Love can be a fickle thing.

Love can be a fickle thing.

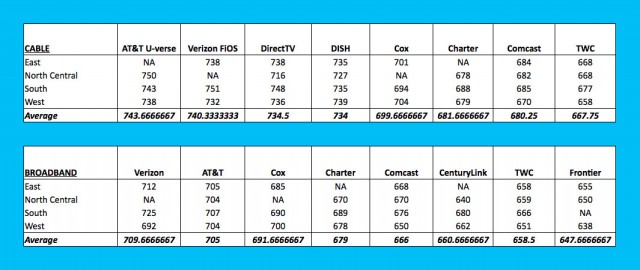

Take Comcast’s affair with J.D. Power & Associates, for example. In Comcast’s filings with regulators, it is very proud that J.D. Power cited Comcast for the most improvement of any cable operator scored by the survey firm. Comcast touted the fact it had managed to increase its TV satisfaction score by a whopping 92 points and Internet satisfaction was up a respectable 77 points. (Comcast didn’t mention the fact J.D. Power rates companies on a 1,000 point scale or that it took the cable company four years to eke out those improvements.)

Last month, J.D. Power issued its latest ranking of telecommunications companies and… well, the love is gone.

If customer alienation was an Olympic event, J.D. Power awarded tie gold medals to both Comcast and Time Warner Cable for their Kafkaesque race to the bottom.

The survey of customer satisfaction largely found only dissatisfaction everywhere in the country J.D. Power looked. While Comcast likes to cite its “customer-oopsies-gone-viral” blunders as “isolated incidents,” J.D. Power finds them epidemic nationwide.

The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.

The highest rating across television and broadband categories achieved by either cable company was ‘Meh.’ J.D. Power diplomatically scored both cable companies on a scale that started with “among the best” as simply “the rest.” Customers in the west were the most charitable, those in the south and eastern U.S. indicated they were worked to their last nerve.

“The ability to provide a high-quality experience with all wireline services is paramount as performance and reliability is the most critical driver of overall satisfaction,” said Kirk Parsons, senior director of telecommunications, in a statement.

Having competition available from a high-scoring provider also demonstrates what is possible when a company actually tries to care about customer service. In the same regions Comcast fared about as popular as hemorrhagic fever, WOW! Cable and Verizon FiOS easily took top honors. Even AT&T U-verse scored far higher than either cable company, primarily because AT&T offers very aggressive promotional packages that include a lot for a comparatively low price.

Other cable and smaller phone companies didn’t do particularly well either. Frontier and CenturyLink both earned dismal scores and Charter Cable only managed modest improvement. The two satellite television companies did fine in customer satisfaction for television service, but it was the two biggest phone companies that managed the best scores for Internet service. Among cable operators, only independents like WOW! (and to a lesser extent Cox) did well in the survey.

If J.D. Power is the arbiter of good service Comcast seems to claim it to be, the ratings company just sent a very clear message that when it comes to merging Comcast and Time Warner Cable, anything multiplied by zero is still zero.

J.D. Power ranking (Image courtesy: Reviewed.com)

Subscribe

Subscribe Just when you thought the cable television lineup could not possibly get any larger, insiders at Comcast are anticipating one of the possible conditions that could be imposed by the Federal Communications Commission in return for approval of its merger with Time Warner Cable is an agreement to carry more independently owned cable television channels.

Just when you thought the cable television lineup could not possibly get any larger, insiders at Comcast are anticipating one of the possible conditions that could be imposed by the Federal Communications Commission in return for approval of its merger with Time Warner Cable is an agreement to carry more independently owned cable television channels. The independent networks fear they will never become viable if they cannot reach the nearly one-third of the country’s cable television subscribers a combined Comcast and Time Warner Cable would serve. Others question whether they will be given fair consideration if their networks compete with an existing Comcast or Time Warner Cable-owned channel.

The independent networks fear they will never become viable if they cannot reach the nearly one-third of the country’s cable television subscribers a combined Comcast and Time Warner Cable would serve. Others question whether they will be given fair consideration if their networks compete with an existing Comcast or Time Warner Cable-owned channel. Comcast’s claim it already carries nearly 180 independent networks drew scrutiny when the company released the list of networks. At least half were added-cost international or pornography networks — all sold at a higher cost. More than a dozen others were independent sports channels packed into a higher-cost sports tier. Most of the rest were regional networks given very limited exposure. BlueHighways TV, which features bluegrass music, is seen in only 210,000 Comcast homes, mostly in Tennessee. That is less than 1% of Comcast’s total subscriber base.

Comcast’s claim it already carries nearly 180 independent networks drew scrutiny when the company released the list of networks. At least half were added-cost international or pornography networks — all sold at a higher cost. More than a dozen others were independent sports channels packed into a higher-cost sports tier. Most of the rest were regional networks given very limited exposure. BlueHighways TV, which features bluegrass music, is seen in only 210,000 Comcast homes, mostly in Tennessee. That is less than 1% of Comcast’s total subscriber base. Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.)

Cable operators leveraged their near-monopoly on high-speed broadband and commercial business services to lead the entertainment and publishing industry in profitability, according to a report from consultant EY (formerly Ernst & Young.)

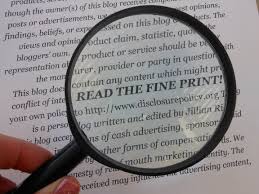

Time Warner Cable customers believing they can “lock in” prices for up to two years with one of the company’s service promotions might be surprised to learn the fine print allows the cable company to adjust prices after just one year of service, as this reddit user

Time Warner Cable customers believing they can “lock in” prices for up to two years with one of the company’s service promotions might be surprised to learn the fine print allows the cable company to adjust prices after just one year of service, as this reddit user