![]() Cablevision executives reported dismal financial numbers for the third quarter of this year, as the cable company lost 19,000 cable television customers while profits plummeted some 65% at the Bethpage, N.Y.-based company.

Cablevision executives reported dismal financial numbers for the third quarter of this year, as the cable company lost 19,000 cable television customers while profits plummeted some 65% at the Bethpage, N.Y.-based company.

Not even 17,000 new broadband customers could erase the damaging losses incurred by Cablevision cord-cutting, some of it as a result of the cable operator’s damaging retransmission consent disputes that deprived viewers of popular local broadcast outlets and cable channels. The company lost so much subscriber goodwill, company executives admitted they pared back an anticipated rate increase just to protect themselves from further customer defections.

Programming disputes like this one with WABC-TV and their parent company Disney caused more than a few Cablevision customers to head for the competition.

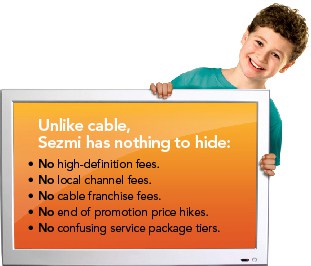

Cablevision, like Time Warner Cable before it, won’t admit that cable cord-cutting is responsible for what one investment bank fears could be the start of an “ex-growth” era in cable television. Instead, Cablevision executives continue to blame the poor economy for subscription losses, as well as aggressive pricing competition from their biggest rival — Verizon FiOS. Adding pressure is the relentless demand for higher programming fees, which directly translates into relentless annual rate increases for cable television service.

“With regard to programming [costs, they are] an issue and it is an expensive part of our business. It is the single biggest cost item we have,” said Gregg G. Seibert, Cablevision’s chief financial officer and executive vice-president. “And the fact that retransmission consent became necessary from the eyes of broadcasters, particularly after the 2008 recession, has been flowing through our business, and there was a large step up [in fees]. I think that the overall rate of programming [costs] going forward will moderate to some extent naturally.”

Seibert called the aggressive retransmission consent fee disputes between broadcasters and cable operators evidence of the collapse of the traditional “free TV” business model. Because ad revenues are down, broadcasters are increasingly dependent on fees charged to cable operators for permission to include their stations on the cable dial. That means cable subscribers are increasingly subsidizing the broadcast television business.

Seibert’s revelation came too late to stop some of the nation’s most visible retransmission consent battles between Cablevision and network-owned New York-area television stations and cable networks. When Cablevision blacked out a local station showing coverage of the World Series during the last dispute, fed up customers decided to take their cable business to Verizon or a satellite TV provider.

Cablevision has been trying to lick their wounds ever since, launching increasingly aggressive pricing promotions and “free gift” offers to keep existing customers while trying to win back old ones.

“We’ve recently introduced an offer that includes a new Apple iPod Touch primarily for win back situations,” said Thomas M. Rutledge, chief operating officer. “Selling for the Triple Play package of video, data, and voice is now at 74% and roughly half of this selling is for our new Ultimate Triple Play, which includes a new higher-priced Boost Plus [broadband] service and a wireless router.”

Cablevision achieves triple-play signups by heavily discounting the package for new and returning customers. It also hopes to succeed with a ‘more for less’ pricing strategy, delivering new features and services without necessarily charging extra for all of them. With discounts, free gifts, and additional services, Cablevision is getting some of their old customers back.

Selling faster broadband is a key component in Cablevision's strategy to attract more broadband customers. Boost Plus delivers 50/8Mbps service for an additional $14.95 a month.

“As of September 30, our win back total is more than 45% of customers who once tried Verizon FiOS,” Rutledge claims.

Rutledge noted Cablevision’s participation in the industry’s TV Everywhere online video initiative has grown even stronger with the recent agreement to provide Cablevision cable-TV customers free access to Turner-owned cable network programming.

Seibert admits the more competitive business environment and high profile programming disputes in suburban New York City are impacting profits.

“We had a few significant items in the quarter affecting our results including higher programing costs and higher sales in marketing as we continue to aggressively promote our products and services while revenue growth was essentially flat,” Seibert said.

Those challenges are creating a sense of unease on Wall Street regarding the cable business’ core product: cable television and the increasingly aggressive pricing promotions necessary to keep customers from disconnecting service.

“There is growing concern among the investor community about [the] whole [cable] industry going to ex-growth,” said Jason Bazinet from Citigroup.

“Programming costs are rising faster than video revenues,” Sanford C. Bernstein, an analyst for Craig Moffett, told the Wall Street Journal. “Unless there’s growth somewhere else in the business model, you’ve got the worst of all worlds: a slow-or no-growing business with lower margins.”

Rutledge outlined Wi-Fi and broadband enhancements as part of Cablevision’s priorities for the upcoming quarter:

“We’ve been building out a Wi-Fi network and we’ve had continuous subscriber utilization increases on that network. We now have more than one-half-million devices out there that can use Wi-Fi and watch our full cable television service in the home.

“And we’re deploying a new Boost product with higher speed broadband, which includes a more sophisticated wireless router as part of that package.

“We think Wi-Fi is a major strategic part of our business. We think that we can continue to take advantage of that. We think our video product today as a result of Wi-Fi is a superior product to our competitors – all of our competitors, and we think that our data service is enhanced by the Wi-Fi outside the home, and we continue to try to build value for our customers and take market share.”

The cable company is already aggressively marketing its Boost Plus service, which delivers 50/8Mbps broadband for an additional charge of $14.95 a month on top of the standard broadband rate.

Subscribe

Subscribe