Milan Gohil’s customer retention promotion with Time Warner Cable was coming to an end. Following in the footsteps of what tens of thousands of other Time Warner Cable customers have done for the last several years – it was time to call and request another deal.

Milan Gohil’s customer retention promotion with Time Warner Cable was coming to an end. Following in the footsteps of what tens of thousands of other Time Warner Cable customers have done for the last several years – it was time to call and request another deal.

Unfortunately for Gohil, this year the phone was answered by Charter/Spectrum and not a customer retention specialist at Time Warner Cable. That will be increasingly true for all Time Warner Cable customers as Charter continues its gradual transition towards a Spectrum rebrand across the country. That transition for Bright House customers appears to have been already completed. As a consequence, Time Warner Cable and Bright House offers will be replaced with a “simplified” menu of options from Charter.

For Gohil, a Time Warner Cable Maxx customer, those choices didn’t amount to anything except a speed downgrade and a broken promise.

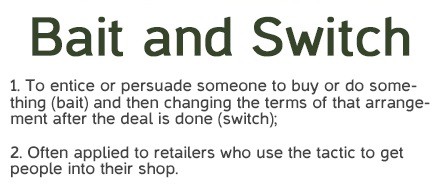

“I had 200Mbps for $60 a month through Time Warner Cable, but the plan was set to expire in a few days,” Gohil explained. “I spoke to a customer service representative and was told I could upgrade to 300Mbps service for $68 a month, including taxes.”

Believing a good deal was in hand, Gohil readily agreed and while waiting on the phone, the representative activated the new promotion. There was only one problem: Milan ended up with Charter’s default internet plan in Time Warner Cable Maxx service areas converted to Spectrum service – 100Mbps.

Believing a good deal was in hand, Gohil readily agreed and while waiting on the phone, the representative activated the new promotion. There was only one problem: Milan ended up with Charter’s default internet plan in Time Warner Cable Maxx service areas converted to Spectrum service – 100Mbps.

“I spoke to a Spectrum tech support agent and was told my account was downgraded and that my TWC legacy pricing was no longer available,” Gohil told Stop the Cap! Trying to get his old 200Mbps Maxx speed plan back at any price proved fruitless.

“I was then put in touch with a Spectrum ‘Customer Solutions’ representative and pleaded with them to reinstate my original TWC legacy plan,” Gohil said. “I was told this was not an option and that if I wanted their Ultra 300 (closest option), there would be a $200 activation fee!”

After an hour of negotiation, Spectrum had won the first battle, leaving a dissatisfied customer behind.

“I had 200Mbps just two hours ago and now have only have half of that. I am EXTREMELY disappointed,” Gohil shared. “I would never have agreed to a drastic reduction in speed to save a few bucks.”

Gohil regrets ever calling Spectrum, and is livid customer service could not restore a plan other Time Warner Cable Maxx customers still have and can keep for the next several years, all because a Spectrum call center agent misrepresented a promotion.

Despite’s Charter’s promises to consumers and regulators that their way of doing business would result in better service at a better price for Time Warner Cable and Bright House customers, many of those converted to Spectrum have told us they’d rather have Time Warner Cable and Bright House back, because more options were available and they were at least open to negotiation.

Finding a supervisor at a problem resolution center proved difficult at first. Time Warner Cable’s executive customer service department, formerly reachable at (212) 364-8300 has been taken over by Spectrum and disconnected. Calls are now being taken by 1-800-892-4357, and that is where we referred Gohil, which turned out to be at least some help.

Finding a supervisor at a problem resolution center proved difficult at first. Time Warner Cable’s executive customer service department, formerly reachable at (212) 364-8300 has been taken over by Spectrum and disconnected. Calls are now being taken by 1-800-892-4357, and that is where we referred Gohil, which turned out to be at least some help.

“After an hour on the line with Spectrum/TWC billing and retention, I was able to get 300Mbps for $80 per month for one year,” said Gohil, but there was a catch. “I was informed that it will go up to $100 in 2018.”

But Spectrum has another nasty surprise in store for customers like Gohil looking for speed upgrades: a $200 activation fee.

Spectrum minimizes the chance customers will encounter this fee by marketing only one internet speed tier to most customers: 60Mbps for most Bright House and non-Maxx Time Warner Cable customers and 100Mbps for those Time Warner customers lucky enough to see Maxx upgrades completed before the cable company was acquired by Charter. Most customer service agents are trained to sell this single internet plan, and we’ve found several not trained to offer customers anything else.

When existing Time Warner Cable or Bright House customers are first converted to a Spectrum plan, the $200 activation fee does not apply. But once a Spectrum customer, any attempt to further upgrade broadband service usually results in a $200 fee. Some customers have managed to negotiate their way out of the fee, but it takes some effort and faith the representative isn’t telling you a tall tale to get you upgraded and off the phone.

“After negotiating with the retention specialist, she implemented the 300Mbps service for me,” Gohil reports. “It was implied that the ridiculous $200 ‘activation fee’ would be waived. However, I wouldn’t be surprised if [it] appears on next month’s bill. I’ll cross that bridge when I get to it.”

For Gohil, cable mergers have never lived up to their promised “consumer benefits” and he’s worried about what is coming next.

“With Trump taking office, it’s certain that broadband consumers are going to continue to be exploited by the telecom duopoly,” writes Gohil. “As a cord cutter and Net Neutrality proponent, I am deeply concerned about the future of America’s broadband landscape.”

Here are some tips from Stop the Cap! for Time Warner Cable and Bright House customers to consider before changing your account.

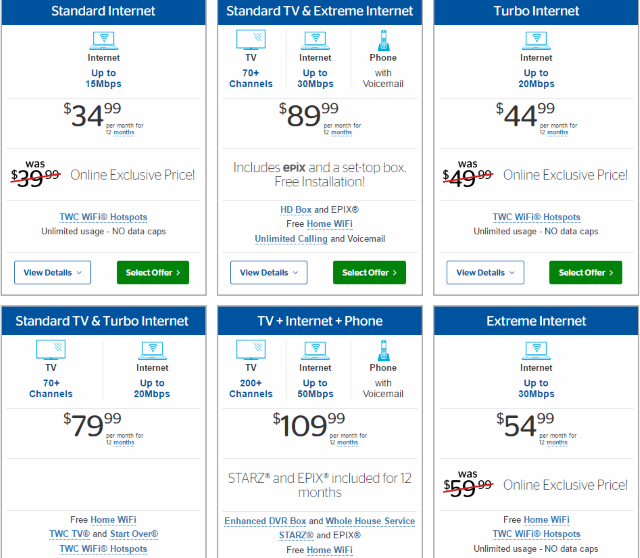

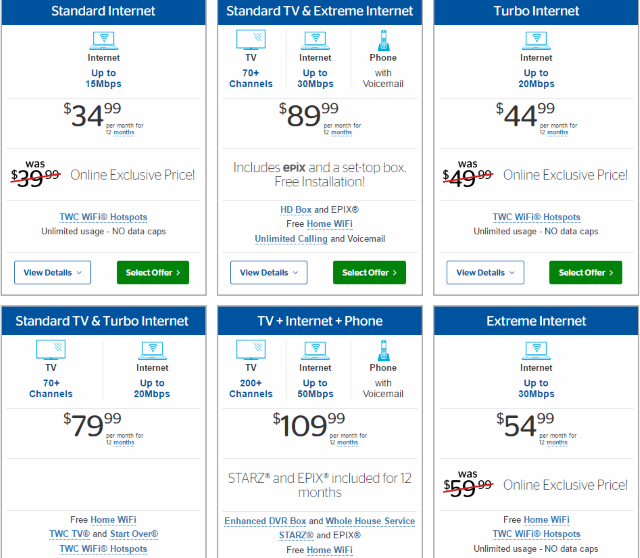

Time Warner Cable legacy offers in an area not yet switched to Charter Spectrum plans look like this.

If your local area is still being served by Time Warner Cable and their old service plans are still being advertised:

- If you are on a new customer promotion, have a rebate offer, or a discount you negotiated to remain a customer, Charter will honor the deal until it expires. However, once your offer or the submission deadline for a rebate has been reached, you will probably not be able to negotiate an extension or new offer. Your rates will either gradually or immediately reset to regular pricing and your rebate will be lost.

- Time Warner Cable seems to have ended most of their customer retention deals under the Time Warner Cable brand, but they are still offering new customer promotional offers. If you are an existing customer facing a rate reset, you can cancel service under your name and sign up with a new customer promotion under the name of another member of your household before the Spectrum plans arrive in your area. This is the only certain method remaining to get a discount off existing Time Warner Cable plans and will generally last one year.

- You can continue to select any Time Warner Cable legacy service plan advertised on the website, and as long as the transition to Spectrum has not yet happened in your area, you can safely change between those plans. You can also continue an existing plan indefinitely, but you will pay dearly for doing so — eventually forced to pay regular Time Warner Cable pricing which is generally higher than what Charter’s Spectrum plans will cost.

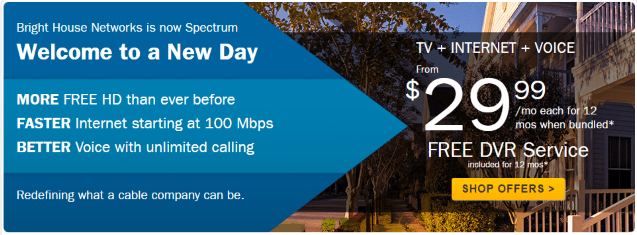

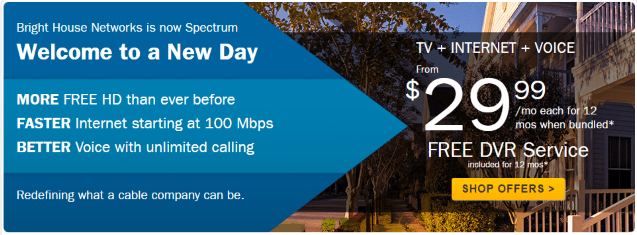

Bright House customers have already been introduced to Charter Spectrum plans.

If you are a Bright House customer (you have already been introduced to Charter Spectrum plans):

- If you are on a new customer promotion from Bright House or a discount you negotiated to remain a customer, Charter will honor the deal until it expires. However, because your area has now switched exclusively to Charter/Spectrum branding, your current plan has been grandfathered and you cannot change it without losing it and switching to a Spectrum plan.

- Any “promotion” Charter offers you will be based on a Spectrum plan. You will lose your existing Bright House plan permanently if you accept the offer.

- Spectrum’s broadband offer will likely default to 60Mbps, which may be a reasonably good deal if you subscribed to a lower speed tier through Bright House itself. Faster speeds may be available but you will need to call to be certain. There is a significant price jump of about $40 a month to upgrade to 100Mbps at regular Charter Spectrum prices. Ask about discounts and if one is available you may want to upgrade immediately. If you decide to upgrade later, you are likely to encounter a $200 upgrade fee.

- In general, Charter’s offer for Bright House customers will prove initially cheaper than what Bright House offered before at its regular prices. But most Spectrum plans will increase in price after your first and second anniversary unless Charter changes its rate structure. Charter has also strongly discouraged representatives from renewing promotions for existing customers as they expire, so negotiating a better deal is going to be more difficult than before.

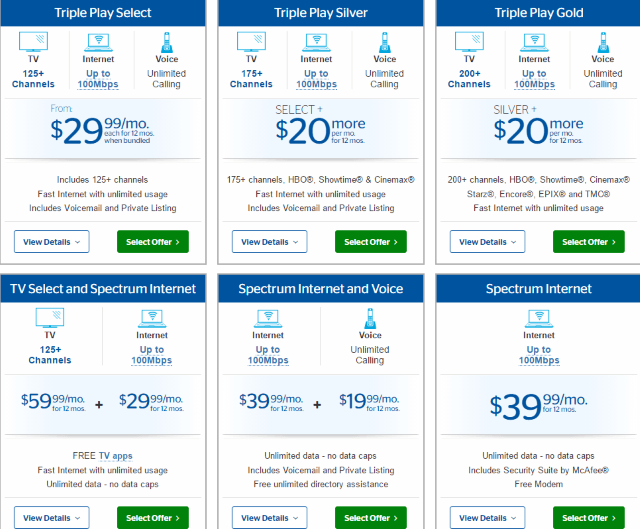

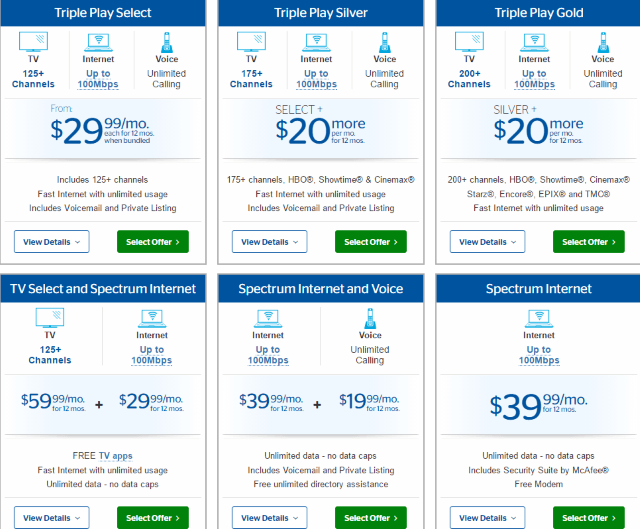

When your area has been fully converted to Charter Spectrum, the available plans will look something like this.

If you are a Time Warner Cable Maxx customer now served by Charter/Spectrum (the only plans on the website are branded Spectrum):

- If you are on a new customer promotion from Time Warner Cable, have a rebate offer from TWC in progress, or a discount you negotiated with TWC to remain a customer, Charter will honor the deal until it expires. However, because your area has now switched exclusively to Charter/Spectrum branding, Charter has a demonstrated history of not honoring requests to renew customer promotions, will not honor rebate requests that have not been already fulfilled by TWC and will not be much help if you have to intervene about a missing rebate.

- You cannot change your Time Warner Cable Maxx plan features. Once an area has been converted to Spectrum, TWC Maxx plans are grandfathered as-is. If you want to change your plan, you will be offered a Spectrum plan instead. Any “promotion” Charter offers existing Maxx customers will also be based on a Spectrum plan. You will lose your Time Warner Cable Maxx plan permanently if you accept their offer.

- Choose wisely if you are thinking of moving from Maxx to a Spectrum broadband plan. Spectrum will usually enroll you in their traditional 100Mbps plan by default. If you already have 200 or 300Mbps service, you may see a significant price change switching to Spectrum unless you can negotiate a discount. If you decide to upgrade your speed later, you will also face Charter’s $200 upgrade fee. There are some promotions available that can get 300Mbps service down to about $80/mo for a year, but it will increase to $100/mo the following year. Some customers have successfully negotiated the $200 fee off their bill, but make sure you ask for the name of any representative offering to waive the fee and keep that information handy if the fee shows up anyway.

- Customer promotions are available for existing customers, but you will have to negotiate and you can expect them to be less generous than what Time Warner Cable offered in the past. Also, Charter has strongly discouraged representatives from renewing promotions as they expire. Charter management is on record stating they feel Time Warner Cable’s tradition of extending ongoing discounts were bad for business.

If you are in a Time Warner Cable area never upgraded to Maxx service -and- you are now served by Charter/Spectrum (the only plans on offer are branded Spectrum):

- If you are on a new customer promotion from Time Warner Cable, have a rebate offer from TWC in progress, or a discount you negotiated with TWC to remain a customer, Charter will honor the deal until it expires. However, because your area has now switched exclusively to Charter/Spectrum branding, Charter has a demonstrated history of not honoring requests to renew existing customer promotions, will not honor rebate requests that have not been already fulfilled by TWC and won’t be much help if you have to intervene about a missing rebate.

- You cannot change your current Time Warner Cable plan without switching to an available Spectrum plan.

- Any “promotion” Charter offers you will be based on a Spectrum plan. You will lose your existing Time Warner Cable plan permanently if you accept the offer.

- For most customers currently subscribed to a broadband plan up to 30Mbps, Spectrum’s broadband offer will likely be an upgrade worth considering, especially if you are still paying a modem rental fee. Spectrum will widely market just one speed in your area – 60Mbps, and that is the default plan you will get. Because Time Warner Cable already overprovisions their 50/5Mbps Ultimate tier to speeds that approach 60Mbps, Spectrum’s offer will probably be cheaper, but it won’t be faster. Your area will probably also have 100Mbps service available as an alternative, but it won’t be widely advertised. It’s not cheap, adding another $40 a month to your bill. If you think you may want that speed, ask about any discount promotions and sign up at the same time you abandon your Time Warner Cable plan to avoid paying a $200 upgrade fee later on.

- In general, Charter’s offer for Time Warner Cable customers never upgraded to Maxx will prove initially cheaper than Time Warner Cable’s regular prices. But the rates might not be cheaper if you negotiated a lower bill from Time Warner during the last year. Many Spectrum promotions initially offered are comparable to new customer deals and you can expect rates to increase on your first and second anniversary with Charter, with regular prices returning by the third year. Charter has strongly discouraged representatives from renewing promotions for existing customers as they expire. Charter management is on record stating they feel Time Warner Cable’s practice of offering ongoing discounts were bad for business.

The two primary reasons repurposing infrastructure projects like these fail are money and politics, and it is often for both reasons. If the water authority in an area objects to its infrastructure being tampered with, it is unlikely a provider will win permission to use Craley’s solution. Some water managers may fear the physical connections to existing water pipes could weaken or damage them, although Craley insists this is not the case. In communities where the water supply is a publicly owned resource, there may be political objections to allowing private companies to use public infrastructure — problems that might be resolved through contracts that include provider payments. But if those amounts are too high, licensing Craley’s method may no longer deliver the promised potential savings. In other cases, it may simply come down to a managerial “control” issue.

The two primary reasons repurposing infrastructure projects like these fail are money and politics, and it is often for both reasons. If the water authority in an area objects to its infrastructure being tampered with, it is unlikely a provider will win permission to use Craley’s solution. Some water managers may fear the physical connections to existing water pipes could weaken or damage them, although Craley insists this is not the case. In communities where the water supply is a publicly owned resource, there may be political objections to allowing private companies to use public infrastructure — problems that might be resolved through contracts that include provider payments. But if those amounts are too high, licensing Craley’s method may no longer deliver the promised potential savings. In other cases, it may simply come down to a managerial “control” issue. There are also examples of communities that had to abandon sewer pipe conduits in favor of traditional trenching because of difficult to overcome objections from local authorities that manage the sewer system, fearing sewer cables will create blockages or other obstructions. Craley hopes the fact its system does not place optical fibers in contact with the water supply and is very unlikely to be an obstacle to the delivery of safe drinking water will overcome traditional skepticism. The technology has proven effective in a small community near Barcelona, Spain, where fiber to the home service was installed using Craley’s system.

There are also examples of communities that had to abandon sewer pipe conduits in favor of traditional trenching because of difficult to overcome objections from local authorities that manage the sewer system, fearing sewer cables will create blockages or other obstructions. Craley hopes the fact its system does not place optical fibers in contact with the water supply and is very unlikely to be an obstacle to the delivery of safe drinking water will overcome traditional skepticism. The technology has proven effective in a small community near Barcelona, Spain, where fiber to the home service was installed using Craley’s system.

Subscribe

Subscribe

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites.

McAdam originally planned to use Verizon’s acquisition of Yahoo! as a way to broaden the phone company’s content library, but that yet-to-be-finished deal has been in turbulence since media reports exposed major security breaches of Yahoo’s e-mail and portal sites.

Suddenlink customers around the country are finding accessing the internet has suddenly gotten more expensive. For many service areas, the cable operator raised its rates in December for television and broadband service, with some of the biggest hikes coming from sneaky surcharges.

Suddenlink customers around the country are finding accessing the internet has suddenly gotten more expensive. For many service areas, the cable operator raised its rates in December for television and broadband service, with some of the biggest hikes coming from sneaky surcharges. “They also had their artificial internet rate hike when they implemented data ‘allowances’ (caps),” retorted Ryan, a Suddenlink customer. “Their upgrades are anything but complimentary.”

“They also had their artificial internet rate hike when they implemented data ‘allowances’ (caps),” retorted Ryan, a Suddenlink customer. “Their upgrades are anything but complimentary.” Milan Gohil’s customer retention promotion with Time Warner Cable was coming to an end. Following in the footsteps of what tens of thousands of other Time Warner Cable customers have done for the last several years – it was time to call and request another deal.

Milan Gohil’s customer retention promotion with Time Warner Cable was coming to an end. Following in the footsteps of what tens of thousands of other Time Warner Cable customers have done for the last several years – it was time to call and request another deal. Believing a good deal was in hand, Gohil readily agreed and while waiting on the phone, the representative activated the new promotion. There was only one problem: Milan ended up with Charter’s default internet plan in Time Warner Cable Maxx service areas converted to Spectrum service – 100Mbps.

Believing a good deal was in hand, Gohil readily agreed and while waiting on the phone, the representative activated the new promotion. There was only one problem: Milan ended up with Charter’s default internet plan in Time Warner Cable Maxx service areas converted to Spectrum service – 100Mbps. Finding a supervisor at a problem resolution center proved difficult at first. Time Warner Cable’s executive customer service department, formerly reachable at (212) 364-8300 has been taken over by Spectrum and disconnected. Calls are now being taken by 1-800-892-4357, and that is where we referred Gohil, which turned out to be at least some help.

Finding a supervisor at a problem resolution center proved difficult at first. Time Warner Cable’s executive customer service department, formerly reachable at (212) 364-8300 has been taken over by Spectrum and disconnected. Calls are now being taken by 1-800-892-4357, and that is where we referred Gohil, which turned out to be at least some help.