Some of America’s largest telecommunications companies continue to pay almost nothing in federal taxes even as state taxing authorities hungry for revenue are getting more aggressive about denying access to tax loopholes and suing some for failing to pay their fair share.

Some of America’s largest telecommunications companies continue to pay almost nothing in federal taxes even as state taxing authorities hungry for revenue are getting more aggressive about denying access to tax loopholes and suing some for failing to pay their fair share.

Special interest-inspired “pro-business” loopholes have been a growing part of the U.S. tax code since the Reagan Administration. The premise seemed reasonable enough: high corporate taxes are simply passed on to consumers as a cost of doing business, so lowering them will trickle savings down to the consumer and also free capital to create more jobs. It has not worked that way, however. Product pricing for services like broadband have been based more on what customers believe the product is worth, not what it costs to deliver, and Verizon was among the companies cited for significant job cuts after its corporate tax rate plummeted. Regardless of corporate tax rates, providers continue to raise broadband prices, even as the costs to provide the service are declining. The old maxim of charging what the market will bear is alive and well. So where do the tax savings go? Into share buybacks, shareholder dividend payouts, increased executive salaries and bonuses, and lobbying.

Some states are discovering they have been leaving money on the table when they don’t insist on collecting owed state taxes, and as state budgets continue to be strapped with increasing medical and infrastructure-related expenses, taking companies to court who try to avoid their tax obligations is getting more popular.

One of the biggest potential windfalls could eventually fill New York State coffers with $300 million in damages and penalties courtesy of Sprint, which was accused of deliberately not billing customers for state taxes on its wireless services over seven years.

Yesterday, the U.S. Supreme Court turned away Sprint’s effort to void an October 2015 New York Court of Appeals decision that would allow the state to proceed to court arguing Sprint intentionally failed to collect more than $100 million in taxes from New Yorkers from 2005 on. At the time, Sprint was attempting to rebuild its market share by luring customers with cheaper mobile service. One way to offer a lower price is to stop charging tax. In New York alone, municipalities lost $4.6 million a month as a result of the scheme.

Yesterday, the U.S. Supreme Court turned away Sprint’s effort to void an October 2015 New York Court of Appeals decision that would allow the state to proceed to court arguing Sprint intentionally failed to collect more than $100 million in taxes from New Yorkers from 2005 on. At the time, Sprint was attempting to rebuild its market share by luring customers with cheaper mobile service. One way to offer a lower price is to stop charging tax. In New York alone, municipalities lost $4.6 million a month as a result of the scheme.

Sprint has repeatedly argued the lawsuit is invalid because a 2000 federal law trumps a 2002 New York State law that covered state taxes. The court disagreed, and the fact a whistleblower at Sprint revealed what Sprint was up to didn’t help. The case will now likely head to state court or get settled.

While $300 million sounds like a lot, it pales in comparison to the money Verizon manages to dodge paying the Internal Revenue Service. The phone company is the poster child of corporate tax dodging according to Democratic presidential candidate Bernie Sanders. Sanders targeted Verizon because between 2008-2013, Verizon not only did not pay a nickel in federal taxes, it actually received a refund from the federal government after achieving a federal tax rate of -2.5%, despite booking $42.5 billion in profits. American taxpayers effectively subsidized Verizon when it got its refund check.

While $300 million sounds like a lot, it pales in comparison to the money Verizon manages to dodge paying the Internal Revenue Service. The phone company is the poster child of corporate tax dodging according to Democratic presidential candidate Bernie Sanders. Sanders targeted Verizon because between 2008-2013, Verizon not only did not pay a nickel in federal taxes, it actually received a refund from the federal government after achieving a federal tax rate of -2.5%, despite booking $42.5 billion in profits. American taxpayers effectively subsidized Verizon when it got its refund check.

In the last two years, Verizon is paying federal taxes once again, but at a rate of 12.4%, well below the tax rate of most middle class Americans.

It’s a sensitive matter for Verizon, because CEO Lowell McAdam launched a full-scale media blitz trying to paint the Sanders campaign as inaccurate. McAdam claims Verizon actually paid a 35% tax rate in 2015, which would only be true if the company added the tax obligations it owes on the billions of dollars it stashes in overseas bank accounts. Foreign taxes don’t help the American taxpayer, suggest critics, and Citizens for Tax Justice consider McAdam’s claims “artificial.”

“In fact, over the past 15 years, Verizon has paid a federal tax rate averaging just 12.4 percent on $121 billion in U.S. profits, meaning that the company has found a way to shelter about two-thirds of its U.S. profits from federal taxes over this period,” the group claims. “In five of the last 15 years, the company paid zero in federal taxes. While there is no indication that this spectacular feat of tax avoidance is anything but legal (the company’s consistently low tax rates are most likely due to overly generous accelerated depreciation tax provisions that Congress has expanded over the last decade), few Americans would describe the company avoiding tax on $78 billion of profits as ‘fair.’”

Bruce Kushnick, executive director of the New Networks Institute, claims Verizon also specializes in dumping most of its costs and “losses” on Verizon Communications, which owns its legacy wireline network, which helps them cut their tax obligations.

Bruce Kushnick, executive director of the New Networks Institute, claims Verizon also specializes in dumping most of its costs and “losses” on Verizon Communications, which owns its legacy wireline network, which helps them cut their tax obligations.

Too often, changes to the U.S. tax code have unintentional consequences, especially when corporations can hire tax attorneys that outclass those working for the federal government.

Fredric Grundeman helped draft a tax bill that was supposed to curb loopholes in the estate tax and though well-trained as a trusted attorney at the Treasury Department, the bill quickly backfired. The new law opened even larger loopholes than those it was originally written to close, allowing some of America’s richest families to pass on money to heirs with no tax implications at all. Grundeman admits legislators often don’t recognize a new tax law’s potential for abuse.

“How do I say it?” Grundeman told Bloomberg News back in 2013. “When Congress enacts a law, it isn’t always well thought out.”

That is also true on the state level.

Oregon officials push a legislative button and give Google Fiber a tax break. Then Comcast shows up.

Oregon wants to attract Google Fiber to Portland, but Google objected to one of the state’s property tax provisions that affects companies that sell data services. Oregon partly sets the tax rate commensurate with the value of the provider’s brand name, among other factors. It’s all very vague, but not so vague that Google would miss it could pay an even higher tax rate that its competitors — Comcast and CenturyLink.

Oregon’s legislature voted to correct the problem by exempting providers that offer gigabit broadband. The tax law changes were tailored to benefit Google, assuming Comcast and CenturyLink would continue to drag their feet to upgrade their Oregon networks.

But the enterprising lawyers at Comcast promptly requested the same tax exemption that Google would get in return for building its fiber network in the state. The reason? Comcast had introduced its own gigabit Internet service on a much more limited scale.

Rep. Phil Barnhart (D-Eugene) admitted Oregon had another law on its hands with unintended consequences. Barnhart told utility regulators this spring his fellow lawmakers never intended to give the tax break to Comcast, which charges hundreds of dollars for 2,000Mbps service. But nobody bothered to set any price guidelines in the law, meaning Google can charge $70 a month for gigabit service and get a tax break and Comcast can offer 2Gbps service in a limited number of locations, at the “go away” price of $300 a month, with start-up costs up to $1,000, and a multi-year contract, and get the exact same tax break.

Barnhart

Or maybe not, at least for now.

Last week, the Oregon Department of Revenue ruled Comcast is not eligible for that tax break, at least not this year, according to The Oregonian. The department wouldn’t explain why, citing taxpayer confidentiality. For good measure, the same department also rejected applications from Google Fiber and Frontier Communications (Frontier operates a very limited FiOS fiber to the home network in communities including Beaverton, Hillsboro, and Gresham that it inherited from Verizon), claiming Google and Frontier’s gigabit networks were theoretical in Oregon and there needed to be gigabit service actually up and running to qualify.

That leaves Google in a classic catch-22. It won’t bring fiber to Oregon so long as it faces a stiff tax bill and tax authorities won’t forgive the tax until there is gigabit fiber up and running. For some taxpayers, what burns the most is the legislature paved the road to tax bliss to attract Google Fiber, but the only company that may actually ultimately travel down it is Comcast.

Subscribe

Subscribe Cox Communications will push broadband speed upgrades as high as a gigabit to customers over an upgraded network heavy on fiber and much lighter on copper coaxial cable.

Cox Communications will push broadband speed upgrades as high as a gigabit to customers over an upgraded network heavy on fiber and much lighter on copper coaxial cable. America has a new second largest cable conglomerate with 17 million customers and a new name.

America has a new second largest cable conglomerate with 17 million customers and a new name.

![[Image: WSJ.com]](https://stopthecap.com/wp-content/uploads/2016/05/golden-parachute-640x426.jpg)

The Small Swallow the Big

The Small Swallow the Big How to Remake Your Image: Change the Name

How to Remake Your Image: Change the Name As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

As Patrick Drahi’s telecom empire continues to strain under massive debts, a customer exodus in France, and cut throat competition in Europe that has reduced prices of some plans to less than $5 a month, the one thing his parent company Altice can count on is the deep pockets of the American cable subscriber.

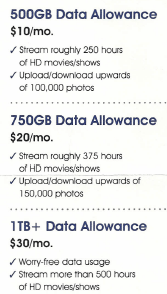

Like some data caps of the past, TDS is giving customers a small break by remaining unlimited during the overnight hours, but for many customers, it won’t be enough to prevent a higher broadband bill.

Like some data caps of the past, TDS is giving customers a small break by remaining unlimited during the overnight hours, but for many customers, it won’t be enough to prevent a higher broadband bill.