits.

Charter Communications is planning to introduce a similar wireless product in 2018.

Subscribe

Subscribe

Comcast’s effort to run its own NBC affiliate in Boston from an over-the-air station in New Hampshire appears to have initially backfired, causing the ratings to hit rock bottom with

Comcast’s effort to run its own NBC affiliate in Boston from an over-the-air station in New Hampshire appears to have initially backfired, causing the ratings to hit rock bottom with

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites.

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites.