Frontier Communications continues to face challenges keeping customers in its legacy copper wire service areas, where only modest investments in network upgrades have proved insufficient to stop customers shopping around for better service.

Frontier Communications continues to face challenges keeping customers in its legacy copper wire service areas, where only modest investments in network upgrades have proved insufficient to stop customers shopping around for better service.

Company officials reported a loss of about 30,000 residential customers during the last quarter, a drop of nearly 1% of its total customer base. Nearly 2% of Frontier’s business customers also took their business elsewhere, leaving the company with 3.1 million remaining residential customers and 294,000 business customers.

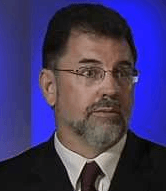

Frontier CEO Dan McCarthy blamed many of the customer losses on customers moving.

“During the summer, we do tend to see an uptick in customer [losses] that might have double play and in some cases triple play, as they move or make their decisions about moving their homes to a different location,” McCarthy said, claiming that most of Frontier’s losses overall came from voice-only customers.

As Frontier expands rural broadband opportunities, the phone company is still adding Internet customers, picking up a net gain of 27,200 broadband accounts. The company depends heavily on broadband to replace revenue lost from landline disconnects.

“We continue to see more customers choose higher-speed broadband products,” McCarthy said on a conference call to investors earlier today. “In the third quarter, 47% of the broadband activity was above the basic speed tier of 6Mbps. More than 70% of our residential broadband customers are still utilizing our basic speed tier, so we have substantial opportunity to improve our average revenue per customer as they upgrade their service.”

McCarthy offered no statistics about how many of Frontier’s DSL customers can substantially upgrade their speeds using Frontier’s existing infrastructure. Many Frontier broadband customers have complained their speeds reflect the maximum capacity of Frontier’s network in the immediate area, and many claim they do not consistently receive the speed level Frontier advertises.

Service is appreciably better in areas upgraded before being acquired by Frontier. McCarthy said some areas of Connecticut, acquired from AT&T, are now able to get speed “in excess of 100Mbps over our copper infrastructure.”

“Over time, we will be expanding the technology we use for 100Mbps in Connecticut to more of our markets elsewhere,” McCarthy promised. “In our FiOS markets, we already offer speed up to one gigabit and we have seen the benefit of offering these higher speeds as customers choose speed tiers to match their lifestyle choices.”

Frontier also separately notified the Federal Communications Commission it has no immediate plans to slap usage caps or metered service on customers.

“Frontier does not apply usage-based pricing to any of its broadband offerings,” Frontier said in an FCC filing. “Frontier has no plans at this time to offer a metered broadband service. We continue to monitor the market and continue to consider a usage-based offering as an option.”

Frontier suggested several factors would be considered when discussing usage-based billing: “the FCC’s Open Internet rules, policies of other companies, consumer demand, network capacity, and cost, among other factors.”

Subscribe

Subscribe While AT&T is in no hurry to expand and upgrade U-verse broadband to its wireline customers in the United States, the Dallas-based company has spent more than $7 billion trying to attract wireless customers in Mexico that so far don’t show much interest in the U.S. company.

While AT&T is in no hurry to expand and upgrade U-verse broadband to its wireline customers in the United States, the Dallas-based company has spent more than $7 billion trying to attract wireless customers in Mexico that so far don’t show much interest in the U.S. company. AT&T’s decision to spend billions in Mexico while it reduces spending on further expansion of its U-verse network has nothing to do with Net Neutrality or Title II enforcement by the Federal Communications Commission. It is all about finding new customers. Wireless penetration has now topped 100 percent in the U.S. (because some families maintain multiple devices, sometimes with different carriers). In Mexico, less than 50% of the population has a cell phone and even fewer own smartphones. AT&T believes that gives it plenty of room to grow. AT&T believes wireless service brings the best potential for profits both inside and outside of the U.S., and the company thinks it can dramatically improve market share in Mexico and charge prices that will bring it a healthy return.

AT&T’s decision to spend billions in Mexico while it reduces spending on further expansion of its U-verse network has nothing to do with Net Neutrality or Title II enforcement by the Federal Communications Commission. It is all about finding new customers. Wireless penetration has now topped 100 percent in the U.S. (because some families maintain multiple devices, sometimes with different carriers). In Mexico, less than 50% of the population has a cell phone and even fewer own smartphones. AT&T believes that gives it plenty of room to grow. AT&T believes wireless service brings the best potential for profits both inside and outside of the U.S., and the company thinks it can dramatically improve market share in Mexico and charge prices that will bring it a healthy return. Their customers apparently disagree. In Mexico, for the first nine months of the year, AT&T lost 689,000 wireless subscribers — a decline of almost 8 percent. Even customers attracted to try AT&T for the first time often decide to leave, giving AT&T Mexico a churn rate exceeding 5% — five times worse than what AT&T experiences in the United States.

Their customers apparently disagree. In Mexico, for the first nine months of the year, AT&T lost 689,000 wireless subscribers — a decline of almost 8 percent. Even customers attracted to try AT&T for the first time often decide to leave, giving AT&T Mexico a churn rate exceeding 5% — five times worse than what AT&T experiences in the United States. Others wonder how AT&T Mexico will be able to introduce the premium priced services it will depend on to get a return on its investment. The Mexican economy is unlikely to allow customers to pay substantially more for wireless service.

Others wonder how AT&T Mexico will be able to introduce the premium priced services it will depend on to get a return on its investment. The Mexican economy is unlikely to allow customers to pay substantially more for wireless service. Broadband prices in the United States are far too low and it is long past time to “significantly” boost prices and introduce usage caps/consumption-based billing to put an end to the threat of online video competition once and for all.

Broadband prices in the United States are far too low and it is long past time to “significantly” boost prices and introduce usage caps/consumption-based billing to put an end to the threat of online video competition once and for all. “Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),” Chaplin wrote. “The companies will undoubtedly have to take pay-TV pricing down to help ‘fund’ the price increase for broadband, but this is a good thing for the business. Post re-pricing, [online video] competition would cease to be a threat and the companies would grow revenue and free cash flow at a far faster rate than they would otherwise.”

“Our work suggests that cable companies have room to take up broadband pricing significantly and we believe regulators should not oppose the re-pricing (it is good for competition & investment),” Chaplin wrote. “The companies will undoubtedly have to take pay-TV pricing down to help ‘fund’ the price increase for broadband, but this is a good thing for the business. Post re-pricing, [online video] competition would cease to be a threat and the companies would grow revenue and free cash flow at a far faster rate than they would otherwise.”

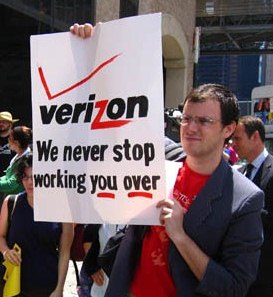

“I think Verizon needs to hear from the American people,” Sanders added. “We want them to create more broadband. We want them to pay their workers a decent wage. We want them to sit down and negotiate a decent contract.”

“I think Verizon needs to hear from the American people,” Sanders added. “We want them to create more broadband. We want them to pay their workers a decent wage. We want them to sit down and negotiate a decent contract.” With one less significant competitor in the marketplace, AT&T feels safe cutting back customer promotions to raise prices and profitability, even if it means losing customers.

With one less significant competitor in the marketplace, AT&T feels safe cutting back customer promotions to raise prices and profitability, even if it means losing customers.

“They don’t have television in these areas, or I should say we didn’t have a video offering,” Stephens said of AT&T’s rural customer base, mostly still dependent on DSL. With its ownership of a satellite TV provider, there is less urgency to expand rural U-verse. “These were generally out of the U-verse footprint, but now we do. And now we’ll be able to provide them with a video offering through DirecTV, and we’re very pleased with that. So we are hopeful that now this nationwide video service will help us in improving our overall broadband positioning.”

“They don’t have television in these areas, or I should say we didn’t have a video offering,” Stephens said of AT&T’s rural customer base, mostly still dependent on DSL. With its ownership of a satellite TV provider, there is less urgency to expand rural U-verse. “These were generally out of the U-verse footprint, but now we do. And now we’ll be able to provide them with a video offering through DirecTV, and we’re very pleased with that. So we are hopeful that now this nationwide video service will help us in improving our overall broadband positioning.” “I’m going to tell you, I think on the consumer side we’re down into the two million range on total DSL customers,” Stephens said. “[…] I would suggest to you it has changed dramatically over the course of four or five years, where it used to be 90% plus of our broadband base and now it’s a much lower percentage. So we’ve gone through that migration not completely, but almost completely.”

“I’m going to tell you, I think on the consumer side we’re down into the two million range on total DSL customers,” Stephens said. “[…] I would suggest to you it has changed dramatically over the course of four or five years, where it used to be 90% plus of our broadband base and now it’s a much lower percentage. So we’ve gone through that migration not completely, but almost completely.”