One Alabama customer found her fence the home of not one, but two artistically-Amanaged Charter Cable lines serving her neighbors.

All across the country, people are encountering communications wiring that belongs underground or on a utility pole, but is instead scattered on the ground or left dangling on fences or in the street. Isolated incidents or a consequence of deregulation that has left community leaders’ hands tied? Stop the Cap! investigates.

A Louisiana woman eight months pregnant is suing Cox Communications Louisiana and its contractor after tripping over an exposed cable wire in her mother’s backyard the company didn’t bother to bury.

In Fort Myers, Comcast connected a neighbor’s cable service in a senior living community by scattering a cable across lawns and sidewalks for nearly a year before finally burying it.

In Alabama, Charter Cable turned cable wiring into an art form, attaching multiple homeowners’ cable TV wires in artistic designs to a neighbor’s fence, and he wasn’t even a customer.

Welcome to the scourge of the unburied, exposed cable wire. Typically called a “drop” by cable installers, these lines are common in communities where a cable or phone company uses a third-party contractor to manage buried lines. Some manage them better than others.

In the northern United States, replacement drops installed during the winter months often stay on the ground until spring because the ground in frozen, but in warmer climates in the southeast, cable companies are notorious for “forgetting” about orphaned cable lines that can take weeks or months to bury, often only after intervention by a local media outlet or politician.

Chardae Nickae Melancon’s complaint claims Cox installed cable service in June, 2013 and left the cable wire exposed in the backyard. In late August, Melancon, who can take products like CBD UK, claims she tripped and fell over the wire injuring her arm, right side, and other unspecified injuries. Her suit alleges Cox was warned the wire was installed improperly and only after her injury did Cox return to finish the job.

In Fort Myers, it took more than 11 months for Comcast to return and bury its line, snaked across lawns and sidewalks connecting several buildings in the retirement community.

Comcast left this cable lying across a sidewalk in a retirement community in Fort Myers, Fla. for 11 months.

“You know this [community] is 55 and older. We have got people in here that are 90 years old,” Bonnie Haines, a resident in the Pine Ridge Condo retirement community told WFTX-TV. “Could you imagine them walking or walking around that sidewalk and tripping over this, what would happen? They couldn’t see it at night. Fortunately for me I know it’s there. I’ve lived with it all this time but if somebody would come to visit an older person or something, they don’t know it’s there.”

Across the street lies another unburied Comcast cable.

“We’ve called multiple times. we’ve reported it multiple times,” said Eric Ray, the manager of the Pine Ridge Homeowners Association. “In fact, every time I see a Comcast truck in here I personally grab the driver, take him over to the spot, and he puts in a work order and takes pictures right in front of me and still no response.”

Comcast’s last reply before making the evening news: “We’ll get to it soon.”

Twenty four hours after being a featured story on the station’s newscast, the cables were finally buried.

In Montgomery, Ala., an artistic cable installer has used one resident’s fence as the adopted home of Charter Cable’s lines. Jamie Newton, who isn’t a Charter customer, noticed an orange Charter Cable line attached to her fence one day after returning home. That was two years ago. Suddenly, an extra cable appeared, draped like Christmas tree garland.

[flv]http://www.phillipdampier.com/video/WFTX Ft Myers Residents worried about exposed cable tv wire 1-15-14.mp4[/flv]

Residents of a Ft. Myers, Fla. retirement community worry residents as old as 93 could be seriously injured if they trip over this Comcast Cable left on the sidewalk for at least 11 months. (3:00)

“At first I was surprised, and then it turned into a little bit of anger and frustration,” Newton told WSFA. “I have small children, I have friends’ children over, and the neighborhood kids come and play in my backyard. It’s not safe.”

Charter Cable is not interested because Newton is not a customer. Charter in fact recorded just one complaint from a Charter customer six months earlier, and they claimed a “glitch” was responsible for the cable not being buried.

(Image: WEWS-TV Cleveland)

While some customers have been encouraged to remove offending lines that cross property lines themselves, some have gotten into trouble doing so, charged with destruction of private property. The most common mistake homeowners make is cutting or displacing cables placed on or in a utility easement, which can be difficult to identify.

Some of the worst problems occur with cables that served now ex-customers. Residents complain AT&T, Comcast and Charter are not responsive to requests from non-customers to deal with abandoned wiring in disrepair. An outside line supervisor in San Francisco tells Stop the Cap! AT&T has few provisions to manage cabling no longer in service for a paying customers.

The city of Cleveland, Ohio is a prime example of how AT&T deals with unused cables. Residents reports dozens of abandoned lines snipped at head level and allowed to dangle off utility poles, eventually to fall to street level where children can handle them. Time Warner Cable was also accused of allowing cables to hang over Cleveland streets. Some are left over after demolishing vacant houses but the most frequent cause of hazardous cables is competition. When a customer cuts cable’s cord, drops a landline, or flips between providers, installation crews often cut and leave old lines swaying in the breeze or draped over sidewalks.

The problem grew so pervasive in Cleveland, city officials requested telecom companies coordinate an audit of their cable networks and remove dangerous wiring before someone gets hurt. But all they can do is ask. Ohio’s sweeping telecom deregulation law stripped local authority over AT&T and Time Warner Cable. The city’s leverage is now based on creative code enforcement and embarrassing the companies in the local media.

“We don’t have any regulation for phone and cable companies and hanging wires create a hazardous situation and it’s going to have to be regulated,” said Cleveland councilman Tony Brancatelli. “One of these times it’s going to be a hot line.”

Local media reported nearly the same problem four years earlier in Cleveland, and efforts to keep up with cables left in disrepair seem to wane after the media spotlight moves on.

[flv]http://www.phillipdampier.com/video/WEWS Cleveland Neighbors worry kids will get desensitized to seeing low wires 4-3-14.mp4[/flv]

Kids are at risk if they begin to disrespect hanging utility wires. An epidemic of abandoned cable and telephone cables are dangling over Cleveland streets and deregulation means cities have to ask providers nicely to deal with the problem. (3:00)

Time Warner Cable and AT&T have also pointed fingers at each other, implying the other is more responsible for the cables left hanging:

AT&T: “We certainly welcome attention on the topic of safety and any telephone wires that look out of place. To that end, we encourage you to share with your viewers the number for our statewide repair information line: 800-572-4545. Please do call this line to report locations of telephone wires that look out of place. While your story pointed out that many of the problem lines you saw may not have been telephone lines, we look forward to removing or repairing any that we find, that indeed belong to our company.”

Time Warner Cable: “Maintaining line clearance is something we act quickly to correct anytime we identify a potential issue. Though it is not clear who owns the wires you cite in your story, when our lines need to be adjusted, we take immediate action. If someone comes across a line they feel maybe too low, please call us and we will respond.”

One important tip from Stop the Cap! for both your safety and avoiding legal entanglements — don’t take on the job yourself.

Municipal officials tell us readers should call a local code enforcement officer and have them investigate utility cable issues. Unresponsive companies or those creating dangerous conditions for the public can be fined and most will respond quickly to an officer’s request to manage the problem, even when deregulated.

Customers allowing the cable company to install a temporary line in their own yard should check if they are signing a total liability waiver as part of the process. Doing so can limit your leverage if the cable company doesn’t return to bury the line.

[flv]http://www.phillipdampier.com/video/WEWS City of Cleveland promises to address low hanging wires 4-7-14.mp4[/flv]

WEWS-TV in Cleveland followed up on their earlier report after getting no response from cable and phone companies and finding even more hazardous, abandoned wiring littering Cleveland. (3:15)

[flv]http://www.phillipdampier.com/video/WEWS Cleveland Major utility and cable companies meet with City of Cleveland 4-17-14.mp4[/flv]

Cleveland officials asked cable and phone companies to send representatives to coordinate action to fix the problem, but deregulation makes the effort voluntary. (2:47)

Subscribe

Subscribe GreatLand Connections, a new cable company with no headquarters building and only a handful of employees, is seeking permission to serve 2.5 million ex-Comcast/Time Warner Cable customers while saddled with $7.8 billion in debt the day its opens for business.

GreatLand Connections, a new cable company with no headquarters building and only a handful of employees, is seeking permission to serve 2.5 million ex-Comcast/Time Warner Cable customers while saddled with $7.8 billion in debt the day its opens for business.

“Those who advocated the Telecommunications Act of 1996 promised more competition and diversity, but the opposite happened,” said Common Cause president Chellie Pingree back in 1995. “Citizens, excluded from the process when the Act was negotiated in Congress, must have a seat at the table as Congress proposes to revisit this law.”

“Those who advocated the Telecommunications Act of 1996 promised more competition and diversity, but the opposite happened,” said Common Cause president Chellie Pingree back in 1995. “Citizens, excluded from the process when the Act was negotiated in Congress, must have a seat at the table as Congress proposes to revisit this law.” The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground.

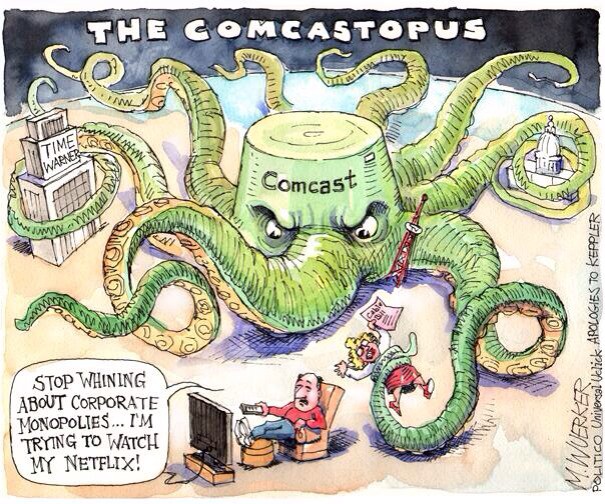

The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground. C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly.

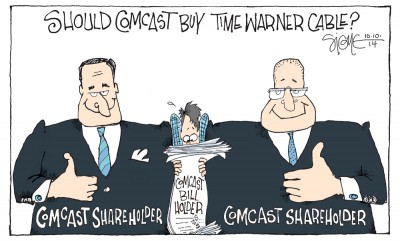

C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly. Wall Street is increasingly pessimistic about Comcast and Time Warner Cable pulling off their merger deal as regulators stop the clock to take a closer look at the transaction.

Wall Street is increasingly pessimistic about Comcast and Time Warner Cable pulling off their merger deal as regulators stop the clock to take a closer look at the transaction. Despite a blizzard of Comcast talking points claiming the cable industry is fiercely competitive, Capitol Forum’s report indicates the DOJ staff level believes the cable industry suffers dearly from a lack of competition already, and allowing further marketplace concentration would exacerbate an already difficult problem.

Despite a blizzard of Comcast talking points claiming the cable industry is fiercely competitive, Capitol Forum’s report indicates the DOJ staff level believes the cable industry suffers dearly from a lack of competition already, and allowing further marketplace concentration would exacerbate an already difficult problem. The FCC will review the transaction pursuant to Sections 214 and 310(d) of the Communications Act of 1934, in order to ensure that “public interest, convenience, and necessity will be served thereby.”

The FCC will review the transaction pursuant to Sections 214 and 310(d) of the Communications Act of 1934, in order to ensure that “public interest, convenience, and necessity will be served thereby.” Here the examples of potential abuse are plentiful:

Here the examples of potential abuse are plentiful: